Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Curtis bought an 8.5% annual coupon bond at par. One year later, he sold the bond at a quoted price of 98. During the

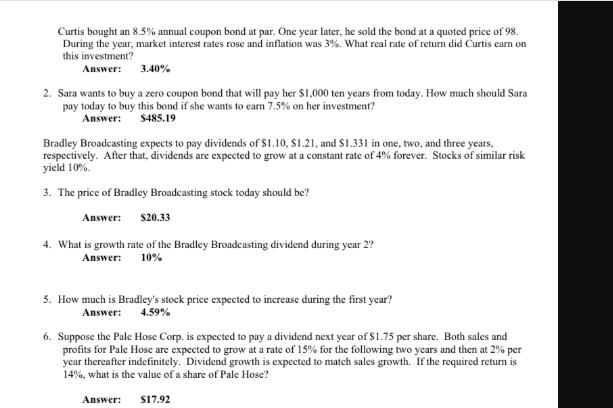

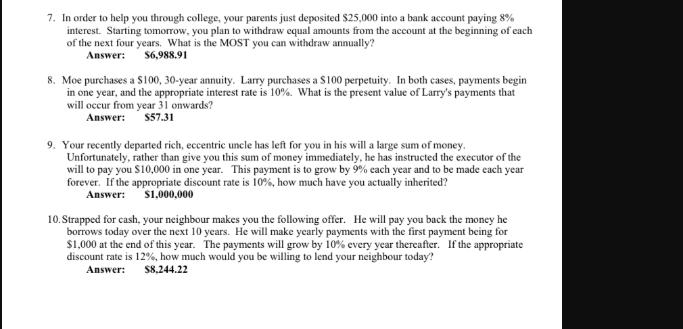

Curtis bought an 8.5% annual coupon bond at par. One year later, he sold the bond at a quoted price of 98. During the year, market interest rates rose and inflation was 3%. What real rate of return did Curtis earn on this investment? Answer: 3.40% 2. Sara wants to buy a zero coupon bond that will pay her $1,000 ten years from today. How much should Sara pay today to buy this bond if she wants to earn 7.5% on her investment? Answer: $485.19 Bradley Broadcasting expects to pay dividends of $1.10, $1.21, and $1.331 in one, two, and three years, respectively. After that, dividends are expected to grow at a constant rate of 4% forever. Stocks of similar risk yield 10%. 3. The price of Bradley Broadcasting stock today should be? Answer: $20.33 4. What is growth rate of the Bradley Broadcasting dividend during year 2? Answer: 10% 5. How much is Bradley's stock price expected to increase during the first year? Answer: 4.59% 6. Suppose the Pale Hose Corp. is expected to pay a dividend next year of $1.75 per share. Both sales and profits for Pale Hose are expected to grow at a rate of 15% for the following two years and then at 2% per year thereafter indefinitely. Dividend growth is expected to match sales growth. If the required return is 14%, what is the value of a share of Pale Hose? Answer: $17.92 7. In order to help you through college, your parents just deposited $25,000 into a bank account paying 8% interest. Starting tomorrow, you plan to withdraw equal amounts from the account at the beginning of each of the next four years. What is the MOST you can withdraw annually? Answer: $6,988.91 8. Moe purchases a $100, 30-year annuity. Larry purchases a $100 perpetuity. In both cases, payments begin in one year, and the appropriate interest rate is 10%. What is the present value of Larry's payments that will occur from year 31 onwards? Answer: $57.31 9. Your recently departed rich, eccentric uncle has left for you in his will a large sum of money. Unfortunately, rather than give you this sum of money immediately, he has instructed the executor of the will to pay you $10,000 in one year. This payment is to grow by 9% each year and to be made each year forever. If the appropriate discount rate is 10%, how much have you actually inherited? Answer: $1,000,000 10. Strapped for cash, your neighbour makes you the following offer. He will pay you back the money he borrows today over the next 10 years. He will make yearly payments with the first payment being for $1,000 at the end of this year. The payments will grow by 10% every year thereafter. If the appropriate discount rate is 12%, how much would you be willing to lend your neighbour today? Answer: $8.244.22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Curtis earned a 340 real rate of return ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started