Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. has parts a),b) 13 Please answer questions, 4, 10 a) and b), and 13 Using formulas needed, and show work. Which would be the

10. has parts a),b)

13

Please answer questions, 4, 10 a) and b), and 13 Using formulas needed, and show work.

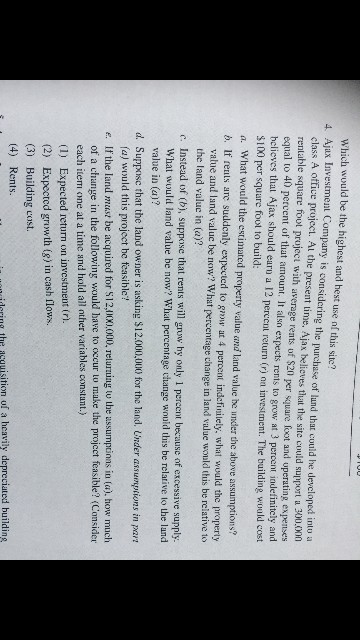

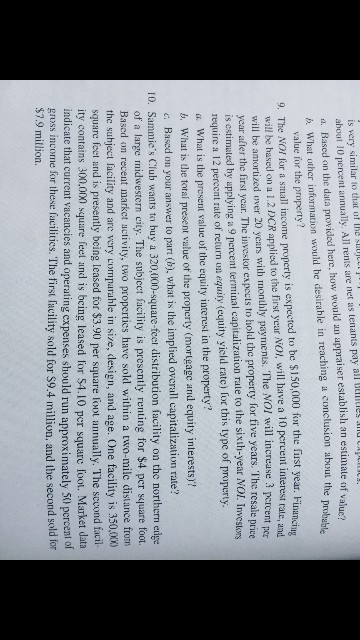

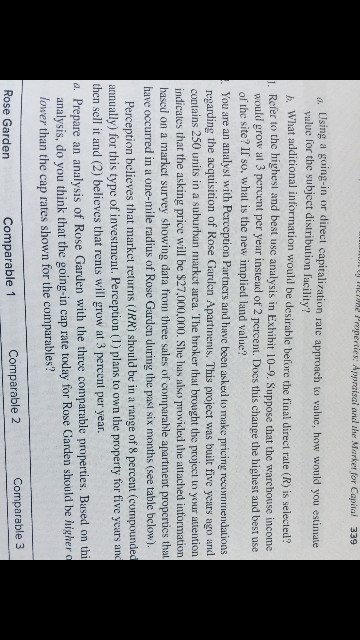

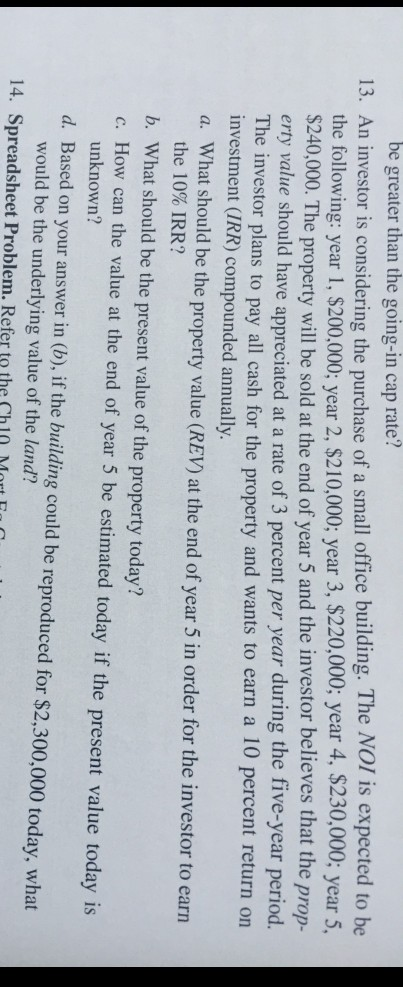

Which would be the highest and hest use nf this site? 4. Ajax Investment Company is considering the purchase of lund that could he devcloped into a class A office project. Al the present time. Ajax belicves that the site could support a 300.000 rentable square fout project with average rents of $20 per square foot and uperating expenses equal to 40 percent of that amount. It alsn expects rents to grow at 3 percent indefinitcly and believes that Ajax should earu a 12 percent return (r) on investment. The building would cost S100 per square foot to build: a. What would the estimated pmperty value and land value he under the above assumptions? b. It reuts are suddenly expected to gww at 4 percent indcfiniiely, what would the property value and land valuc be now? What percentage change in land value would this be relative to the land valuc in (a)? c. Instead of (b), suppose that rents will grow hy only 1 percent because of excessive supply What would land value be now? What percentage change wmuoid this be relative to the land value in (a)? d. Suppose that the land owner is asking $12.000,000 for the land. Under assumptions in part fa) would this project he feasible? e. If the land must be acquired for $12,000,000, relurning tw the assumptinas in (a). how much of a change in the following would bave to occur to make the projcct feasible? (Consider each item one at a time and hold all nther variables constant.) (1) Expected return on investment (r. (2) Expected growth (g) in cash flows. (3) Building cost (4) Rents. laring the acquisition of a heavily depreciated building is very similar to that ot the suj a. Based an the data provided here, how would an appraiser establish an estimate of u h. What uther information would he desirahle in reaching a conclusion about the pro about 10 percent annually All renis are net as tenants pay all CApLI establish an estimate of valuc? value for the property? 9. The NOl for a small income property is expected to be $150,000 for the fiist year. Financi will be hased on a 1.2 DCR applied to the first year NOI, will have a 10 peruent interest rate, and will be amortized over 20 years with monthly payments. The vOI will increase pcrcent rer year alter the first year. The investor expects to hold the property for five years. The resale prive is cstimuted hy applying a 9 percent terminal capitalization rate to the sixth-year NOI. Inv require a 12 percent rate of return un equity (equity yield ratc) fot this type of property a. What is the present value of the equity interest in the property? b. What is the total present value of the property (morteage and equity interests)? nveslkoms Based on your answer to part (h), what is the implied ovcrall capitalization rate? 10. Sammie's Club wants to buy a 320,000-square-feel distribution facility on the northern eige of a large midwestern city. The subject facility is