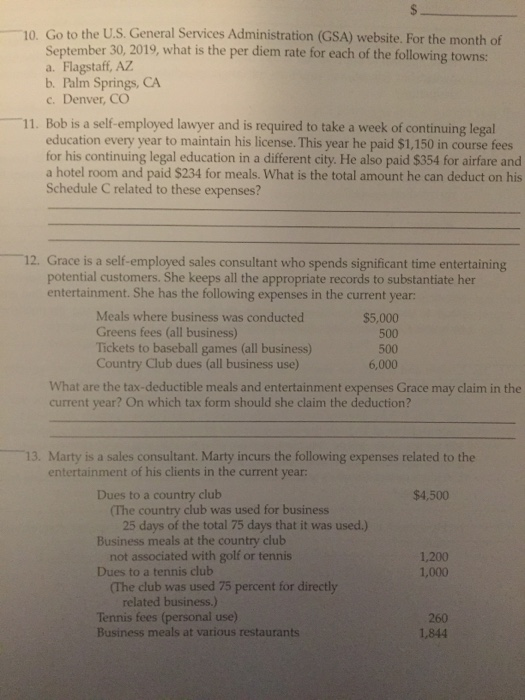

$ 10. Go to the U.S. General Services Administration (GSA) website. For the month of September 30, 2019, what is the per diem rate for each of the following towns: a. Flagstaff, AZ b. Palm Springs, CA c. Denver, CO 11. Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid $1,150 in course fees for his continuing legal education in a different city. He also paid $354 for airfare and a hotel room and paid $234 for meals. What is the total amount he can deduct on his Schedule C related to these expenses? a 12. Grace is a self-employed sales consultant who spends significant time entertaining potential customers. She keeps all the appropriate records to substantiate her entertainment. She has the following expenses in the current year: Meals where business was conducted $5,000 Greens fees (all business) 500 Tickets to baseball games (all business) 500 Country Club dues (all business use) 6,000 What are the tax-deductible meals and entertainment expenses Grace may claim in the current year? On which tax form should she claim the deduction? 13. Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in the current year: Dues to a country club $4,500 (The country club was used for business 25 days of the total 75 days that it was used.) Business meals at the country club not associated with golf or tennis 1,200 Dues to a tennis club 1,000 (The club was used 75 percent for directly related business.) Tennis fees (personal use) 260 Business meals at various restaurants 1,844 $ 10. Go to the U.S. General Services Administration (GSA) website. For the month of September 30, 2019, what is the per diem rate for each of the following towns: a. Flagstaff, AZ b. Palm Springs, CA c. Denver, CO 11. Bob is a self-employed lawyer and is required to take a week of continuing legal education every year to maintain his license. This year he paid $1,150 in course fees for his continuing legal education in a different city. He also paid $354 for airfare and a hotel room and paid $234 for meals. What is the total amount he can deduct on his Schedule C related to these expenses? a 12. Grace is a self-employed sales consultant who spends significant time entertaining potential customers. She keeps all the appropriate records to substantiate her entertainment. She has the following expenses in the current year: Meals where business was conducted $5,000 Greens fees (all business) 500 Tickets to baseball games (all business) 500 Country Club dues (all business use) 6,000 What are the tax-deductible meals and entertainment expenses Grace may claim in the current year? On which tax form should she claim the deduction? 13. Marty is a sales consultant. Marty incurs the following expenses related to the entertainment of his clients in the current year: Dues to a country club $4,500 (The country club was used for business 25 days of the total 75 days that it was used.) Business meals at the country club not associated with golf or tennis 1,200 Dues to a tennis club 1,000 (The club was used 75 percent for directly related business.) Tennis fees (personal use) 260 Business meals at various restaurants 1,844