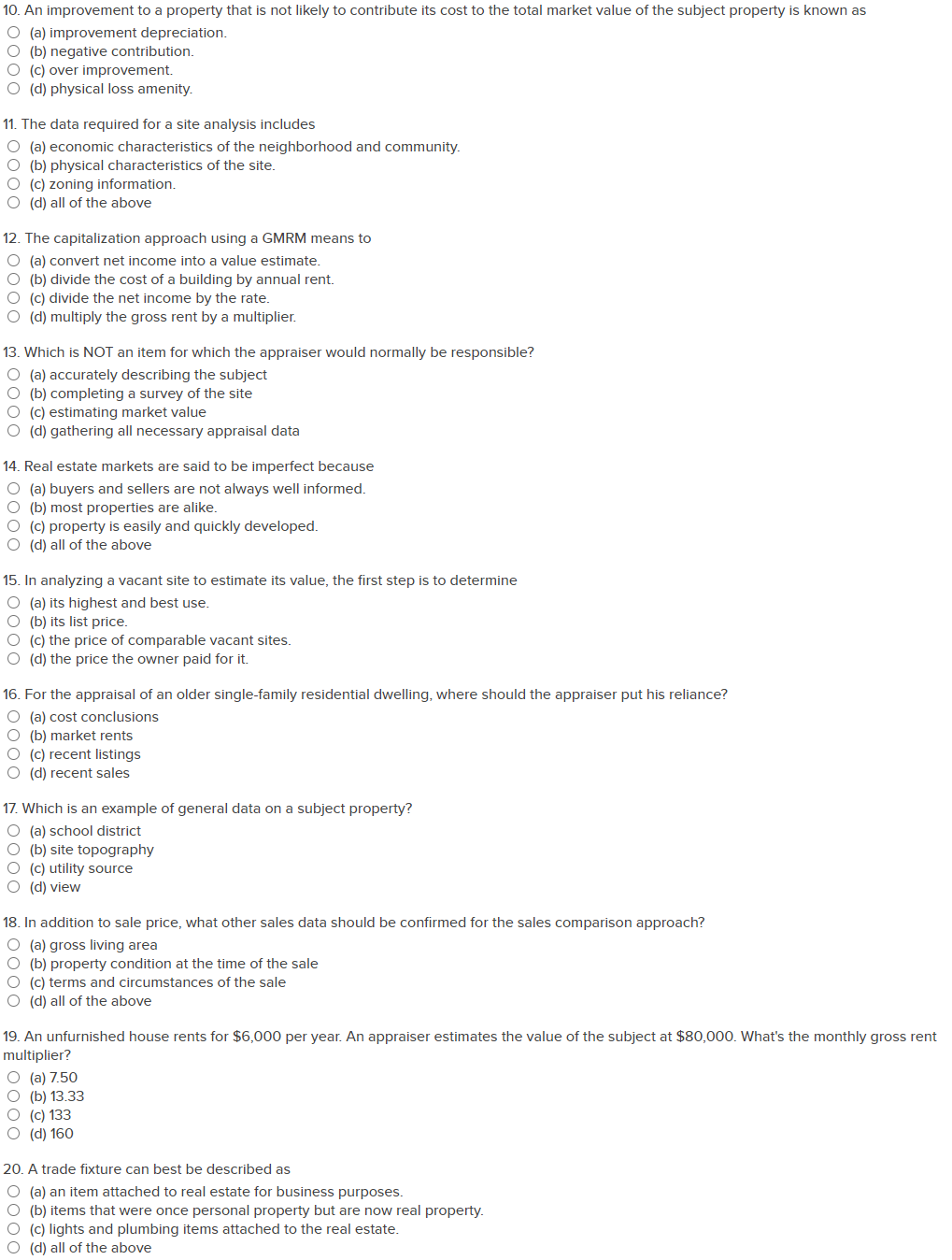

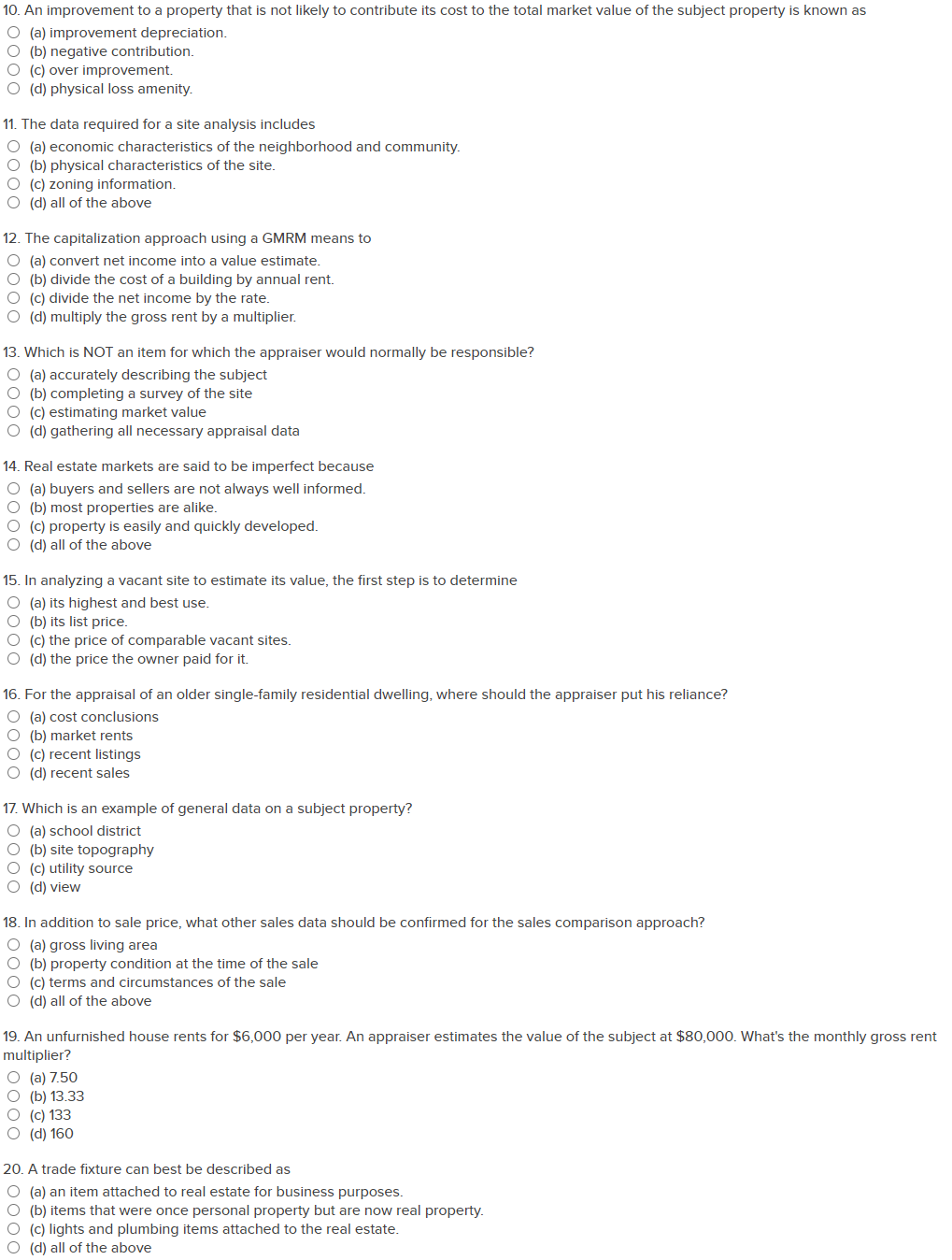

10. An improvement to a property that is not likely to contribute its cost to the total market value of the subject property is known as O (a) improvement depreciation. O (b) negative contribution. O (c) over improvement. O (d) physical loss amenity. 11. The data required for a site analysis includes O (a) economic characteristics of the neighborhood and community. O (b) physical characteristics of the site. O (c) zoning information. (d) all of the above 12. The capitalization approach using a GMRM means to O (a) convert net income into a value estimate. O (b) divide the cost of a building by annual rent. O (c) divide the net income by the rate. (d) multiply the gross rent by a multiplier. 13. Which is NOT an item for which the appraiser would normally be responsible? O (a) accurately describing the subject O (b) completing a survey of the site O (c) estimating market value O (d) gathering all appraisal data 14. Real estate markets are said to be imperfect because (a) buyers and sellers are not always well informed. (b) most properties are alike. O (c) property is easily and quickly developed. O (d) all of the above 15. In analyzing a vacant site to estimate its value, the first step is to determine (a) its highest and best use. O (b) its list price. O (c) the price of comparable vacant sites. O (d) the price the owner paid for it. 16. For the appraisal of an older single-family residential dwelling, where should the appraiser put his reliance? O (a) cost conclusions (b) market rents O (c) recent listings O (d) recent sales 17. Which is an example of general data on a subject property? O (a) school district O (b) site topography O (c) utility source O (d) view 18. In addition to sale price, what other sales data should be confirmed for the sales comparison approach? O (a) gross living area O (b) property condition at the time of the sale O (c) terms and circumstances of the sale O (d) all of the above 19. An unfurnished house rents for $6,000 per year. An appraiser estimates the value of the subject at $80,000. What's the monthly gross rent multiplier? O (a) 7.50 O (b) 13.33 O (c) 133 O (d) 160 20. A trade fixture can best be described as O (a) an item attached to real estate for business purposes. (b) items that were once personal property but are now real property. O (c) lights and plumbing items attached to the real estate. 0 (d) all of the above