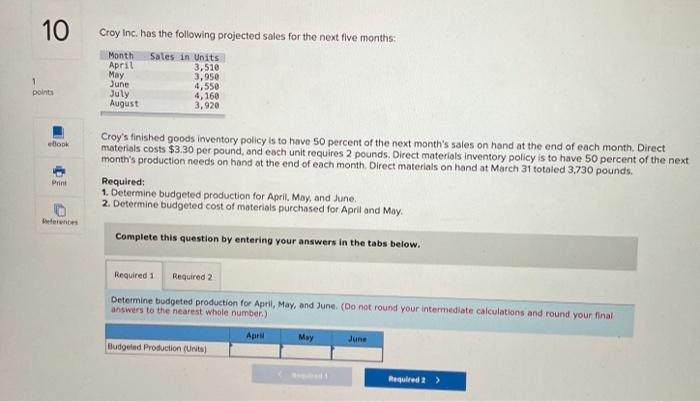

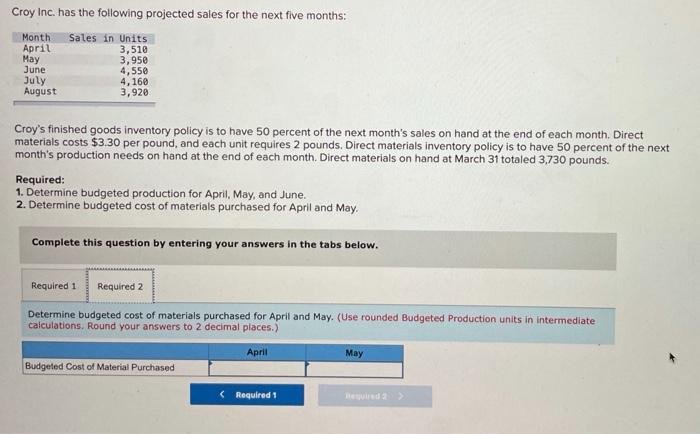

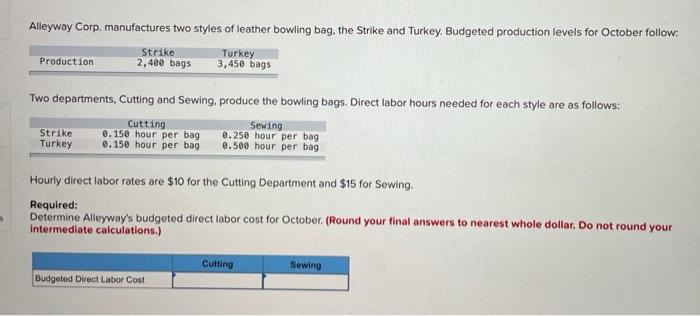

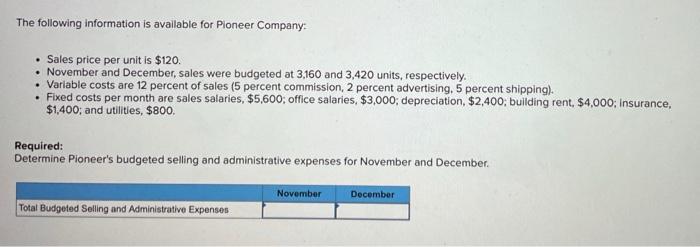

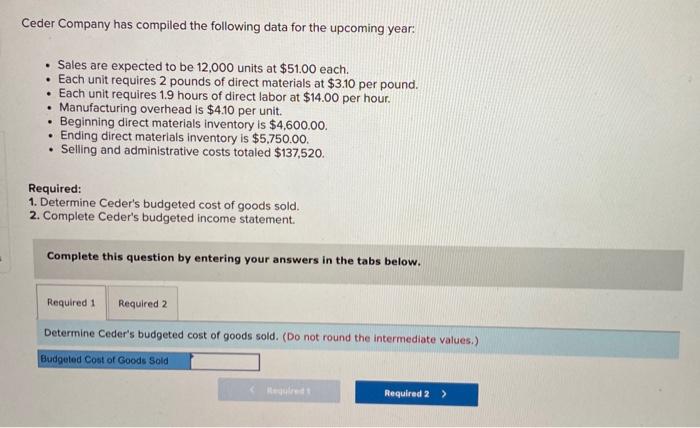

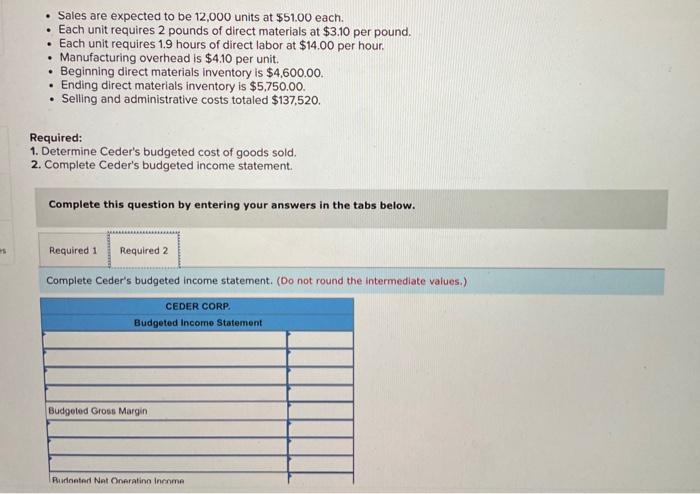

10 Croy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,510 May 3,950 June 4,550 July 4,160 August 3,920 1 points Book Croy's finished goods inventory policy is to have 50 percent of the next month's sales on hand at the end of each month. Direct materials costs $3.30 per pound, and each unit requires 2 pounds. Direct materials Inventory policy is to have 50 percent of the next month's production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3.730 pounds. Required: 1. Determine budgeted production for April, May, and June. 2. Determine budgeted cost of materials purchased for April and Moy. Print Deferon Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted production for April, May, and June. (Do not round your intermediate calculations and round your final answers to the nearest whole number) April May Budgeted Production (Units) Croy Inc. has the following projected sales for the next five months: Month Sales in Units April 3,510 May 3,950 June 4,550 July 4,160 August 3,920 Croy's finished goods inventory policy is to have 50 percent of the next month's sales on hand at the end of each month. Direct materials costs $3.30 per pound, and each unit requires 2 pounds. Direct materials inventory policy is to have 50 percent of the next month's production needs on hand at the end of each month. Direct materials on hand at March 31 totaled 3,730 pounds. Required: 1. Determine budgeted production for April, May, and June. 2. Determine budgeted cost of materials purchased for April and May, Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted cost of materials purchased for April and May. (Use rounded Budgeted Production units in intermediate calculations. Round your answers to 2 decimal places.) April May Budgeted Cost of Material Purchased Required 1 Alleyway Corp. manufactures two styles of leather bowling bag, the Strike and Turkey. Budgeted production levels for October follow: Production Strike 2,480 bags Turkey 3,450 bags Two departments, Cutting and Sewing, produce the bowling bags. Direct labor hours needed for each style are as follows: Cutting Sewing Strike 0.150 hour per bag 0.250 hour per bag Turkey 0.150 hour per bag 2.500 hour per bag Hourly direct labor rates are $10 for the Cutting Department and $15 for Sewing. Required: Determine Alleyway's budgeted direct labor cost for October (Round your final answers to nearest whole dollar. Do not round your Intermediate calculations.) 