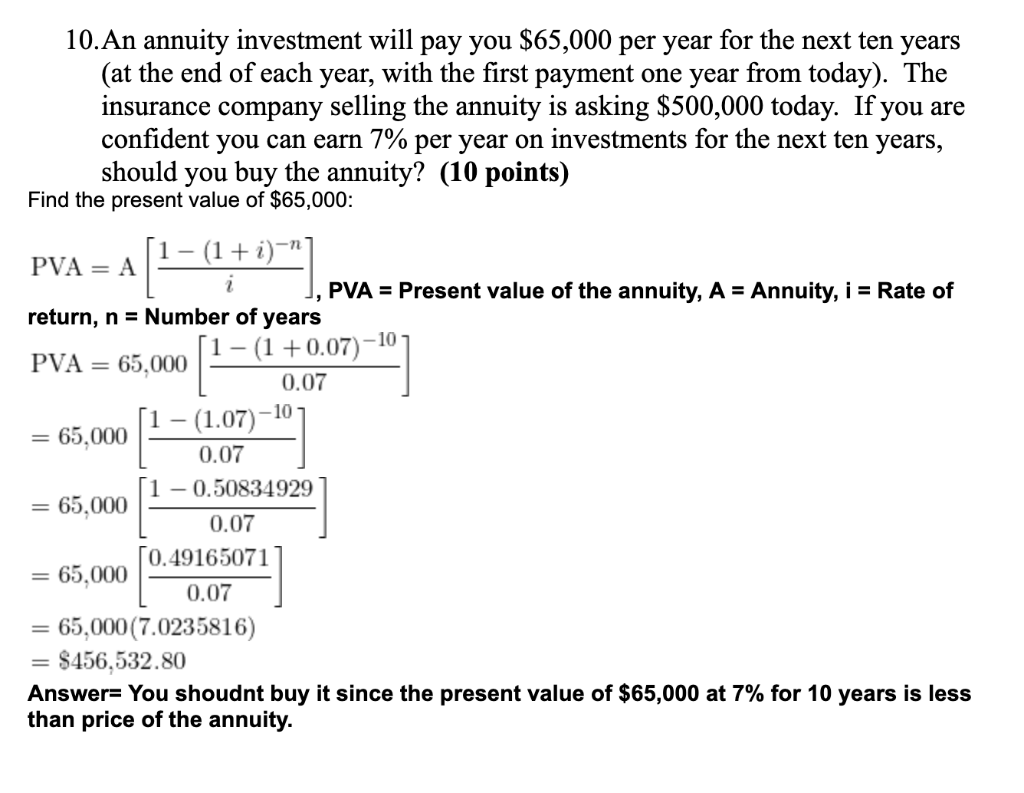

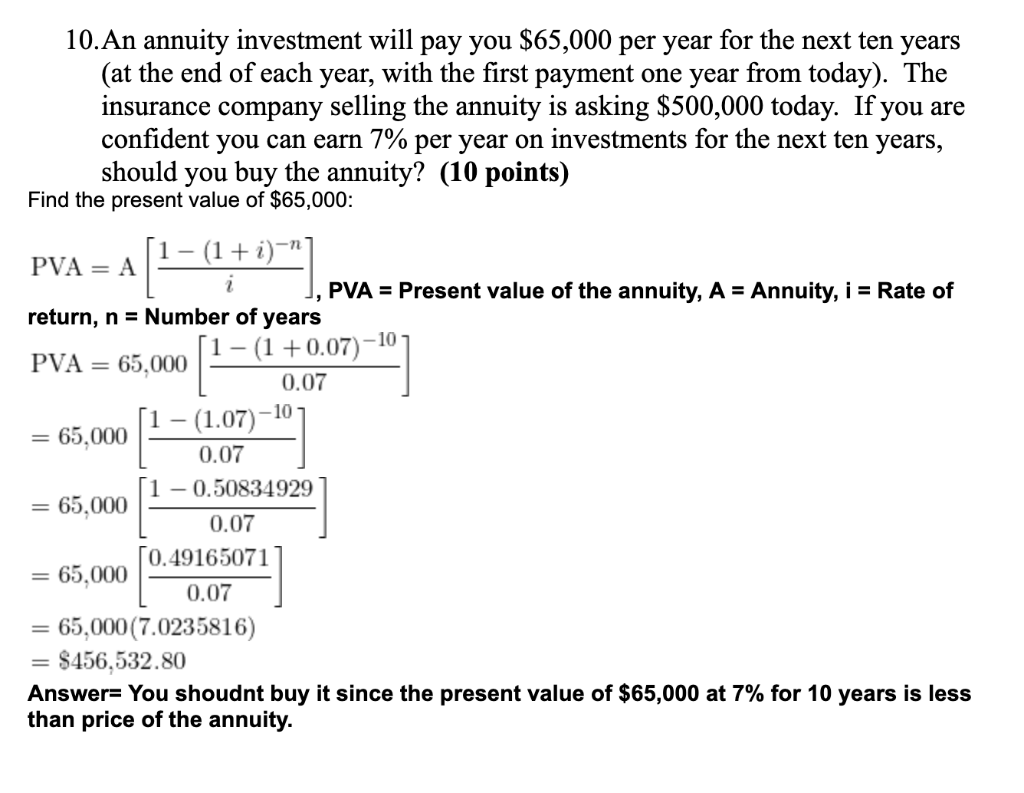

10. An annuity investment will pay you $65,000 per year for the next ten years (at the end of each year, with the first payment one year from today). The insurance company selling the annuity is asking $500,000 today. If you are confident you can earn 7% per year on investments for the next ten years, should you buy the annuity? (10 points) Find the present value of $65,000: PVA = A 1 (1 + i)n' 2 PVA = Present value of the annuity, A = Annuity, i = Rate of return, n = Number of years PVA = 65,000 -10 - (1.07) = 65,000 0.07 10.50834929 = 65,000 0.07 0.49165071 = 65,000 0.07 = 65,000 (7.0235816) $456,532.80 Answer= You shoudnt buy it since the present value of $65,000 at 7% for 10 years is less than price of the annuity. 1-(1+0.07)-107 0.07 14. Consider the growth company in problem 10. Assume that the first year's dividend is the amount you calculated as the answer to problem 10. (if you didn't get an answer just assume a number and continue. Now suppose you find out that the growth forecast is correct for ten years and then the company will cease to exist (e.g., bankrupt) and you will receive no further dividends on the stock. What is your revised estimate of the stock's value today? (6 points) 10. An annuity investment will pay you $65,000 per year for the next ten years (at the end of each year, with the first payment one year from today). The insurance company selling the annuity is asking $500,000 today. If you are confident you can earn 7% per year on investments for the next ten years, should you buy the annuity? (10 points) Find the present value of $65,000: PVA = A 1 (1 + i)n' 2 PVA = Present value of the annuity, A = Annuity, i = Rate of return, n = Number of years PVA = 65,000 -10 - (1.07) = 65,000 0.07 10.50834929 = 65,000 0.07 0.49165071 = 65,000 0.07 = 65,000 (7.0235816) $456,532.80 Answer= You shoudnt buy it since the present value of $65,000 at 7% for 10 years is less than price of the annuity. 1-(1+0.07)-107 0.07 14. Consider the growth company in problem 10. Assume that the first year's dividend is the amount you calculated as the answer to problem 10. (if you didn't get an answer just assume a number and continue. Now suppose you find out that the growth forecast is correct for ten years and then the company will cease to exist (e.g., bankrupt) and you will receive no further dividends on the stock. What is your revised estimate of the stock's value today? (6 points)