Answered step by step

Verified Expert Solution

Question

1 Approved Answer

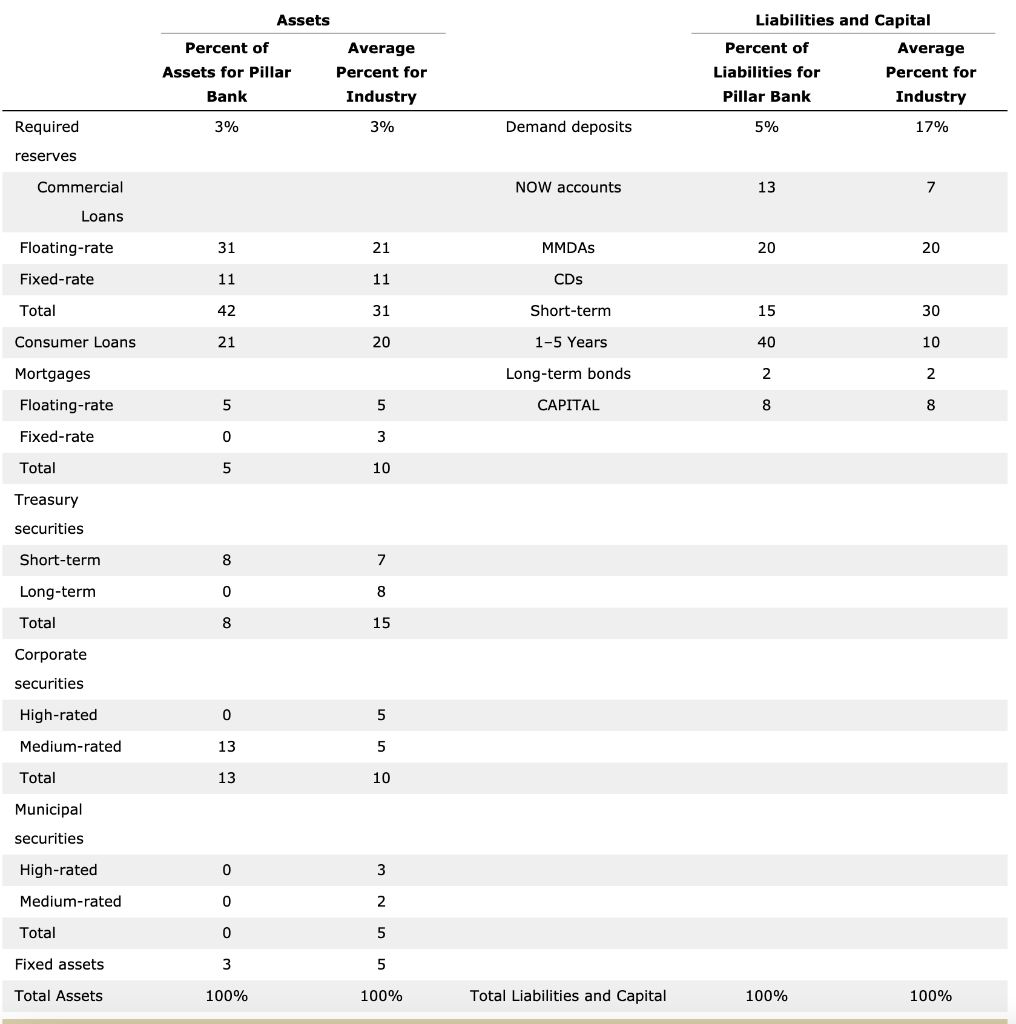

10. Consider the following subsection of Pillars balance sheet, as compared to industry averages. (Note: Each balance sheet component is measured as a percentage. For

10. Consider the following subsection of Pillars balance sheet, as compared to industry averages. (Note: Each balance sheet component is measured as a percentage. For assets, these percentages represent the percentage of total assets. For liabilities, the percentages represent the percentage of total liabilities.)

Based on Pillars volume and composition of loans and securities, Pillars exposure to credit risk should be (lower/higher) than the industry average.

Assets Percent of Assets for Pillar Bank Average Percent for Industry Liabilities and Capital Percent of Average Liabilities for Percent for Pillar Bank Industry 5% 17% Required 3% 3% Demand deposits reserves Commercial NOW accounts 13 7 Loans Floating-rate 31 21 MMDAS 20 20 Fixed-rate 11 11 CDs Total 42 31 Short-term 15 30 Consumer Loans 21 20 1-5 Years 40 10 Mortgages Long-term bonds 2 2 Floating-rate 5 5 CAPITAL 8 8 Fixed-rate 0 3 Total 5 10 Treasury securities Short-term 8 7 Long-term 0 8 Total 8 15 Corporate securities High-rated 0 5 Medium-rated 13 5 Total 13 10 Municipal securities High-rated 0 3 Medium-rated 0 2 Total 0 5 Fixed assets 3 5 Total Assets 100% 100% Total Liabilities and Capital 100% 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started