10

10

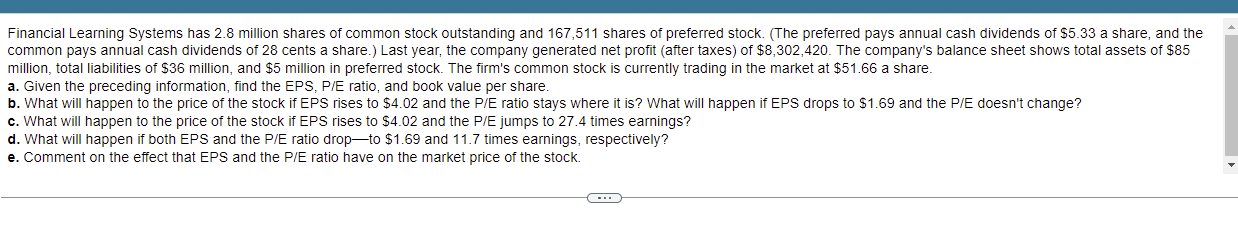

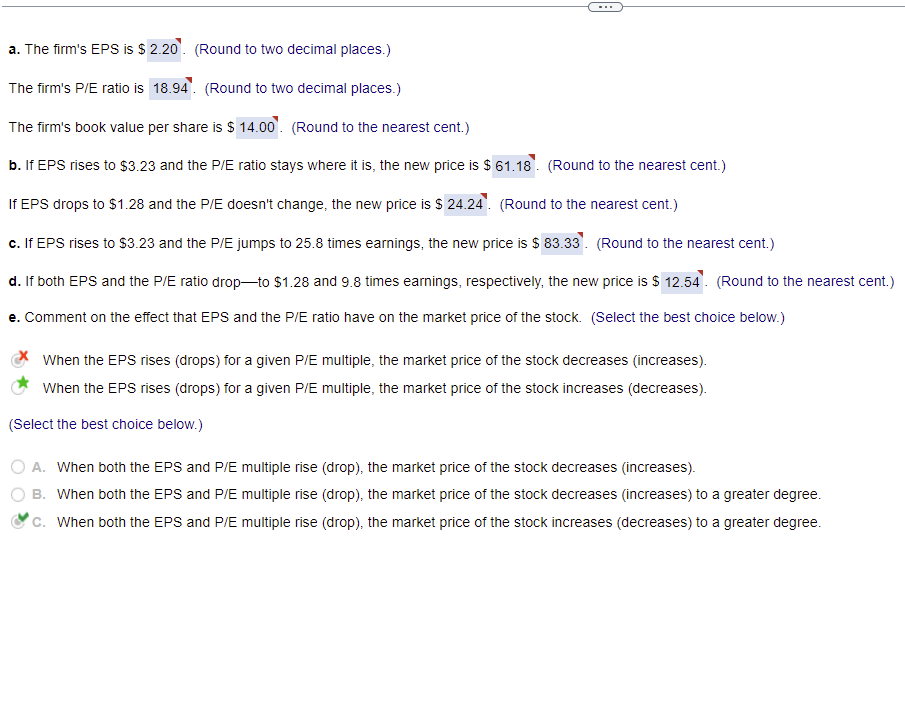

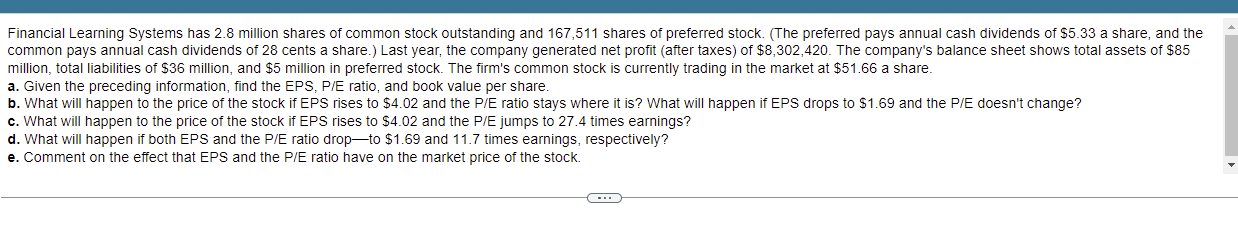

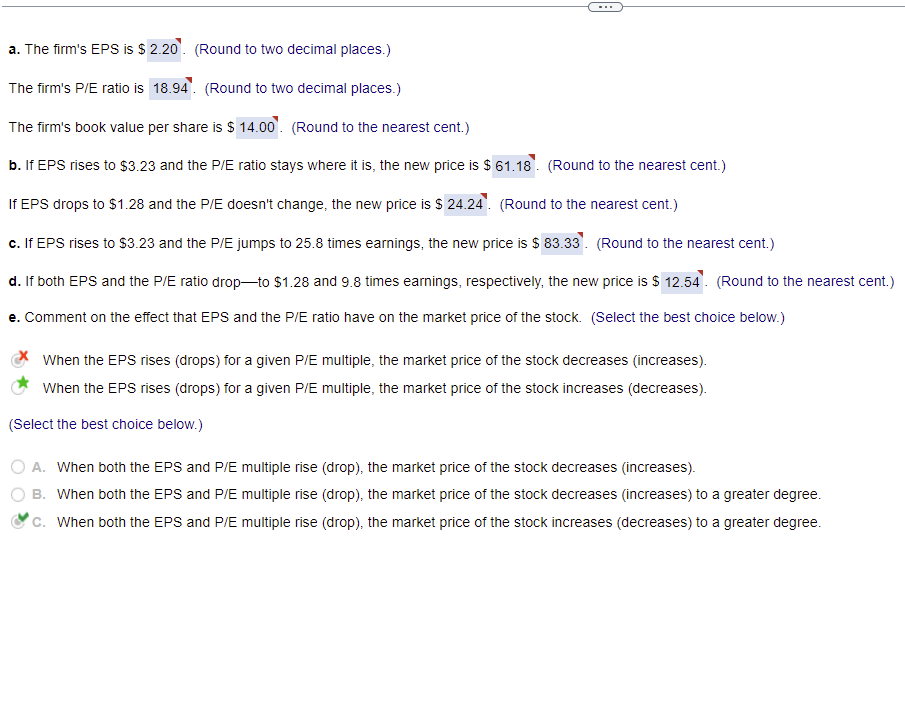

Financial Learning Systems has 2.8 million shares of common stock outstanding and 167,511 shares of preferred stock. (The preferred pays annual cash dividends of $5.33 a share, and the common pays annual cash dividends of 28 cents a share.) Last year, the company generated net profit (after taxes) of $8,302,420. The company's balance sheet shows total assets of $85 million, total liabilities of $36 million, and $5 million in preferred stock. The firm's common stock is currently trading in the market at $51.66 a share. a. Given the preceding information, find the EPS, P/E ratio, and book value per share. b. What will happen to the price of the stock if EPS rises to $4.02 and the P/E ratio stays where it is? What will happen if EPS drops to $1.69 and the P/E doesn't change? c. What will happen to the price of the stock if EPS rises to $4.02 and the P/E jumps to 27.4 times earnings? d. What will happen if both EPS and the P/E ratio drop-to $1.69 and 11.7 times earnings, respectively? e. Comment on the effect that EPS and the P/E ratio have on the market price of the stock. C a. The firm's EPS is $2.20. (Round to two decimal places.) The firm's P/E ratio is 18.94. (Round to two decimal places.) The firm's book value per share is $14.00. (Round to the nearest cent.) b. If EPS rises to $3.23 and the P/E ratio stays where it is, the new price is $61.18. (Round to the nearest cent.) If EPS drops to $1.28 and the P/E doesn't change, the new price is $24.24. (Round to the nearest cent.) c. If EPS rises to $3.23 and the P/E jumps to 25.8 times earnings, the new price is $83.33. (Round to the nearest cent.) d. If both EPS and the P/E ratio drop-to $1.28 and 9.8 times earnings, respectively, the new price is $12.54. (Round to the nearest cent.) e. Comment on the effect that EPS and the P/E ratio have on the market price of the stock. (Select the best choice below.) When the EPS rises (drops) for a given P/E multiple, the market price of the stock decreases (increases). When the EPS rises (drops) for a given P/E multiple, the market price of the stock increases (decreases). (Select the best choice below.) O A. When both the EPS and P/E multiple rise (drop), the market price of the stock decreases (increases). B. When both the EPS and P/E multiple rise (drop), the market price of the stock decreases (increases) to a greater degree. c. When both the EPS and P/E multiple rise (drop), the market price of the stock increases (decreases) to a greater degree

10

10