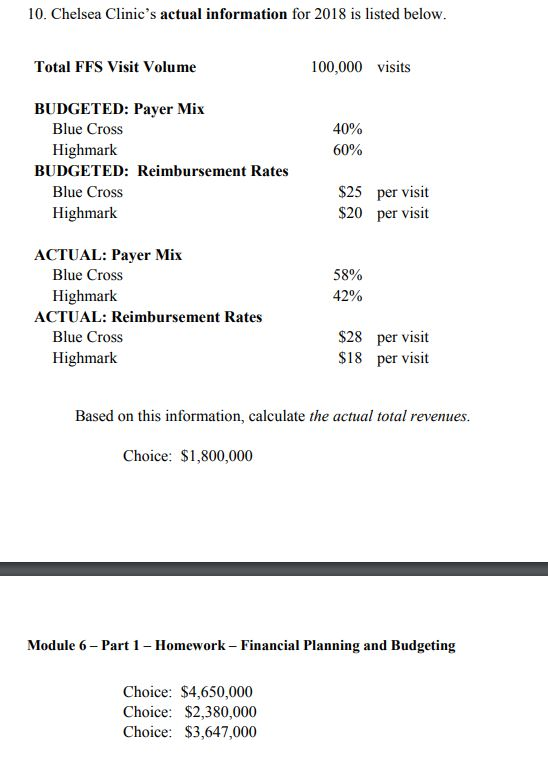

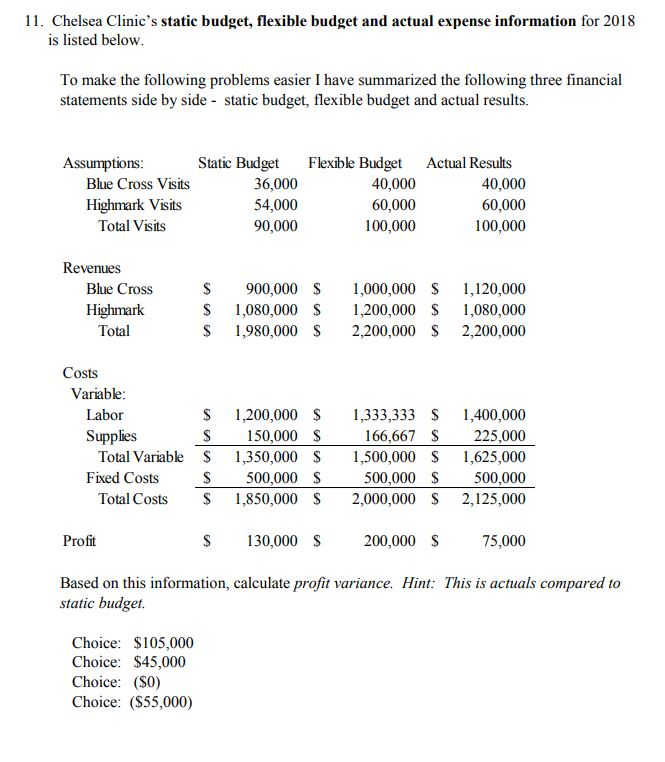

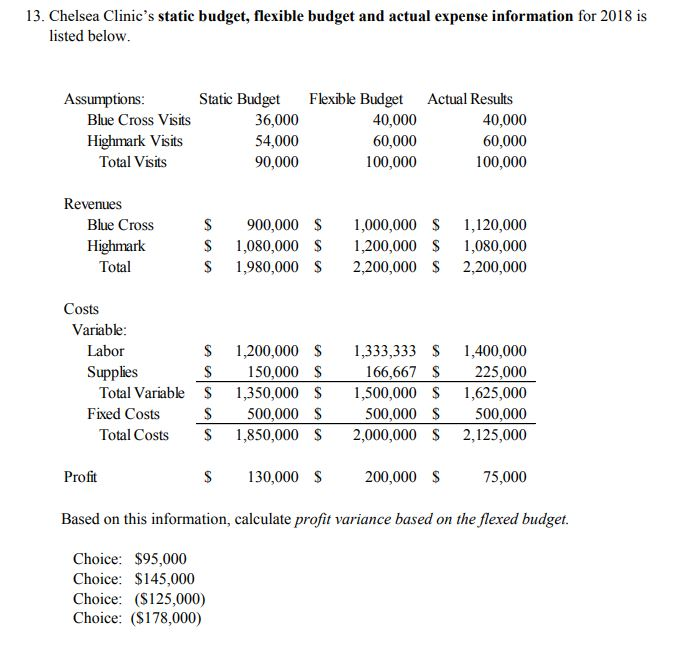

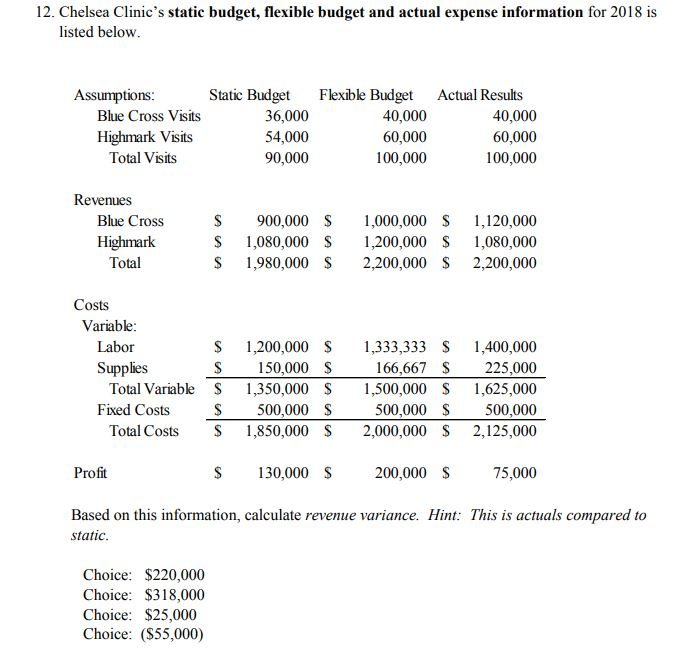

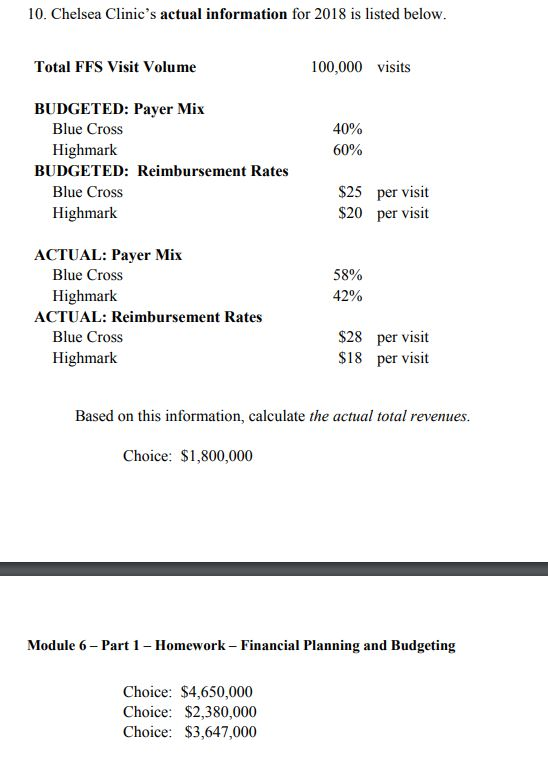

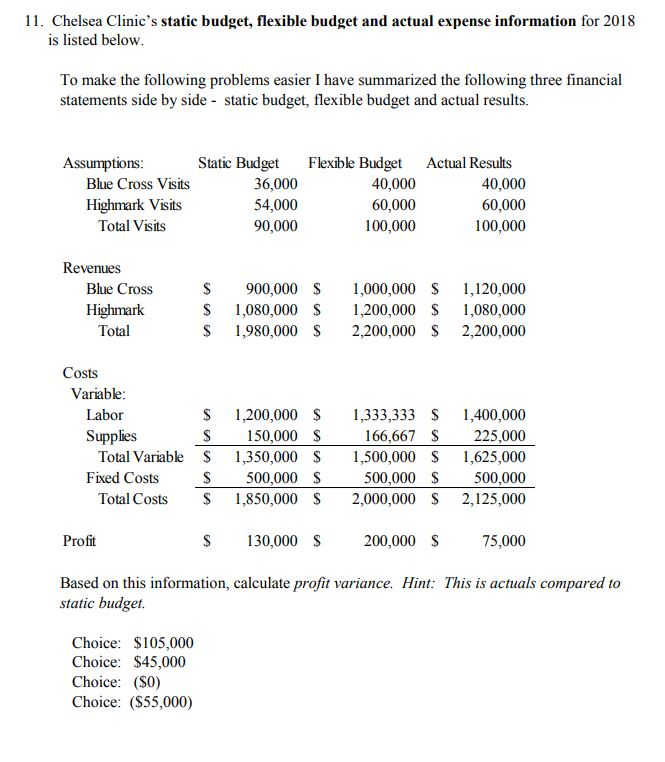

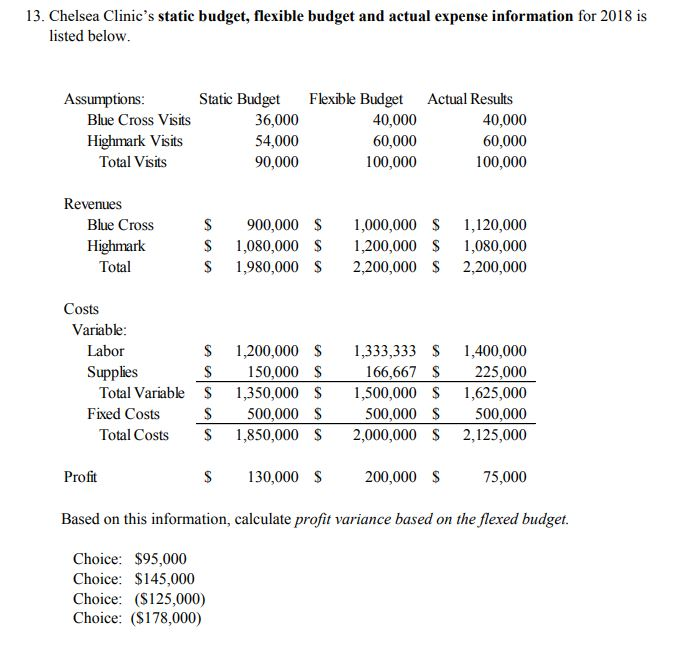

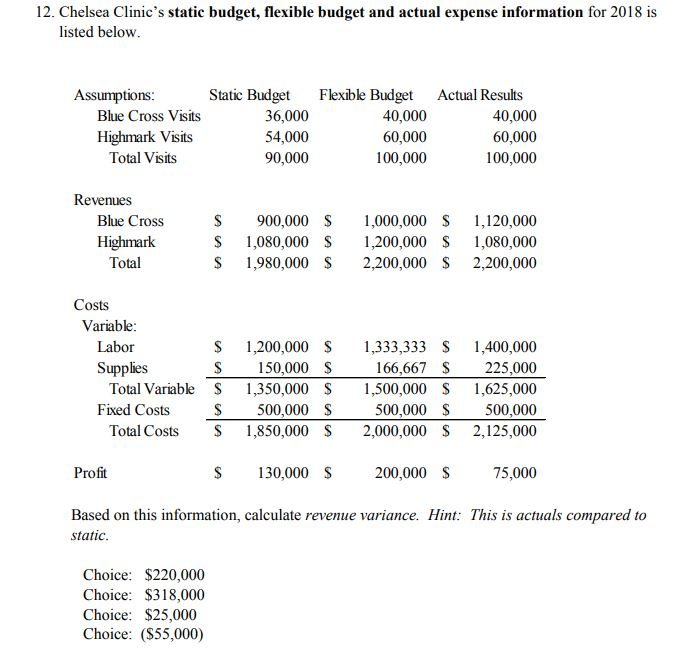

10. Chelsea Clinic's actual information for 2018 is listed below Total FFS Visit Volume 100,000 visits BUDGETED: Payer Mix Blue Cross Highmark Blue Cross Highmark 40% 60% BUDGETED: Reimbursement Rates S25 per visit S20 per visit ACTUAL: Payer Mix Blue Cross Highmark 5890 42% ACTUAL: Reimbursement Rates Blue Cross S28 per visit $18 per visit Highmark Based on this information, calculate the actual total revenues Choice: $1,800,000 Module 6- Part 1 Homework- Financial Planning and Budgeting Choice: $4,650,000 Choice: $2,380,000 Choice: $3,647,000 11. Chelsea