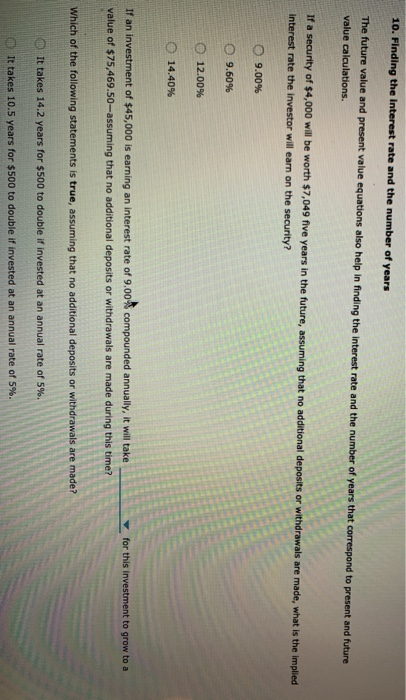

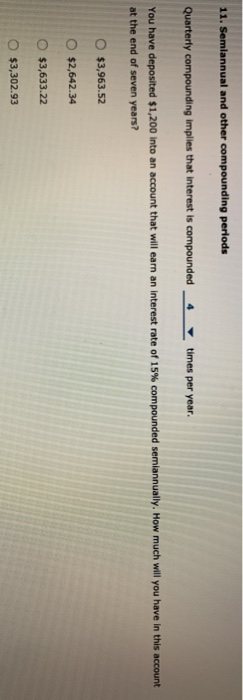

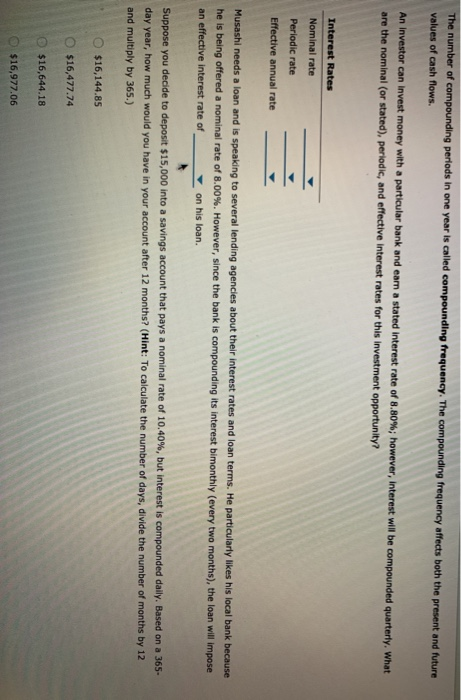

10. Finding the Interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security of $4,000 will be worth $7,049 five years in the future, assuming that no additional deposits or withdrawals are made, what is the implied Interest rate the investor will earn on the security? 9.00% 9.60% 12.00% 14.40% If an investment of $45,000 is earning an interest rate of 9.00% compounded annually, it will take value of $75,469.50-assuming that no additional deposits or withdrawals are made during this time? for this investment to grow to a Which of the following statements is true, assuming that no additional deposits or withdrawals are made? It takes 14.2 years for $500 to double if invested at an annual rate of 5%. It takes 10.5 years for $500 to double if invested at an annual rate of 5%. 11. Semiannual and other compounding periods Quarterly compounding implies that interest is compounded 4 times per year. You have deposited $1,200 into an account that will earn an interest rate of 15% compounded semiannually. How much will you have in this account at the end of seven years? $3,963.52 $2,642.34 O $3,633.22 $3,302.93 The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash flows. An Investor can Invest money with a particular bank and eam a stated interest rate of 8.80%; however, Interest will be compounded quarterly. What are the nominal (or stated), periodic, and effective interest rates for this investment opportunity? Interest Rates Nominal rate Periodic rate Effective annual rate Musashi needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes his local bank because he is being offered a nominal rate of 8.00%. However, since the bank is compounding its interest bimonthly (every two months), the loan will impose an effective interest rate of on his loan. Suppose you decide to deposit $15,000 into a savings account that pays a nominal rate of 10.40%, but interest is compounded daily. Based on a 365 day year, how much would you have in your account after 12 months? (Hint: To calculate the number of days, divide the number of months by 12 and multiply by 365.) $16,144.85 $16,477.74 $16,644.18 $16,977.06