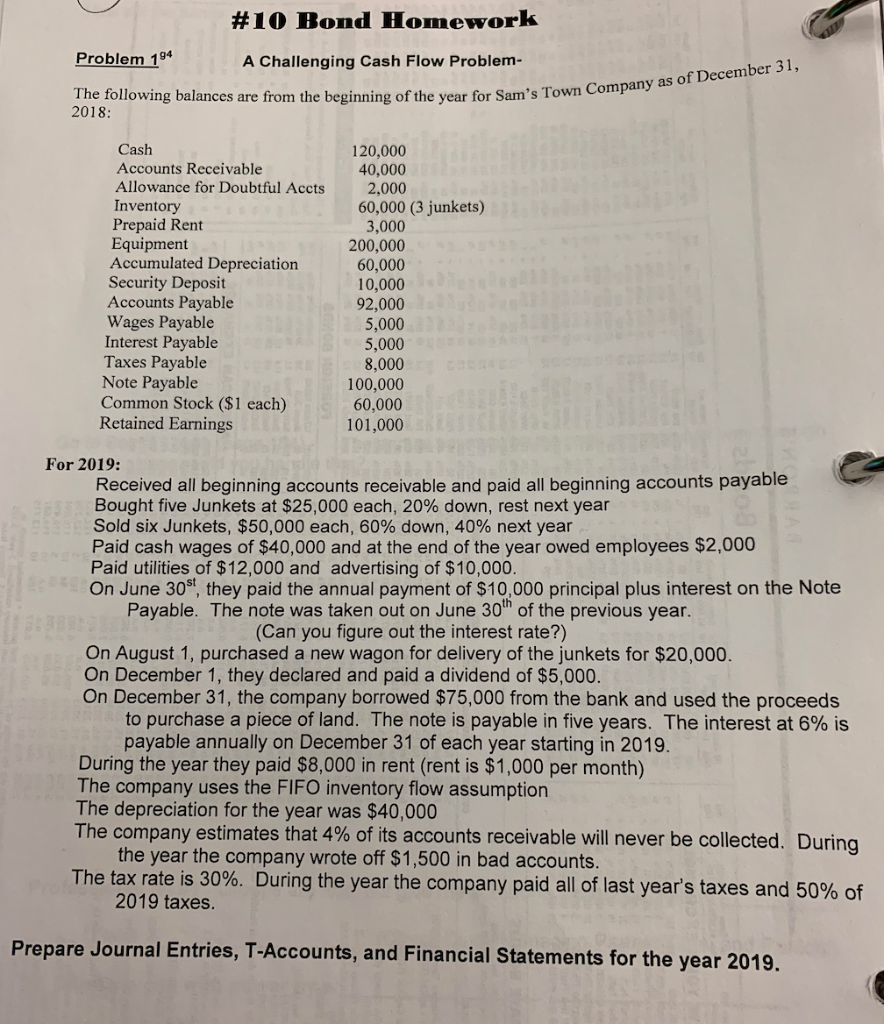

#10 Bond Homework Problem 14 A Challenging Cash Flow Problem- Company as of December 31, The following balances are from the beginning of the year for Sam's Town 2018: Cash 120,000 40,000 2,000 Accounts Receivable Allowance for Doubtful Accts Inventory 60,000 (3 junkets) Prepaid Rent 3,000 200,000 60,000 10,000 92,000 5,000 5,000 8,000 100,000 60,000 101,000 Equipment Accumulated Depreciation Security Deposit Accounts Payable Wages Payable Interest Payable Taxes Payable Note Payable Common Stock ($1 each) Retained Earnings For 2019: Received all beginning accounts receivable and paid all beginning accounts payable Bought five Junkets at $25,000 each, 20% down, rest next year sold six Junkets, $50,000 each, 60% down, 40% next year Paid cash wages of $40,000 and at the end of the year owed employees $2,000 Paid utilities of $12,000 and advertising of $10,000 On June 30s, they paid the annual payment of $10,000 principal plus interest on the Note Payable. The note was taken out on June 30th of the previous year (Can you figure out the interest rate?) On August 1, purchased a new wagon for delivery of the junkets for $20,000. On December 1, they declared and paid a dividend of $5,000. On December 31, the company borrowed $75,000 from the bank and used the proceeds to purchase a piece of land. The note is payable in five years. The interest at 6% is payable annually on December 31 of each year starting in 2019 During the year they paid $8,000 in rent (rent is $1,000 per month) The company uses the FIFO inventory flow assumption The depreciation for the year was $40,000 The company estimates that 4% of its accounts receivable will never be collected. During the year the company wrote off $1,500 in bad accounts The tax rate is 30%. During the year the company paid all of last year's taxes and 50% of 2019 taxes Prepare Journal Entries, T-Accounts, and Financial Statements for the year 2019 #10 Bond Homework Problem 14 A Challenging Cash Flow Problem- Company as of December 31, The following balances are from the beginning of the year for Sam's Town 2018: Cash 120,000 40,000 2,000 Accounts Receivable Allowance for Doubtful Accts Inventory 60,000 (3 junkets) Prepaid Rent 3,000 200,000 60,000 10,000 92,000 5,000 5,000 8,000 100,000 60,000 101,000 Equipment Accumulated Depreciation Security Deposit Accounts Payable Wages Payable Interest Payable Taxes Payable Note Payable Common Stock ($1 each) Retained Earnings For 2019: Received all beginning accounts receivable and paid all beginning accounts payable Bought five Junkets at $25,000 each, 20% down, rest next year sold six Junkets, $50,000 each, 60% down, 40% next year Paid cash wages of $40,000 and at the end of the year owed employees $2,000 Paid utilities of $12,000 and advertising of $10,000 On June 30s, they paid the annual payment of $10,000 principal plus interest on the Note Payable. The note was taken out on June 30th of the previous year (Can you figure out the interest rate?) On August 1, purchased a new wagon for delivery of the junkets for $20,000. On December 1, they declared and paid a dividend of $5,000. On December 31, the company borrowed $75,000 from the bank and used the proceeds to purchase a piece of land. The note is payable in five years. The interest at 6% is payable annually on December 31 of each year starting in 2019 During the year they paid $8,000 in rent (rent is $1,000 per month) The company uses the FIFO inventory flow assumption The depreciation for the year was $40,000 The company estimates that 4% of its accounts receivable will never be collected. During the year the company wrote off $1,500 in bad accounts The tax rate is 30%. During the year the company paid all of last year's taxes and 50% of 2019 taxes Prepare Journal Entries, T-Accounts, and Financial Statements for the year 2019