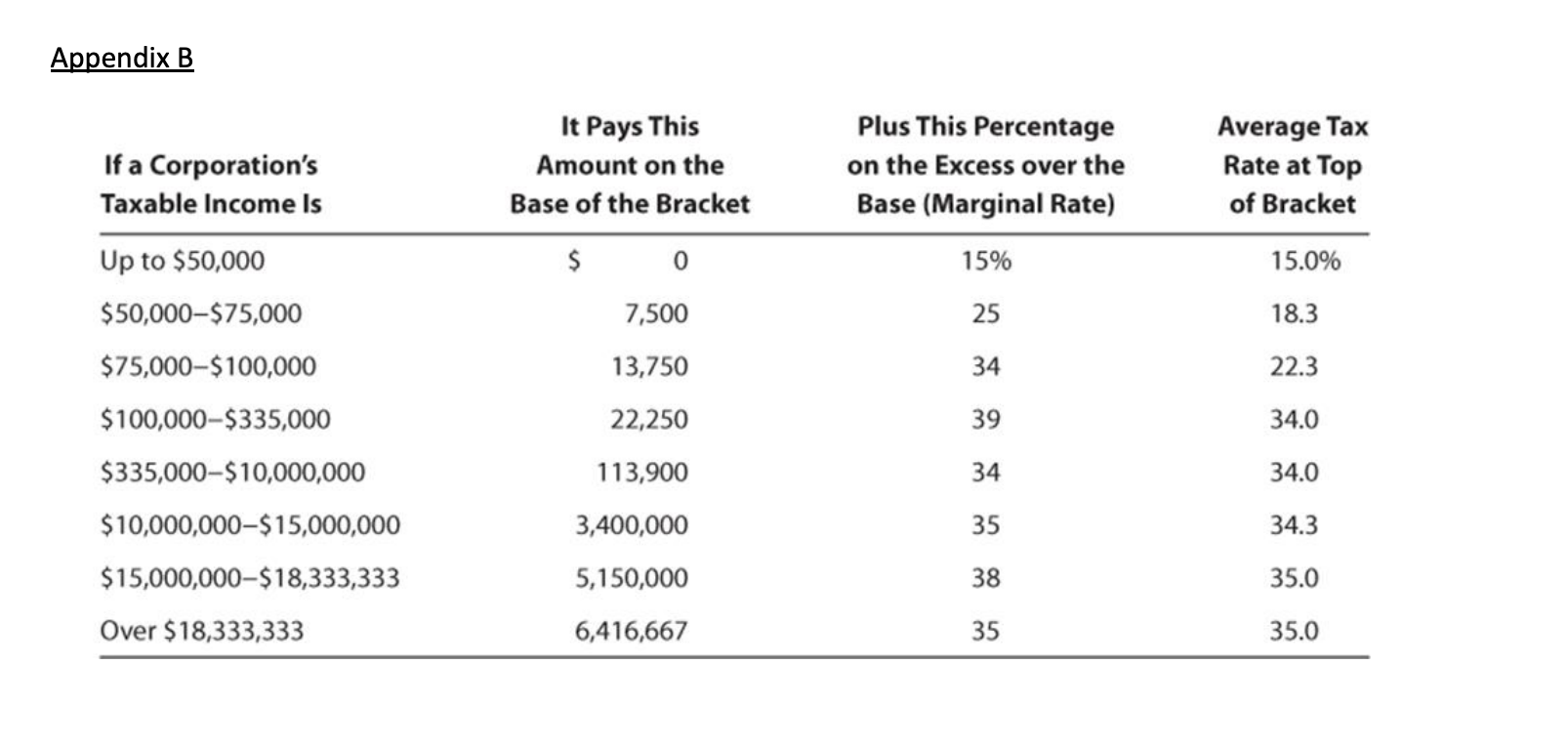

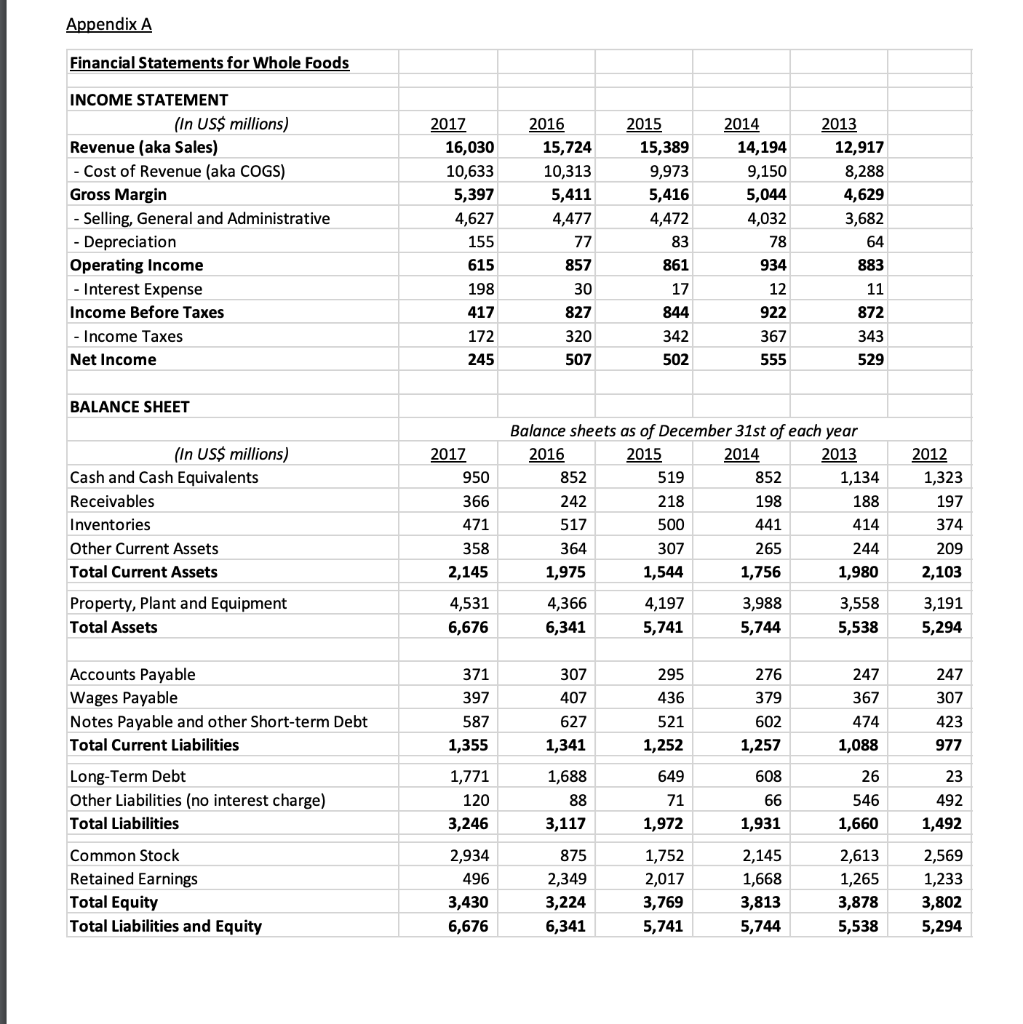

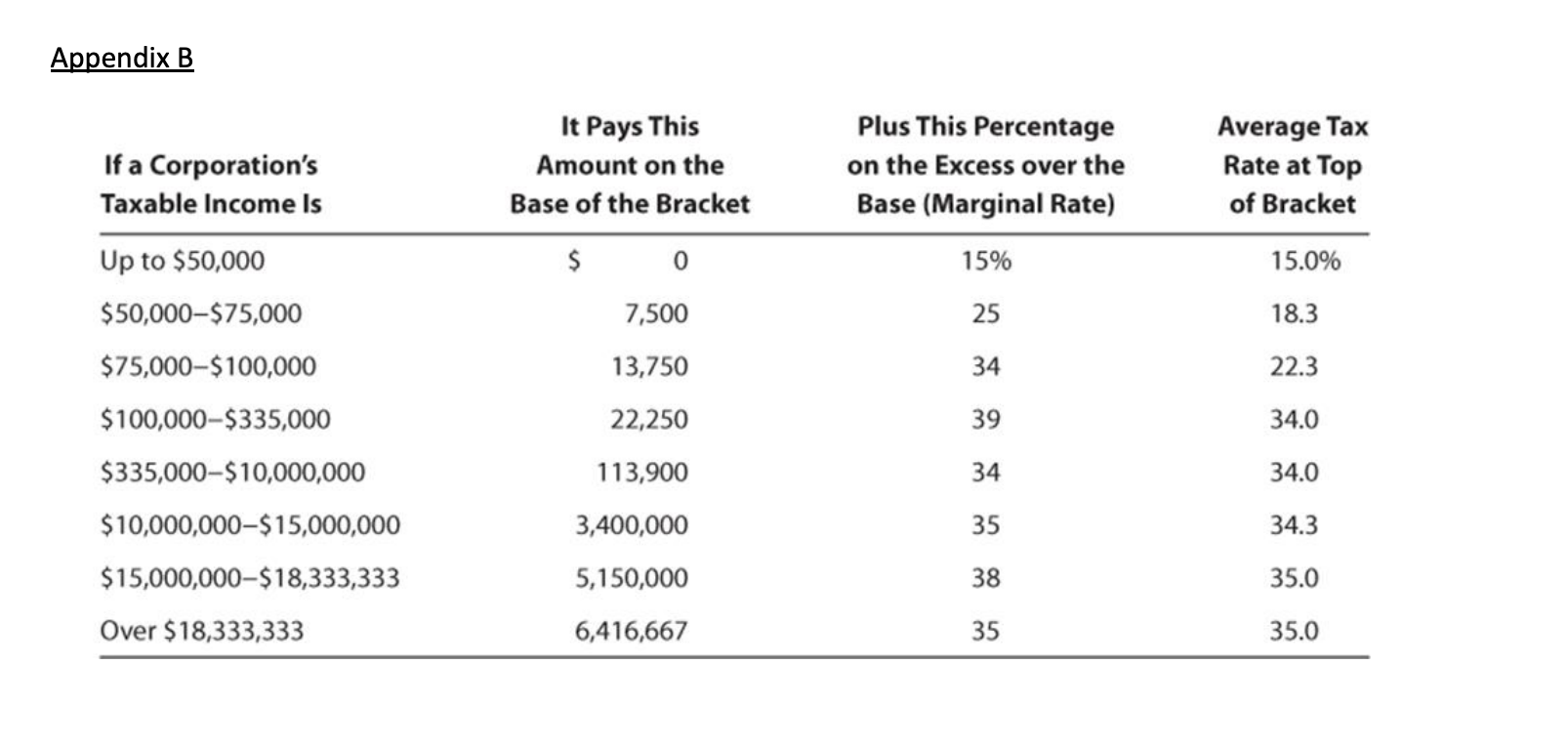

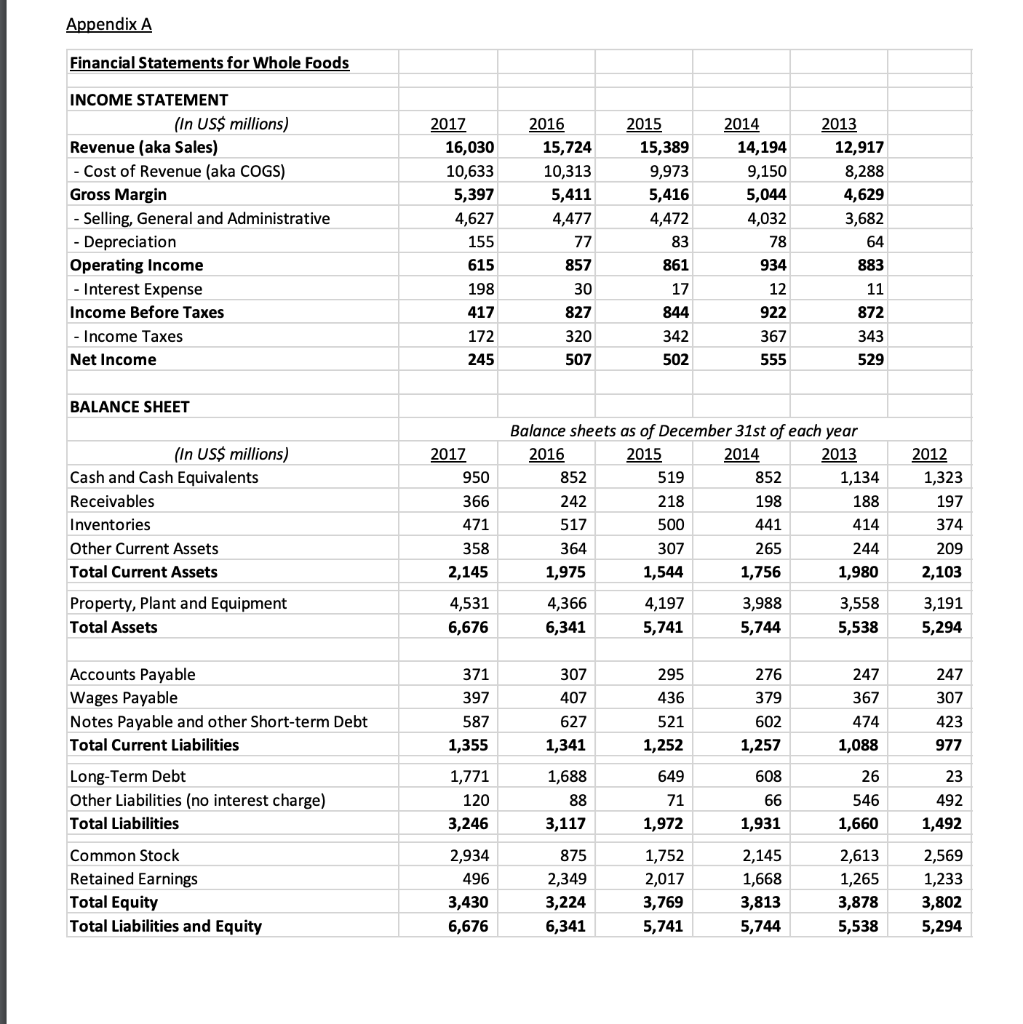

10. Imagine that your company had the following financial performance: Gross Margin: $350,000, EBIT: $120,000, EBT: $80,000, and dividends of $10,000 Also assume that they pay taxes based on the tax table in Appendix B. What would your company's tax liability be? Appendix B It Pays This Amount on the Base of the Bracket $ 0 7,500 Plus This Percentage on the Excess over the Base (Marginal Rate) 15% Average Tax Rate at Top of Bracket 15.0% 25 18.3 