Answered step by step

Verified Expert Solution

Question

1 Approved Answer

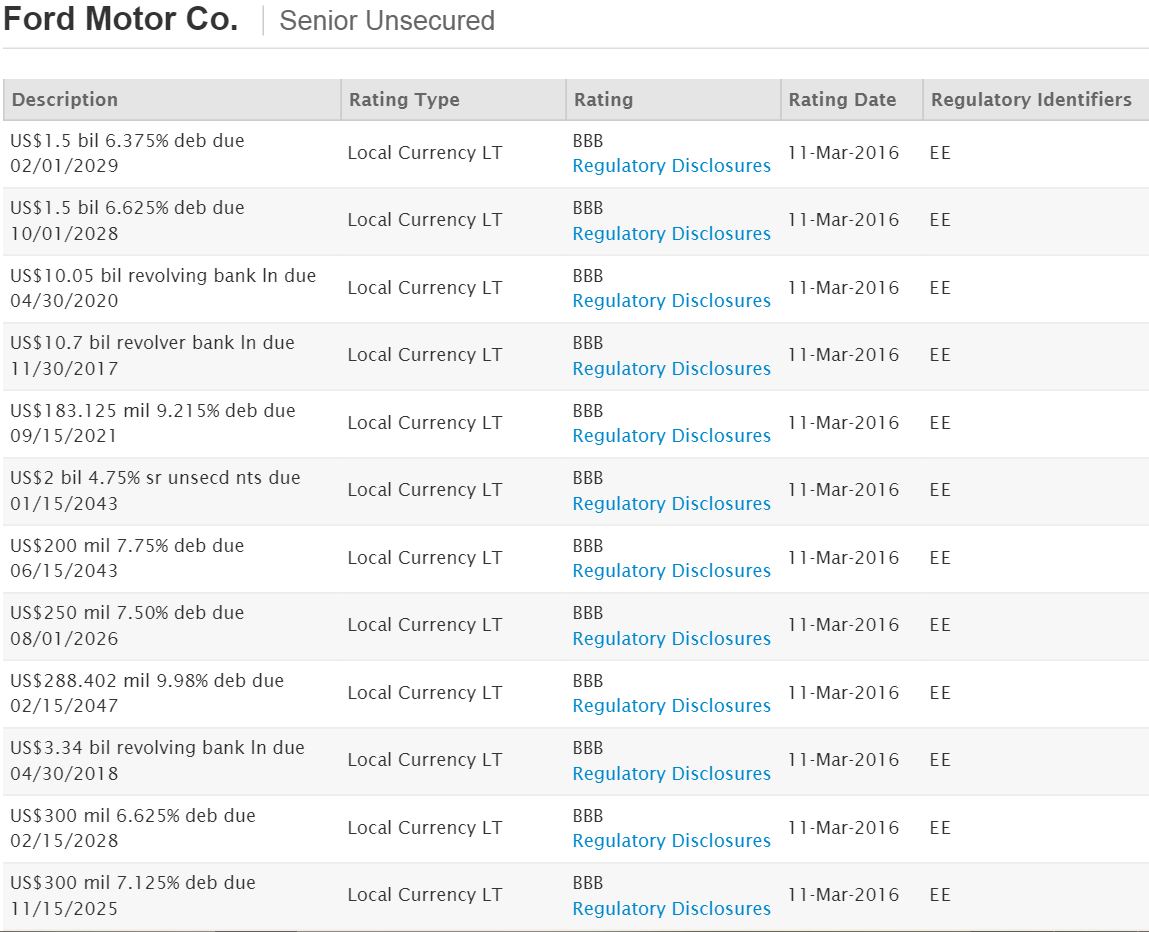

10. Assume now that Ford's credit rating achieves the highest level possible. Consequently, Ford is not only able to benefit from lower discount rates, but

10. Assume now that Ford's credit rating achieves the highest level possible. Consequently, Ford is not only able to benefit from lower discount rates, but also from a lower coupon rate. The coupon rate is now 50 bps. lower than before. What will be the bond's fair price, Yield To Maturity and Current Yield under these circumstances? How many bonds will Ford need to issue now to be able to raise the desired funds?

10. Assume now that Ford's credit rating achieves the highest level possible. Consequently, Ford is not only able to benefit from lower discount rates, but also from a lower coupon rate. The coupon rate is now 50 bps. lower than before. What will be the bond's fair price, Yield To Maturity and Current Yield under these circumstances? How many bonds will Ford need to issue now to be able to raise the desired funds?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started