Answered step by step

Verified Expert Solution

Question

1 Approved Answer

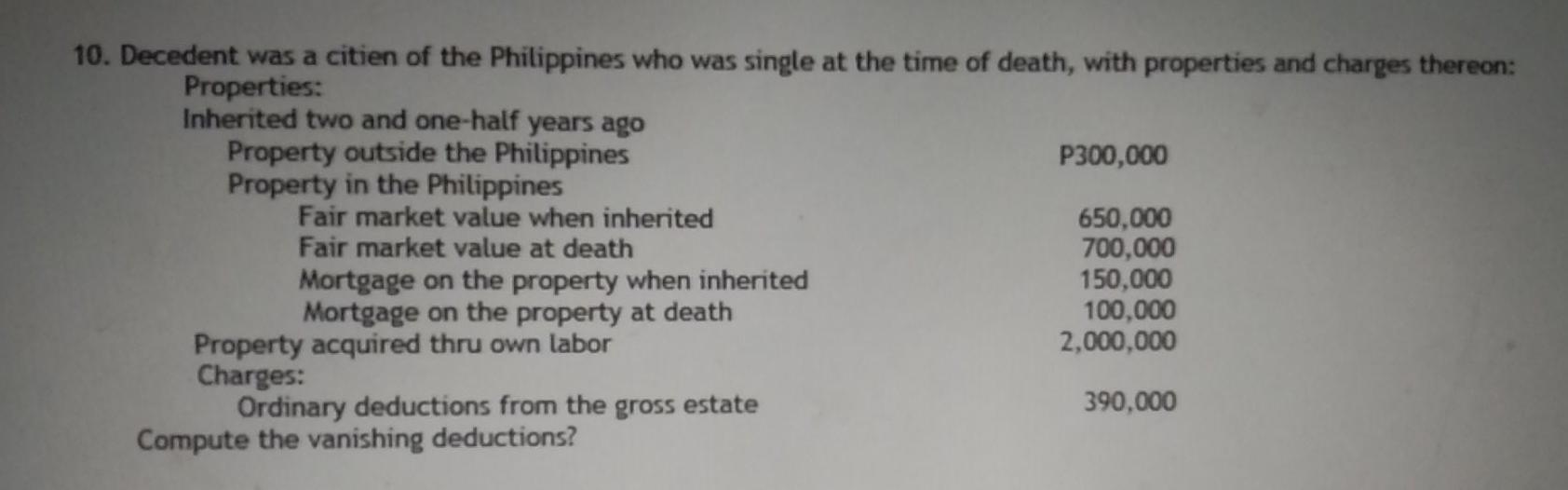

10. Decedent was a citien of the Philippines who was single at the time of death, with properties and charges thereon: Properties: Inherited two and

10. Decedent was a citien of the Philippines who was single at the time of death, with properties and charges thereon: Properties: Inherited two and one-half years ago Property outside the Philippines P300,000 Property in the Philippines Fair market value when inherited 650,000 Fair market value at death 700,000 Mortgage on the property when inherited 150,000 Mortgage on the property at death 100,000 Property acquired thru own labor 2,000,000 Charges: Ordinary deductions from the gross estate 390,000 Compute the vanishing deductions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started