Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Corporate valuation model The corporate valuation model, the price to earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples

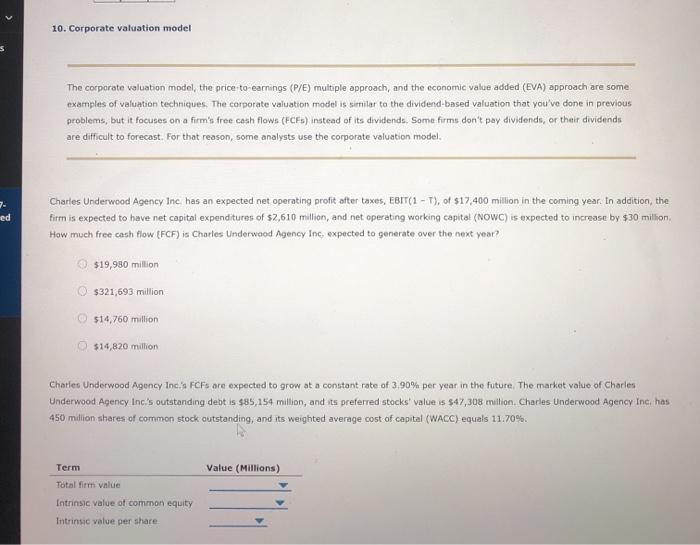

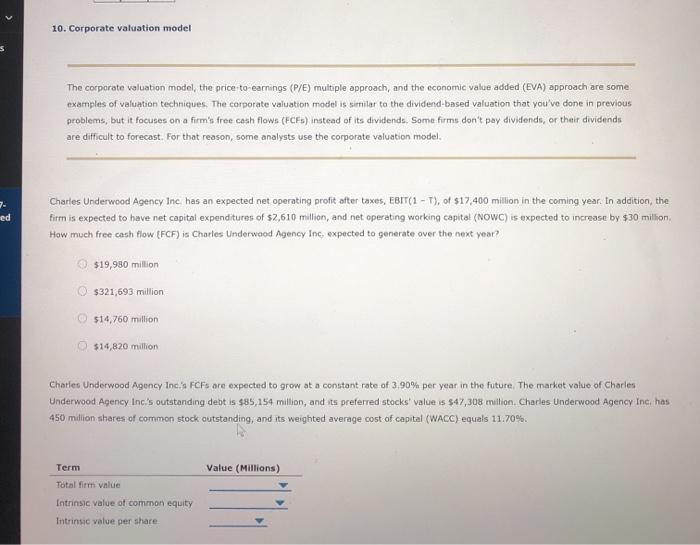

10. Corporate valuation model The corporate valuation model, the price to earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm's free cash flows (FCFS) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast for that reason, some analysts use the corporate valuation model 7- ed Charles Underwood Agency Inc has an expected net operating profit after taxes, EBIT(1 - 1), of $17,400 million in the coming year. In addition, the firm is expected to have net capital expenditures of $2,610 million, and net operating working capital (NOWC) is expected to increase by $30 million How much free cash flow (FCF) is Charles Underwood Agency Inc, expected to generate over the next year? $19,980 million $321,693 million $14,760 million $14,820 million Chatfes Underwood Agency Inc.'s Fors are expected to grow at a constant rate of 3.90% per year in the future. The market value of Charles Underwood Agency Inc.'s outstanding debt is $85,154 million, and its preferred stocks' value is $47,308 milion. Charles Underwood Agency Inc. has 450 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 11.70% Value (Millions) Term Total firm value Intrinsic value of common equity Intrinsic value per share

10. Corporate valuation model The corporate valuation model, the price to earnings (P/E) multiple approach, and the economic value added (EVA) approach are some examples of valuation techniques. The corporate valuation model is similar to the dividend-based valuation that you've done in previous problems, but it focuses on a firm's free cash flows (FCFS) instead of its dividends. Some firms don't pay dividends, or their dividends are difficult to forecast for that reason, some analysts use the corporate valuation model 7- ed Charles Underwood Agency Inc has an expected net operating profit after taxes, EBIT(1 - 1), of $17,400 million in the coming year. In addition, the firm is expected to have net capital expenditures of $2,610 million, and net operating working capital (NOWC) is expected to increase by $30 million How much free cash flow (FCF) is Charles Underwood Agency Inc, expected to generate over the next year? $19,980 million $321,693 million $14,760 million $14,820 million Chatfes Underwood Agency Inc.'s Fors are expected to grow at a constant rate of 3.90% per year in the future. The market value of Charles Underwood Agency Inc.'s outstanding debt is $85,154 million, and its preferred stocks' value is $47,308 milion. Charles Underwood Agency Inc. has 450 million shares of common stock outstanding, and its weighted average cost of capital (WACC) equals 11.70% Value (Millions) Term Total firm value Intrinsic value of common equity Intrinsic value per share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started