5 Cutting Sewing Budgeted Direct Labor Cost The following information is available for Pioneer Company: Sales price per unit is $120. November and December, sales were budgeted at 3.160 and 3,420 units, respectively. Variable costs are 12 percent of sales (5 percent commission, 2 percent advertising, 5 percent shipping). Fixed costs per month are sales salaries, $5,600; office salaries, $3,000; depreciation, $2,400, building rent, $4,000: Insurance, $1,400; and utilities, $800. Required: Determine Pioneer's budgeted selling and administrative expenses for November and December November December Total Budgeted Selling and Administrative Expenses Ceder Company has compiled the following data for the upcoming year: Sales are expected to be 12,000 units at $51.00 each. Each unit requires 2 pounds of direct materials at $3.10 per pound. Each unit requires 1.9 hours of direct labor at $14.00 per hour. Manufacturing overhead is $4.10 per unit. Beginning direct materials inventory is $4,600.00 Ending direct materials inventory is $5,750.00 . Selling and administrative costs totaled $137,520. Required: 1. Determine Ceder's budgeted cost of goods sold. 2. Complete Ceder's budgeted income statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine Ceder's budgeted cost of goods sold. (Do not round the intermediate values.) Budgeted Cost of Goods Sold Required 2 > Sales are expected to be 12,000 units at $51.00 each. Each unit requires 2 pounds of direct materials at $3.10 per pound. Each unit requires 1.9 hours of direct labor at $14.00 per hour. Manufacturing overhead is $4.10 per unit. Beginning direct materials Inventory is $4,600.00. Ending direct materials inventory is $5,750.00. Selling and administrative costs totaled $137,520. . Required: 1. Determine Ceder's budgeted cost of goods sold. 2. Complete Ceder's budgeted income statement Complete this question by entering your answers in the tabs below. Required 1 Required 2 Complete Ceder's budgeted income statement. (Do not round the intermediate values.) CEDER CORP. Budgeted Income Statement Budgeted Gross Margin Rudenter NetOnerating Income