presently renting for $4 per square foot. Based on recent market uctivity, two propertics have solkd within a two-milc distance from the suhject facility and are very comparahle in size, design, and age. One facility is 350,0x square feet and is presently being leased for $3.90 per square foot annually. The sccond facil ity contains 300.000 square feet and is bcing leased for $4.10 per square foot. Market data indicate that current vacancies and operating expenses should run approximately 50 percent of gross income for these facilitics. The first facility sold for S9.4 million, and the second sold for $7.9 million. le Properties: Appraisai aned the Marker for Capital 339 Jsing a going-in or direct capitalization rate approach to value, how would valuc for the subjcct distribution facility'? you estimate . What additional intormation would be desirable before the final direct rate (R) is selected? 1. Refer to the highest and best usc analysis in Exhibit 10-9. Suppose that the warchouse income would grow al 3 percent per year instead of 2 percent. Docs this change the highest and best use of the site? If so. whal is the new implied land value? You are an analyst with Perception Partners and have been asked to make pricing recsumendations regarding the acquisition of Rose Garden Apartinents. This project was built five ycars ago and contains 250 units in a suburban market area. The broker that brought the project to your attention indicates that the asking price will be $27,000,000. She has als provided the attached information hascd on a market survey showing data from three sales of comparable apartment propertics that have occurred in a one-mile radius of Rose Garden during the past six months (see table below) Perception believes that market returns (IRR) should be in a range of 8 percent (compounde annually) for this type of investment. Perception (1) plans to own the property for five years and then sell it and (2) believes that rents will grow at 3 percent per year a. Prepare an analysis of Rose Garden with the three comparable properties. Based on thi analysis, do you think that the going-in cap rate today for Rose Garden should be higher lower than the cap rates shown for the comparables? Comparable 2 Comparable 3 Rose Garden Comparable 1 be greater than the going-in cap rate? 13. An investor is considering the purchase of a small office building. The NOI is expected to be the following: year 1, $200,000; year 2, $210,000; year 3, $220,000; year 4, $230,000; year 5 $240,000. The property will be sold at the end of year 5 and the investor believes that the prop- erty value should have appreciated at a rate of 3 percent per year during the five-year period. The investor plans to pay all cash for the property and wants to earn a 10 percent return on investment (IRR) compounded annually a. What should be the property value (REV) at the end of year 5 in order for the investor to earr the 10% IRR? b. What should be the present value of the property today? c. How can the value at the end of year 5 be estimated today if the present value today is unknown? d. Based on your answer in (b), if the building could be reproduced for $2,300,000 today, what would be the underlying value of the land? 14. Spreadsheet Problem. Refer to the h10 Mort 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started