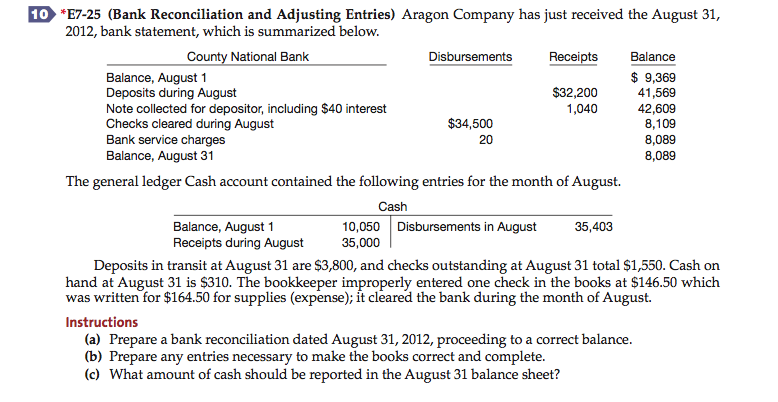

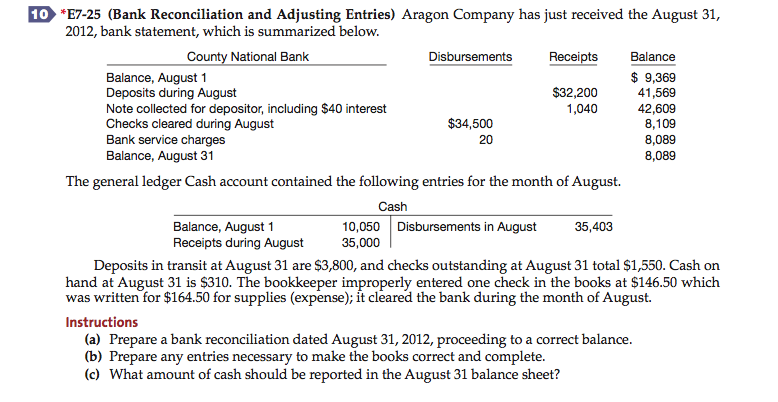

10 *E7-25 (Bank Reconciliation and Adjusting Entries) Aragon Company has just received the August 31 2012, bank statement, which is summarized below. County National Bank Disbursements Receipts Balance Balance, August 1 9,369 $32,200 41,569 Deposits during August Note collected for depositor, including $40 interest 1,040 42,609 $34,500 Checks cleared during August 8,109 Bank service charges 20 8,089 Balance, August 31 8,089 The general ledger Cash account contained the following entries for the month of August. Cash Balance, August 1 10,050 Disbursements in August 35,403 Receipts during August 35,000 Deposits in transit at August 31 are $3,800, and checks outstanding at August 31 total $1,550. Cash on hand at August 31 is $310. The bookkeeper improperly entered one check in the books at $146.50 which was written for $164.50 for supplies (expense); it cleared the bank during the month of August. Instructions (a) Prepare a bank reconciliation dated August 31,2012, proceeding to a correct balance. (b) Prepare any entries necessary to make the books correct and complete (c) What amount of cash should be reported in the August 31 balance sheet? 10 *E7-25 (Bank Reconciliation and Adjusting Entries) Aragon Company has just received the August 31 2012, bank statement, which is summarized below. County National Bank Disbursements Receipts Balance Balance, August 1 9,369 $32,200 41,569 Deposits during August Note collected for depositor, including $40 interest 1,040 42,609 $34,500 Checks cleared during August 8,109 Bank service charges 20 8,089 Balance, August 31 8,089 The general ledger Cash account contained the following entries for the month of August. Cash Balance, August 1 10,050 Disbursements in August 35,403 Receipts during August 35,000 Deposits in transit at August 31 are $3,800, and checks outstanding at August 31 total $1,550. Cash on hand at August 31 is $310. The bookkeeper improperly entered one check in the books at $146.50 which was written for $164.50 for supplies (expense); it cleared the bank during the month of August. Instructions (a) Prepare a bank reconciliation dated August 31,2012, proceeding to a correct balance. (b) Prepare any entries necessary to make the books correct and complete (c) What amount of cash should be reported in the August 31 balance sheet