Question

10. Ivory Corporation is reviewing an investment proposal that has an initial cost of $52,500. An estimate of the investment's end-of-year book value, the yearly

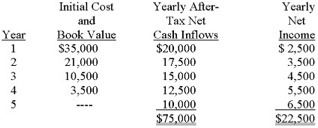

10. Ivory Corporation is reviewing an investment proposal that has an initial cost of $52,500. An estimate of the investment's end-of-year book value, the yearly after-tax net cash inflows, and the yearly net income are presented in the schedule below. Yearly after-tax net cash inflows include savings from the depreciation tax shield. The investment's salvage value at the end of each year is equal to book value, and there will be no salvage value at the end of the investment's life.

Ivory uses a 14% after-tax target rate of return for new investment proposals. Required:

A. Calculate the project's payback period.

B. Calculate the accounting rate of return on the initial investment.

C. Calculate the proposal's net present value. Round to the nearest dollar.

Yearly Initial Cost and Yearly After Tax Net Net Income $ 2,500 3,500 4,500 Year Book Value Cash Inflows $20,000 17,500 15,000 12,500 10000 $75,000 $35,000 21,000 10,500 3,500 5,500 $22,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started