Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Consider the following economy of ComplexLand: - There are 600 risky securities in the economy. The total market value of all these securities is

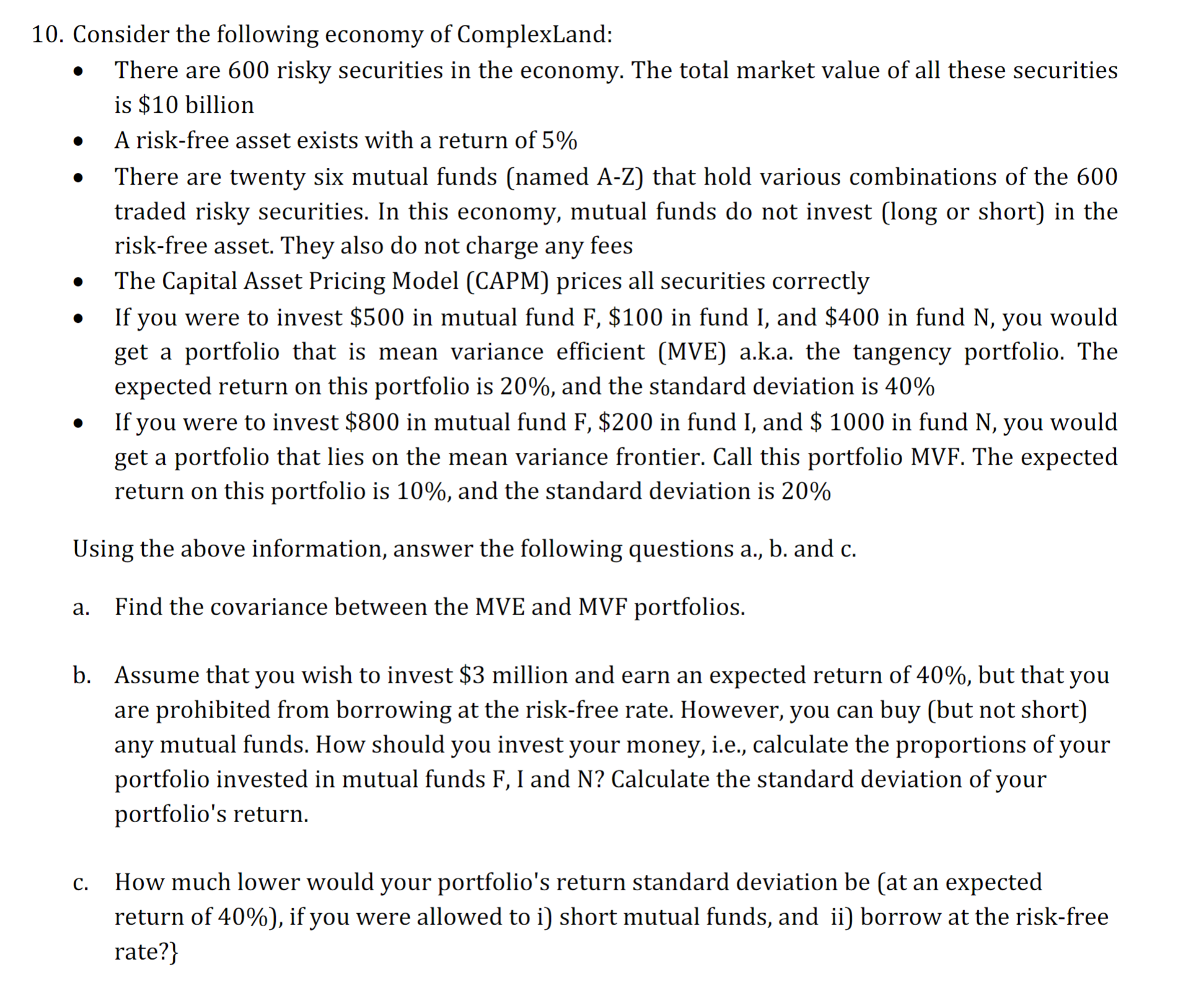

10. Consider the following economy of ComplexLand: - There are 600 risky securities in the economy. The total market value of all these securities is $10 billion - A risk-free asset exists with a return of 5% - There are twenty six mutual funds (named A-Z) that hold various combinations of the 600 traded risky securities. In this economy, mutual funds do not invest (long or short) in the risk-free asset. They also do not charge any fees - The Capital Asset Pricing Model (CAPM) prices all securities correctly - If you were to invest $500 in mutual fund F, \$100 in fund I, and $400 in fund N, you would get a portfolio that is mean variance efficient (MVE) a.k.a. the tangency portfolio. The expected return on this portfolio is 20%, and the standard deviation is 40% - If you were to invest \$800 in mutual fund F, \$200 in fund I, and \$ 1000 in fund N, you would get a portfolio that lies on the mean variance frontier. Call this portfolio MVF. The expected return on this portfolio is 10%, and the standard deviation is 20% Using the above information, answer the following questions a., b. and c. a. Find the covariance between the MVE and MVF portfolios. b. Assume that you wish to invest $3 million and earn an expected return of 40%, but that you are prohibited from borrowing at the risk-free rate. However, you can buy (but not short) any mutual funds. How should you invest your money, i.e., calculate the proportions of your portfolio invested in mutual funds F, I and N? Calculate the standard deviation of your portfolio's return. c. How much lower would your portfolio's return standard deviation be (at an expected return of 40% ), if you were allowed to i) short mutual funds, and ii) borrow at the risk-free rate?\}

10. Consider the following economy of ComplexLand: - There are 600 risky securities in the economy. The total market value of all these securities is $10 billion - A risk-free asset exists with a return of 5% - There are twenty six mutual funds (named A-Z) that hold various combinations of the 600 traded risky securities. In this economy, mutual funds do not invest (long or short) in the risk-free asset. They also do not charge any fees - The Capital Asset Pricing Model (CAPM) prices all securities correctly - If you were to invest $500 in mutual fund F, \$100 in fund I, and $400 in fund N, you would get a portfolio that is mean variance efficient (MVE) a.k.a. the tangency portfolio. The expected return on this portfolio is 20%, and the standard deviation is 40% - If you were to invest \$800 in mutual fund F, \$200 in fund I, and \$ 1000 in fund N, you would get a portfolio that lies on the mean variance frontier. Call this portfolio MVF. The expected return on this portfolio is 10%, and the standard deviation is 20% Using the above information, answer the following questions a., b. and c. a. Find the covariance between the MVE and MVF portfolios. b. Assume that you wish to invest $3 million and earn an expected return of 40%, but that you are prohibited from borrowing at the risk-free rate. However, you can buy (but not short) any mutual funds. How should you invest your money, i.e., calculate the proportions of your portfolio invested in mutual funds F, I and N? Calculate the standard deviation of your portfolio's return. c. How much lower would your portfolio's return standard deviation be (at an expected return of 40% ), if you were allowed to i) short mutual funds, and ii) borrow at the risk-free rate?\} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started