13,750 34 22.3 If a Corporation's Taxable income Is Up to $50,000 $50,000-$75,000 $75,000-$100,000 $100,000-$335,000 $335,000-$10,000,000 $10,000,000-$ 15,000,000 $15,000,000-$18,333,333 Over $18,333,333 22,250 39 34.0 113,900 34 34.0 3,400,000 35 34.3 5,150,000 38 35.0 6,416,667 35 35.0 Appendix A Financial Statements for Whole Foods 2017 16,030 10,633 5,397 4,627 INCOME STATEMENT (In US$ millions) Revenue (aka Sales) - Cost of Revenue (aka COGS) Gross Margin - Selling, General and Administrative - Depreciation Operating Income - Interest Expense Income Before Taxes - Income Taxes Net Income 2016 15,724 10,313 5,411 4,477 77 2015 15,389 9,973 5,416 4,472 83 861 17 844 342 502 155 2014 14,194 9,150 5,044 4,032 78 934 12 922 367 555 2013 12,917 8,288 4,629 3,682 64 615 857 883 198 417 172 245 30 827 320 872 343 529 507 BALANCE SHEET 2012 1,323 852 197 (In US$ millions) Cash and Cash Equivalents Receivables Inventories Other Current Assets Total Current Assets 2017 950 366 471 358 2,145 Balance sheets as of December 31st of each year 2016 2015 2014 2013 852 519 1,134 242 218 198 188 517 500 441 414 364 307 265 244 1,975 1,544 1,756 1,980 4,366 4,197 3,988 3,558 6,341 5,741 5,744 5,538 374 209 2,103 Property, Plant and Equipment Total Assets 4,531 6,676 3,191 5,294 Accounts Payable Wages Payable Notes Payable and other Short-term Debt Total Current Liabilities 371 397 587 1,355 307 407 627 1,341 295 436 521 1,252 276 379 602 1,257 247 367 474 1,088 247 307 423 977 Long-Term Debt Other Liabilities (no interest charge) Total Liabilities 1,771 120 3,246 1,688 88 3,117 649 71 1,972 608 66 1,931 26 546 1,660 23 492 1,492 Common Stock Retained Earnings Total Equity Total Liabilities and Equity 2,934 496 3,430 6,676 875 2,349 3,224 6,341 1,752 2,017 3,769 5,741 2,145 1,668 3,813 5,744 2,613 1,265 3,878 5,538 2,569 1,233 3,802 5,294