Answered step by step

Verified Expert Solution

Question

1 Approved Answer

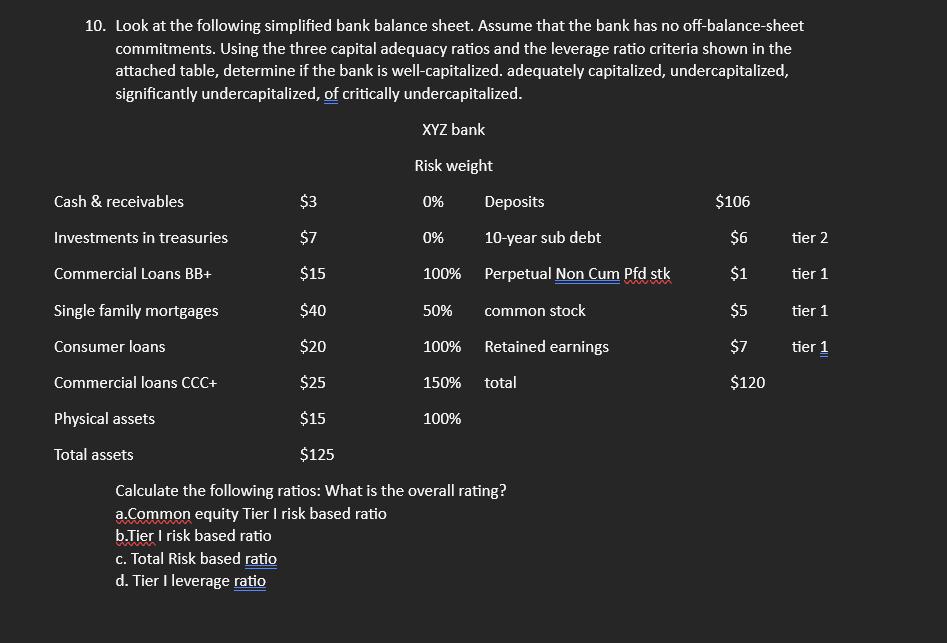

10. Look at the following simplified bank balance sheet. Assume that the bank has no off-balance-sheet commitments. Using the three capital adequacy ratios and

10. Look at the following simplified bank balance sheet. Assume that the bank has no off-balance-sheet commitments. Using the three capital adequacy ratios and the leverage ratio criteria shown in the attached table, determine if the bank is well-capitalized. adequately capitalized, undercapitalized, significantly undercapitalized, of critically undercapitalized. XYZ bank Risk weight 0% Deposits 0% 10-year sub debt 100% Perpetual Non Cum Pfd stk common stock 100% Retained earnings 150% total Cash & receivables Investments in treasuries Commercial Loans BB+ Single family mortgages Consumer loans Commercial loans CCC+ Physical assets Total assets $3 $7 $15 $40 $20 $25 $15 $125 50% 100% Calculate the following ratios: What is the overall rating? a.Common equity Tier I risk based ratio b.Tier I risk based ratio c. Total Risk based ratio d. Tier I leverage ratio $106 $6 $1 $5 $7 $120 tier 2 tier 1 tier 1 tier 1

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the capital adequacy ratios mentioned in the question we first need to calculate the riskweighted assets RWAs using the risk weights prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started