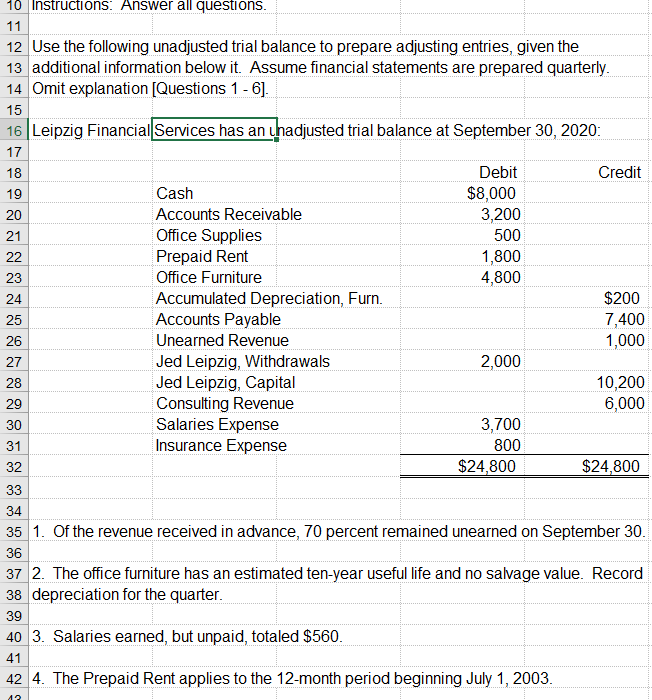

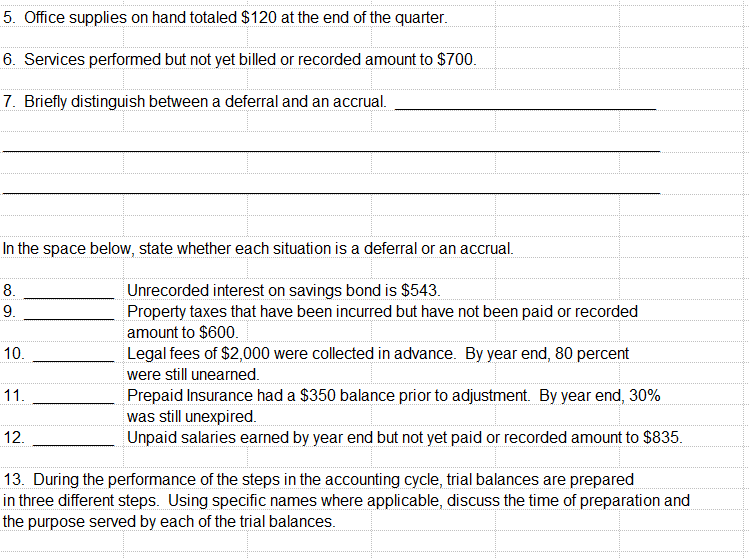

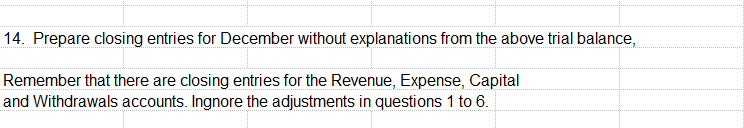

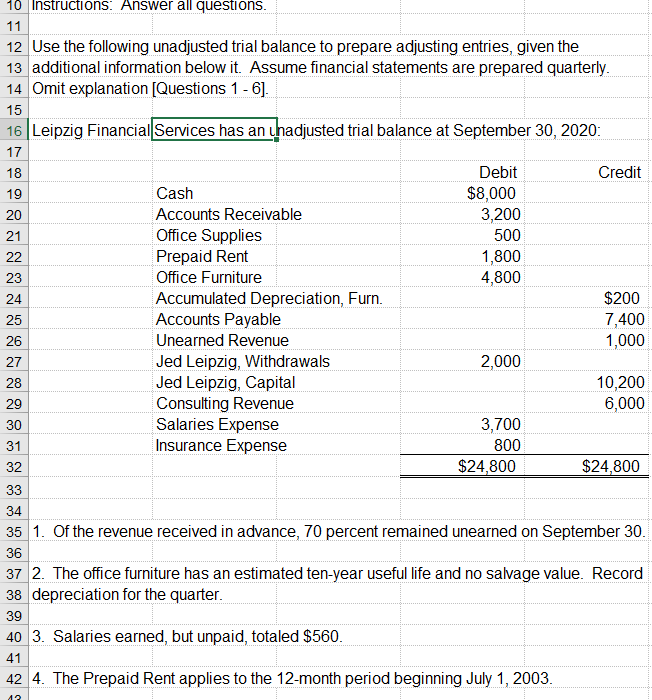

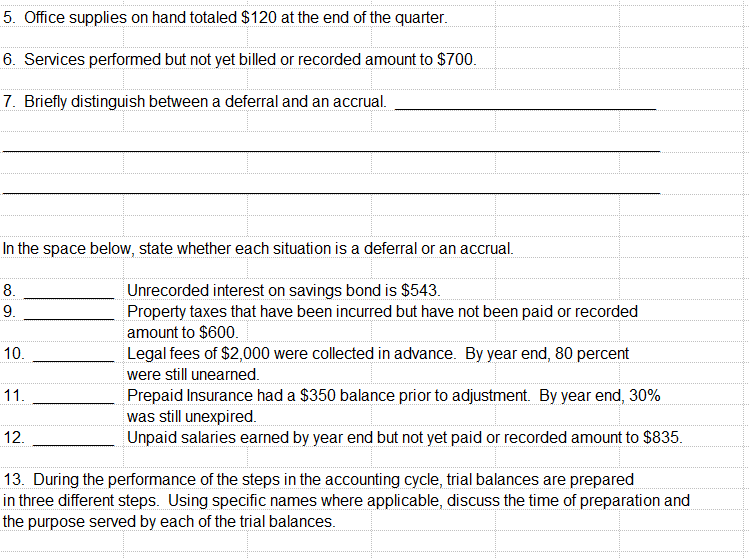

10 Instructions. Answer all questions. 11 12 Use the following unadjusted trial balance to prepare adjusting entries, given the 13 additional information below it. Assume financial statements are prepared quarterly. 14 Omit explanation [Questions 1 - 6]. 15 16 Leipzig Financial Services has an uhadjusted trial balance at September 30, 2020: 17 18 Debit Credit 19 Cash $8,000 20 Accounts Receivable 3,200 21 Office Supplies 500 22 Prepaid Rent 1,800 23 Office Furniture 4,800 24 Accumulated Depreciation, Furn. $200 25 Accounts Payable 7,400 26 Unearned Revenue 1,000 27 Jed Leipzig, Withdrawals 2,000 28 Jed Leipzig, Capital 10,200 29 Consulting Revenue 6,000 30 Salaries Expense 3,700 31 Insurance Expense 800 32 $24,800 $24,800 33 34 35 1. Of the revenue received in advance, 70 percent remained unearned on September 30. 36 37 2. The office furniture has an estimated ten-year useful life and no salvage value. Record 38 depreciation for the quarter. 39 40 3. Salaries earned, but unpaid, totaled $560. 41 42 4. The Prepaid Rent applies to the 12-month period beginning July 1, 2003. 9 5. Office supplies on hand totaled $120 at the end of the quarter. 6. Services performed but not yet billed or recorded amount to $700. 7. Briefly distinguish between a deferral and an accrual. In the space below, state whether each situation is a deferral or an accrual. 8. 9. 10. Unrecorded interest on savings bond is $543. Property taxes that have been incurred but have not been paid or recorded amount to $600. Legal fees of $2,000 were collected in advance. By year end, 80 percent were still unearned. Prepaid Insurance had a $350 balance prior to adjustment. By year end, 30% was still unexpired. Unpaid salaries earned by year end but not yet paid or recorded amount to $835. 11. 12. 13. During the performance of the steps in the accounting cycle, trial balances are prepared in three different steps. Using specific names where applicable, discuss the time of preparation and the purpose served by each of the trial balances. 14. Prepare closing entries for December without explanations from the above trial balance, Remember that there are closing entries for the Revenue, Expense, Capital and Withdrawals accounts. Ingnore the adjustments in questions 1 to 6