10. Corporate valuation model

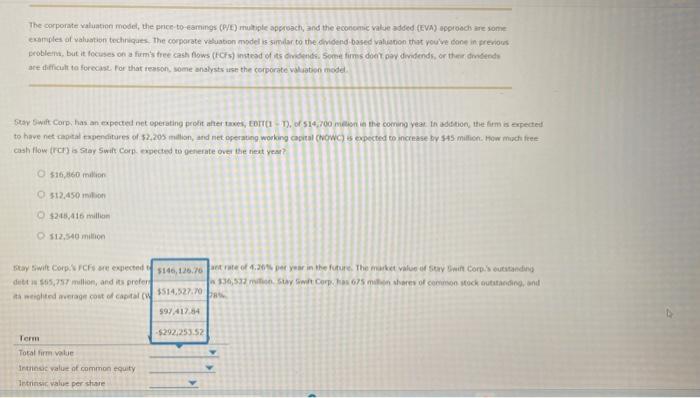

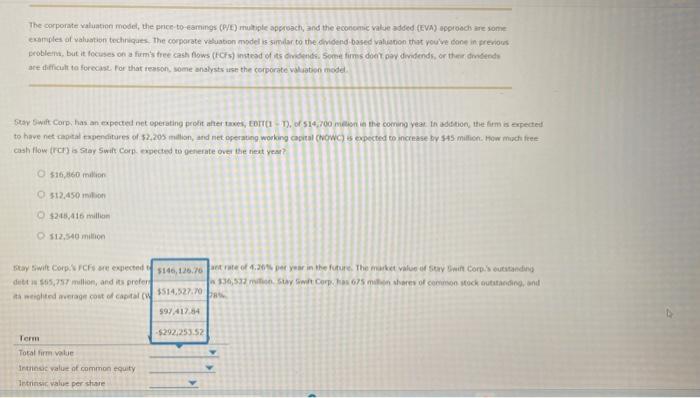

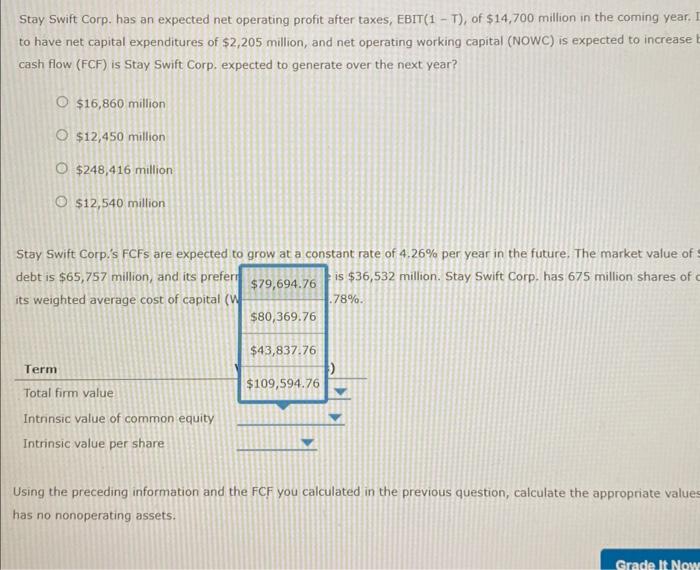

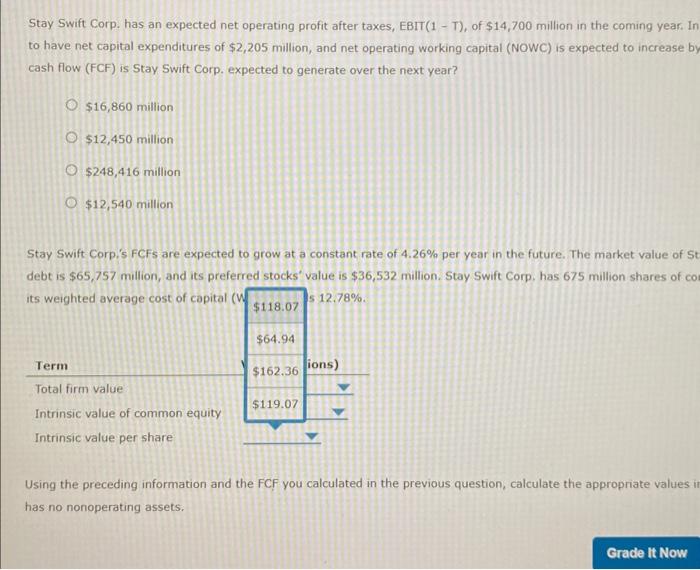

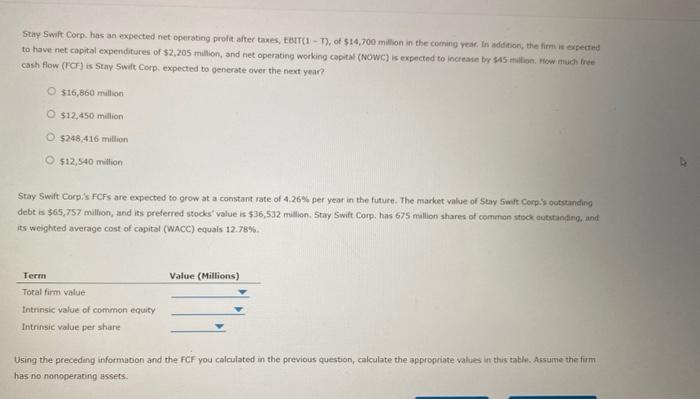

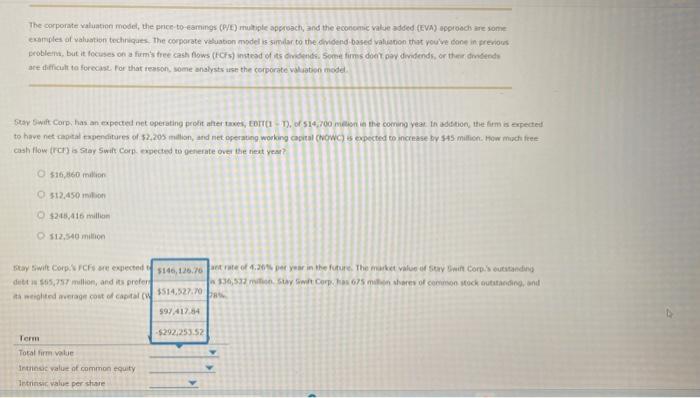

The corporate vahuation moded, the price to eamings (Prt) mulipte spgroachy and the ecoocrie value added (EVA) apptodohs are some charphies at wahuation techniques. The comparate valuation mpodel is sumilar to the dividend based valuabon that you've done in preniout afe ditficult to forecask for that reason. some shalysts arse the corporate valiation motel. cash flow (reb) a stay Swith Corp. ropected to geferate ove the heat yest? 416,360 midis 512,450 mitsot 4246,416 milisan 112,540 mition iet rate of 4:20% ger year in lhe foture. The emakct value od fory Dwit corbis ouratandind dete in \$tis,797 mullion, and ins oreter ata merolited average cost of caphat Stay Swift Corp. has an expected net operating profit after taxes, EBIT (1T), of $14,700 million in the coming year. to have net capital expenditures of $2,205 million, and net operating working capital (NOWC) is expected to increase cash flow (FCF) is Stay Swift Corp, expected to generate over the next year? $16,860 milion $12,450 milion $248,416 million $12,540 million Stay Swift Corp.'s FCFs are expected to grow at a constant rate of 4.26% per year in the future, The market value of debt is $65,757 million, and its preferm $79,694.76=$36,532 million. Stay Swift Corp. has 675 million shares of its weighted average cost of capital ( W. 1.78% Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate value has no nonoperating assets. Stay