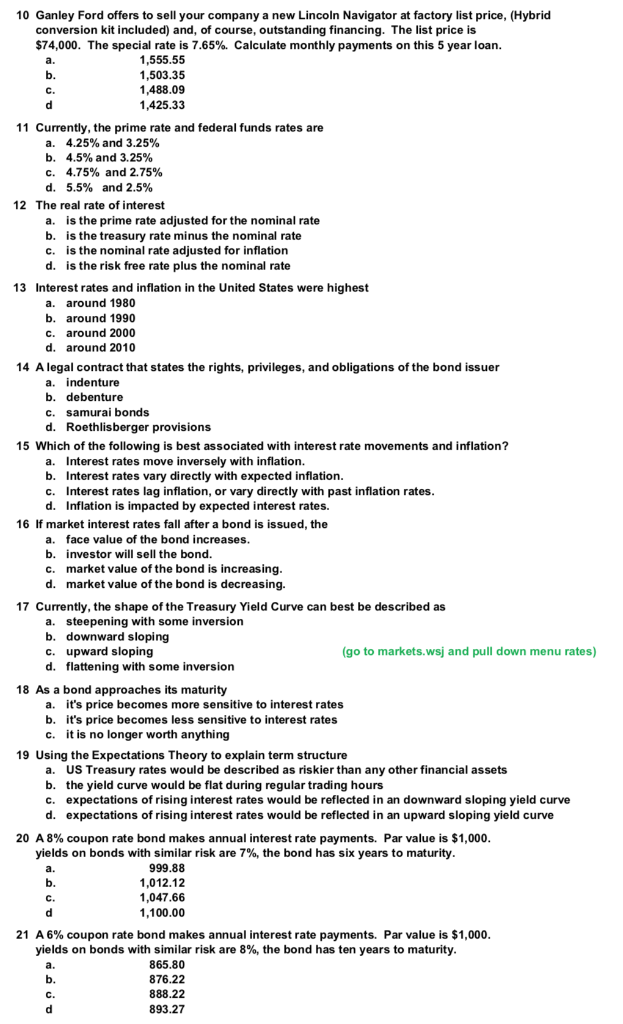

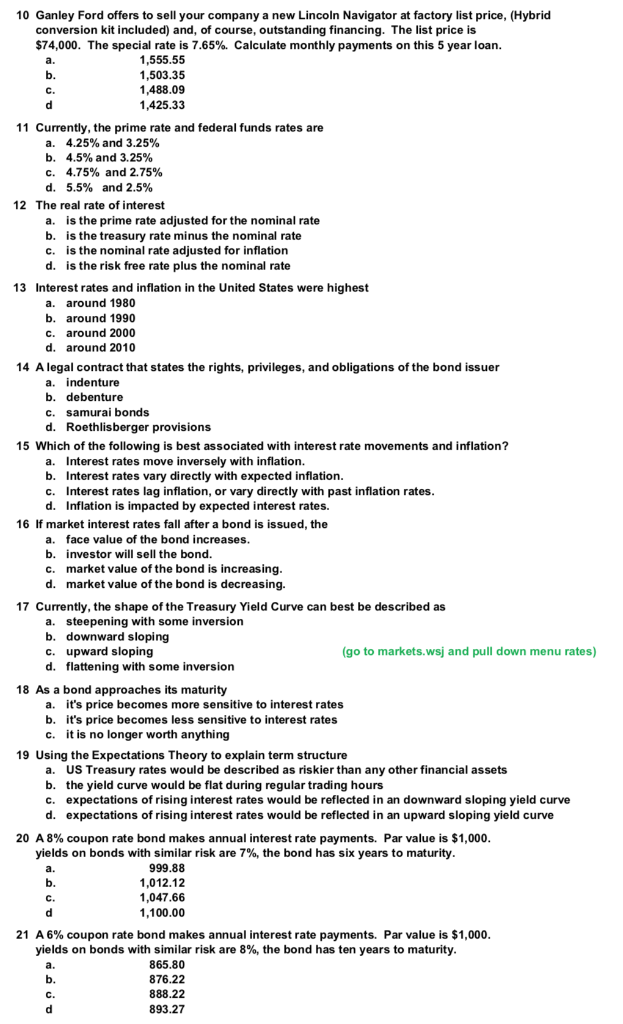

10 Ganley Ford offers to sell your company a new Lincoln Navigator at factory list price, (Hybrid conversion kit included) and, of course, outstanding financing. The list price is $74,000. The special rate is 7.65%. Calculate monthly payments on this 5 year loan. 1,555.55 1,503.35 1,488.09 1,425.33 C. 11 Currently, the prime rate and federal funds rates are a. b, c. d. 4.25% and 3.25% 4.5% and 3.25% 4.75% and 2.75% 5.5% and 2.5% 12 The real rate of interest a. b. c. d. is the prime rate adjusted for the nominal rate is the treasury rate minus the nominal rate is the nominal rate adjusted for inflation is the risk free rate plus the nominal rate 13 Interest rates and inflation in the United States were highest around 1980 b. around 1990 c. around 2000 d. around 2010 14 A legal contract that states the rights, privileges, and obligations of the bond issuer a. indenture b. debenture c. samurai bonds d. Roethlisberger provisions 15 Which of the following is best associated with interest rate movements and inflation? a. Interest rates move inversely with inflation. b. Interest rates vary directly with expected inflation c. Interest rates lag inflation, or vary directly with past inflation rates d. Inflation is impacted by expected interest rates. 16 If market interest rates fall after a bond is issued, the a. face value of the bond increases. b. investor will sell the bond. market value of the bond is increasing d. c. market value of the bond is decreasing. 17 Currently, the shape of the Treasury Yield Curve can best be described as a. steepening with some inversion b. downward sloping c. upward sloping d. flattening with some inversion (go to markets.wsj and pull down menu rates) 18 As a bond approaches its maturity a. b. c, it's price becomes more sensitive to interest rates it's price becomes less sensitive to interest rates it is no longer worth anything 19 Using the Expectations Theory to explain term structure a. b. c. d. US Treasury rates would be described as riskier than any other financial assets the yield curve would be flat during regular trading hours expectations of rising interest rates would be reflected in an downward sloping yield curve expectations of rising interest rates would be reflected in an upward sloping yield curve 20 A 8% coupon rate bond makes annual interest rate payments. Par value is $1,000 yields on bonds with similar risk are 7%, the bond has six years to maturity 999.88 1,012.12 1,047.66 1,100.00 a. 21 A 6% coupon rate bond makes annual interest rate payments. Par value is $1,000 yields on bonds with similar risk are 8%, the bond has ten years to maturity. 865.80 876.22 888.22 893.27 a. C