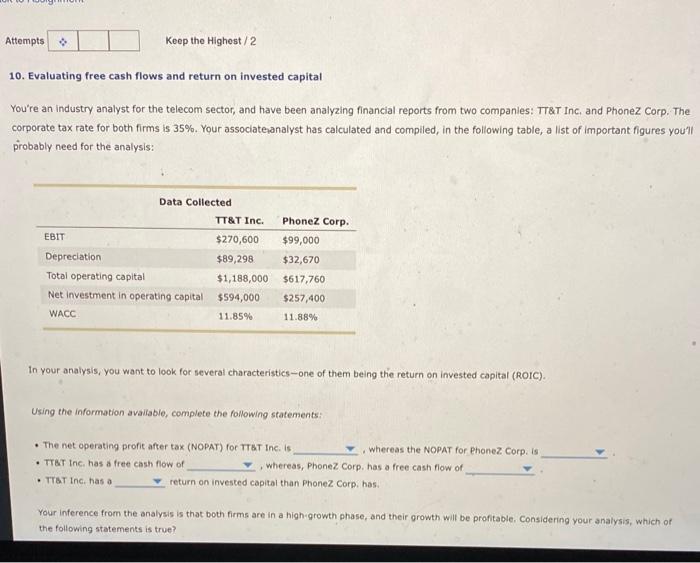

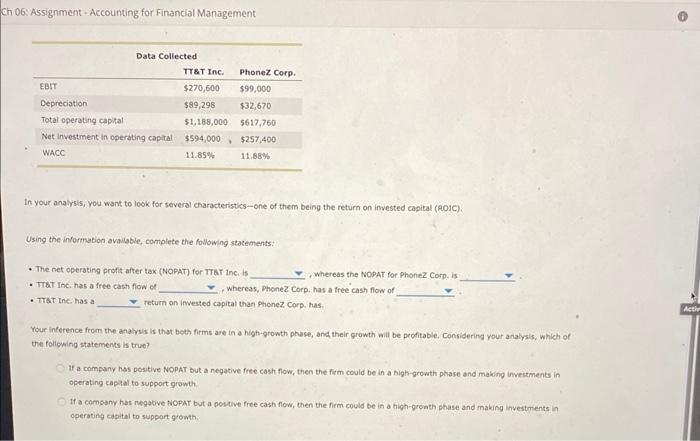

10. Evaluating free cash flows and return on invested capital You're an industry analyst for the telecom sector, and have been analyzing financial reports from two companies: TT\&T Inc, and Phonez Corp. The corporate tax rate for both firms is 35%. Your associatesanalyst has calculated and compiled, in the following table, a list of important figures you'l probably need for the analysis: In your analysis; you want to look for several characteristics-one of them being the return on invested capital (ROIC). Using the information available, complete the following statements: - The net operating profit after tax (NOPAT) for TTST Inc. is whereas the NOPAT for PhoneZ Corp. is - THBT Inc, has a free cash flow of whereas, Phonez Corp. has a free cash flow of - TTat inc, has a return on invested capital than PhoneZ Corp, has. Your inference from the analysis is that both firms are in a high-growth phase, and their growth will be profitable. Considering your analysis, which of the following statements is true? Ch 06: Assignment - Accounting for Financial Management In your anaysis, you want to look for several characteristics - one of them being the return on invested capital (eoic). Using the information avaliable, complete the following statements: - The net operating profit after tax (NOPAT) for TTBT inci is whereas the NOPAT for PhoneZ Corp. is - Trat inci, has a free cash flow of - Whereas, Phonez Corp. has a free cash flow of - Trat inc has a return on invested capital than shonez. Corp. has. Your inference from the anarus is that both frms are in a high-growth phase, and their growth will be pecfitable. Considering your anaigsis, which of the following statements is true? If a company has positive NOPAT but a negative free cash flow, then the fitm could be in a high-growth phase and making inveitments in operating captal to support growh. If a comoany has negative NOPAT but a postive free cash flow, then the firm could be in a high-gronth phase and making investments in operating capital to suppart gowth