Clinic's static budget, flexible budget and actual expense information for 2018 is listed below To make the following problems easier I have summarized the following three financial statements side by side - static budget, flexible budget and actual results Assumptions Static Budget Flexible Budget Actual Results Blue Cross Visits Highmark Visits Total Visits 36,000 54,000 90,000 40,000 60,000 100,000 40,000 60,000 100,000 Revenues Blue Cross Highmark Total S 900,000 $ 1,000,000 S ,20,000 S 1,080,000 S ,200,000 S 1,080,000 S 1,980,000 S 2,200,000 S 2,200,000 Costs Variable S 1,200,000 S 1,333,333 S 1,400,000 166,667 225,000 Total Variable S ,350,000 S 1,500,000 S 1,625,000 500,000 S500,000 Total Costs 1,850,000 S 2,000,000 S 2,125,000 Labor Supplies S 150,000 $ Fixed Costs S 500,000 S Profit S 30,000 S 200,000 $ 75,000 Based on this information, calculate profit variance. Hint: This is actuals compared to static budget Choice: $105,000 Choice: $45,000 Choice: ($0) Choice: (S55,000) 13. Chelsea Clinic's static budget, flexible budget and actual expense information for 2018 is listed below Assumptions Static Budget Flexible Budget Actual Results Blue Cross Visits Highmark Visits Total Visits 36,000 54,000 90,000 40,000 60,000 100,000 40,000 60,000 100,000 Revenues Blue Cross Highmark Total S 900,000 $ 1,000,000 S ,120,000 S 1,080,000 S ,200,000 S 1,080,000 S 1,980,000 S 2,200,000 S 2,200,000 Costs Variable Labor Supplies S 1,200,000 S 333,333 S 1,400,000 166,667 225,000 Total Variable S 1,350,000 S 1,500,000 S 1,625,000 500,000 S500,000 Total Costs 1,850,000 S 2,000,000 S 2,125,000 S 50,000 S Fixed Costs S 500,000 S Profit S 130,000 S 200,000S 75,000 Based on this information, calculate profit variance based on the flexed budget Choice: $95,000 Choice: $145,000 Choice: (S125,000) Choice: ($178,000) 12. Chelsea Clinic's static budget, flexible budget and actual expense information for 2018 is listed below Assumptions Static Budget Flexible Budget Actual Results Blue Cross Visits Highmark Visits Total Visits 36,000 54,000 90,000 40,000 60,000 100,000 40,000 60,000 100,000 Revenues Blue Cross Highmark Total S 900,000 S 1,000,000 S 1,120,000 S 1,080,000 S ,200,000 S 1,080,000 S 1,980,000 S 2,200,000 S 2,200,000 Costs Variable S 1,200,000 S 1,333,333 S 1,400,000 166,667 225,000 Total Variable S ,350,000 S 1,500,000 S 1,625,000 500,000 S 500,000 Total Costs S,850,000 S 2,000,000 S 2,125,000 Labor Supplies S 150,000 S Fixed Costs S 500,000 S Profit S 130,000 S 200,000 S 75,000 Based on this information, calculate revenue variance. Hint: This is actuals compared to static Choice: $220,000 Choice: $318,000 Choice: $25,000 Choice: (S55,000)