Swift Corp. has an expected net operating profit after taxes, EBIT (1T), of $14,700 million in the coming year. Ir to have net capital expenditures of $2,205 million, and net operating working capital (NOWC) is expected to increase b cash flow (FCF) is Stay Swift Corp. expected to generate over the next year? $16,860 million $12,450 million $248,416 million $12,540 million Stay Swift Corpi's FCFs are expected to grow at a constant rate of 4.26% per year in the future. The market value of 5 debt is $65,757 million, and its preferred stocks' value is $36,532 million. Stay Swift Corp, has 675 million shares of co Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate values has no nonoperating assets. Stay Swit Corp. has an expected net operating profit affer taxes, tBIT (11), of 514,700 millon in the cominio rear, In adidion, the fieni is expetted to have net capital expenditures of $2,205 inillion, and net operating working capital (fowc) is expected to increase by $45 mallion. flow numeh free eash flow (rCF) is Stay Swit Corp. expected to generate over the next year? 316,660 milison $12,450 million 5248,416 million 512,540 million Stay Swit Corpis FCF's are expected to grow at a constant rate of 4.26% per year in the future. The market value of 5 bay Siaut Corp. outstanding debt is $65,757 mullion, and its preferred stocks' value is 536,532 million, 5 tay 5 wift Corp. has 675 mallion shares of cormenae Mtock autatanding, and its weighted average cost of capital (WACC) equals 12.78% Using the preceding information and the FCF you calculated in the previous question, calculate the appropriate valies in this takle. Assume the fimm has no nonoperating ussets