Answered step by step

Verified Expert Solution

Question

1 Approved Answer

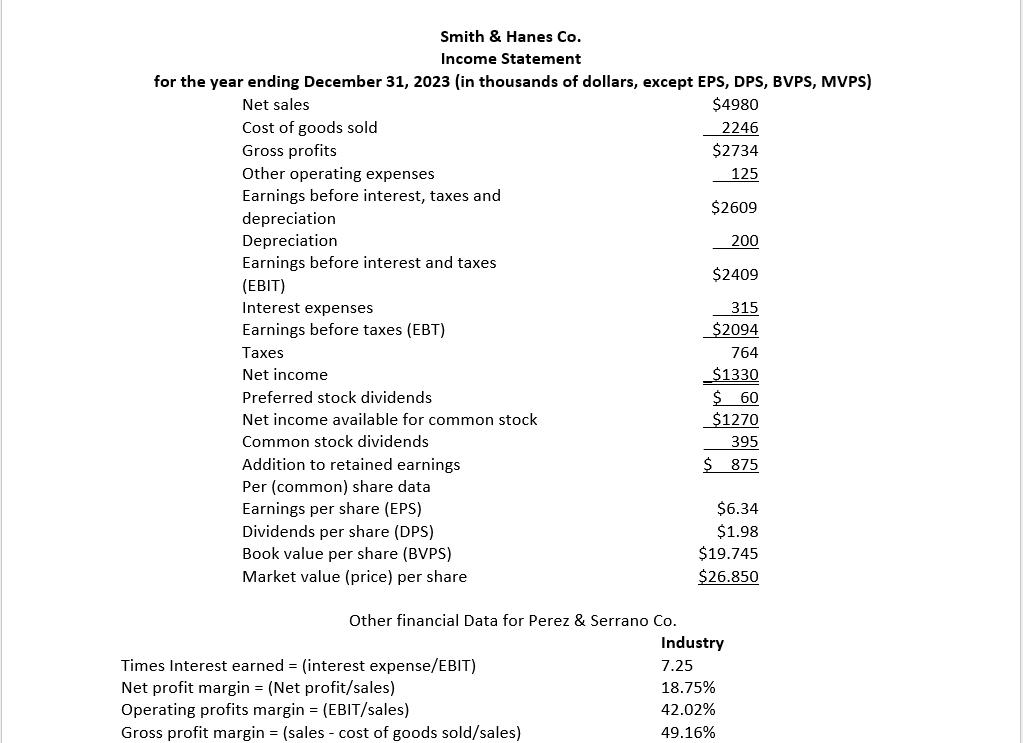

Smith & Hanes Co. Income Statement for the year ending December 31, 2023 (in thousands of dollars, except EPS, DPS, BVPS, MVPS) $4980 2246

Smith & Hanes Co. Income Statement for the year ending December 31, 2023 (in thousands of dollars, except EPS, DPS, BVPS, MVPS) $4980 2246 $2734 125 $2609 200 $2409 315 $2094 764 _$1330 $ 60 $1270 395 $ 875 Net sales Cost of goods sold Gross profits Other operating expenses Earnings before interest, taxes and depreciation Depreciation Earnings before interest and taxes (EBIT) Interest expenses Earnings before taxes (EBT) Taxes Net income Preferred stock dividends Net income available for common stock Common stock dividends Addition to retained earnings Per (common) share data Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share Other financial Data for Perez & Serrano Co. Times Interest earned = (interest expense/EBIT) Net profit margin = (Net profit/sales) Operating profits margin = (EBIT/sales) Gross profit margin = (sales - cost of goods sold/sales) $6.34 $1.98 $19.745 $26.850 Industry 7.25 18.75% 42.02% 49.16% Part I Using Excel or any other electronic sheet; prepare the Common Sized Income Statement for Smith & Hanes Co. Part II Compute the followings profitability ratios, compare with the industry and evaluate the performance of the Smith & Hanes Col, Inc. using the scale: better, on par or worse. a. Gross profits ratio = b. Operating profits margin = c. Net profit margin = Part III If the gross profits ratio for Smith & Hanes Co. is worse than the industry's gross profit ratio. You are the financial analyst for Smith & Hanes Co. and the management ask you a recommendation for improve that ratio. What would you recommend? Why?

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Part I Common Sized Income Statement for Smith Hanes Co To prepare the Common Sized Income Statement we express each line item as a percentage of net sales The calculations are as follows Net sales 49...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started