Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. I got 1,550 to deduct but I had 7,550 but im not sure On January 1, X9, Gerald received his 50 percent profits and

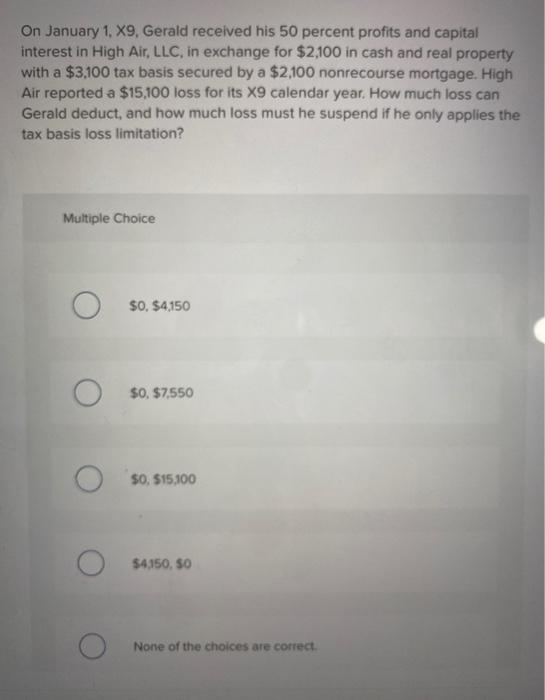

10. I got 1,550 to deduct but I had 7,550 but im not sure  On January 1, X9, Gerald received his 50 percent profits and capital interest in High Air, LLC, in exchange for $2,100 in cash and real property with a $3,100 tax basis secured by a $2,100 nonrecourse mortgage. High Air reported a $15,100 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation? Multiple Choice $0, $4,150 $0, $7,550 SO. $15,100 $4150.50 None of the choices are correct. On January 1, X9, Gerald received his 50 percent profits and capital interest in High Air, LLC, in exchange for $2,100 in cash and real property with a $3,100 tax basis secured by a $2,100 nonrecourse mortgage. High Air reported a $15,100 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation? Multiple Choice $0, $4,150 $0, $7,550 SO. $15,100 $4150.50 None of the choices are correct

On January 1, X9, Gerald received his 50 percent profits and capital interest in High Air, LLC, in exchange for $2,100 in cash and real property with a $3,100 tax basis secured by a $2,100 nonrecourse mortgage. High Air reported a $15,100 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation? Multiple Choice $0, $4,150 $0, $7,550 SO. $15,100 $4150.50 None of the choices are correct. On January 1, X9, Gerald received his 50 percent profits and capital interest in High Air, LLC, in exchange for $2,100 in cash and real property with a $3,100 tax basis secured by a $2,100 nonrecourse mortgage. High Air reported a $15,100 loss for its X9 calendar year. How much loss can Gerald deduct, and how much loss must he suspend if he only applies the tax basis loss limitation? Multiple Choice $0, $4,150 $0, $7,550 SO. $15,100 $4150.50 None of the choices are correct

10. I got 1,550 to deduct but I had 7,550 but im not sure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started