Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Lundholm Company purchased a machine for $102.100 on January 1, 2016. Lundholm depreciates machines of this type by the straight-line method over a 10

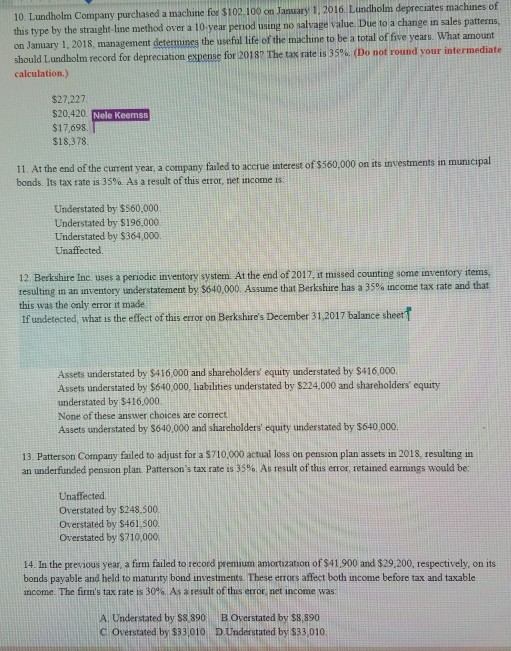

10. Lundholm Company purchased a machine for $102.100 on January 1, 2016. Lundholm depreciates machines of this type by the straight-line method over a 10 year period using no salvage value. Due to a change in sales patterns, on January 1, 2018, management determines the useful life of the machine to be a total of five years. What amount should Lundholm record for depreciation expense for 2018 The tax rate is 35%. (Do not round your intermediate calculation.) $27.227 $20,420. Nele Keemss $17.698 $18,378 11. At the end of the current year, a company failed to accrue interest of $560,000 on its investments in municipal bonds. Its tax rate is 35%. As a result of this error, net income is Understated by $560.000 Understated by $196,000 Understated by $364,000. Unaffected 12. Berkshire Inc. uses a periodic inventory system. At the end of 2017, it missed counting some inventory items, resulting in an inventory understatement by $640,000. Assume that Berkshire has a 35% income tax rate and that this was the only error it made If undetected, what is the effect of this error on Berkshire's December 31,2017 balance sheet Assets understated by $416,000 and shareholders' equity understated by $416,000 Assets understated by $640 000. liabilities understated by $224.000 and shareholders' equity understated by $416,000 None of these answer choices are correct Assets understated by S640,000 and shareholders' equity understated by S640,000. 13. Patterson Company failed to adjust for a 710,000 actual loss on pension plan assets in 2018, resulting in an underfunded pension plan. Patterson's tax rate is 35% As result of this error, retained earnings would be Unaffected Overstated by $248.500 Overstated by $461,500 Overstated by $710,000 14. In the previous year, a firm failed to record premium amortization of S41 900 and $29,200, respectively, on its bonds payable and held to maturity bond investments. These errors affect both income before tax and taxable income. The firm's tax rate is 30%. As a result of this error net income was: A Understated by S8 890 B.Overstated by $8,890 c Overstated by $33,010 D. Understated by $33,010

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started