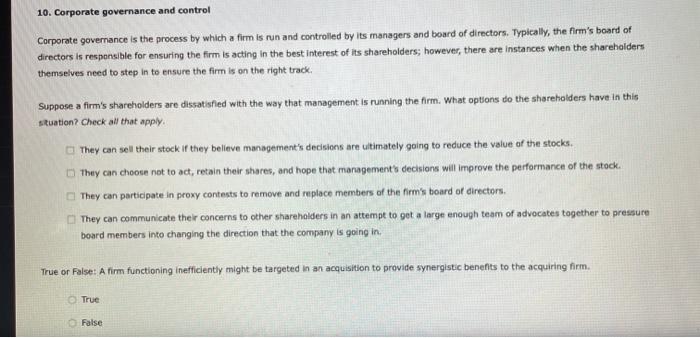

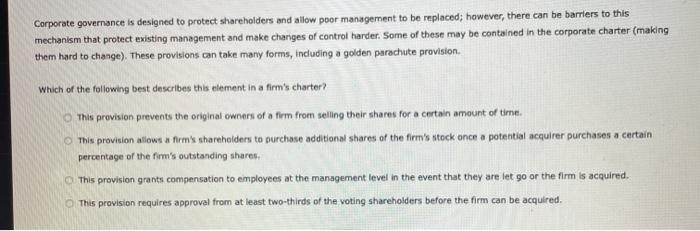

10. Corporate governance and control Corporate governance is the process by which a firm is run and controlled by its managers and board of directors. Typically, the firm's board of directors is responsible for ensuring the firm is acting in the best interest of its shareholders; however, there are instances when the shareholders themselves need to step in to ensure the firm is on the right track Suppose a firm's shareholders are dissatisfied with the way that management is running the firm. What options to the shareholders have in this situation? Check all that apply. They can sell their stock if they believe management's decisions are ultimately going to reduce the value of the stocks. They can choose not to act, retain their shares, and hope that management's decisions will improve the performance of the stock. They can participate in proxy contests to remove and replace members of the firm's board of directors. They can communicate their concerns to other shareholders in an attempt to get a large enough team of advocates together to pressure board members into changing the direction that the company is going in, True or False: A firm functioning inefficiently might be targeted in an acquisition to provide synergistic benefits to the acquiring firm. True False Corporate governance is designed to protect shareholders and allow poor management to be replaced; however, there can be barriers to this mechanism that protect existing management and make charges of control harder. Some of these may be contained in the corporate charter (making them hard to change). These provisions can take many forms, including a golden parachute provision. Which of the following best describes this element in a firm's charter? This provision prevents the original owners of a firm from selling their shares for a certain amount of time. This provision allows a firm's shareholders to purchase additional shares of the firm's stock once a potential acquirer purchases a certain percentage of the firm's outstanding shares This provision grants compensation to employees at the management level in the event that they are let go or the firm is acquired. This provision requires approval from at least two-thirds of the voting shareholders before the firm can be acquired