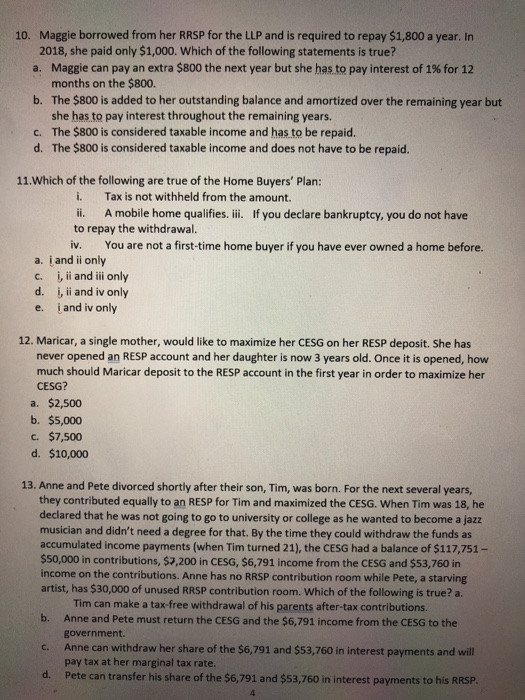

10. Maggie borrowed from her RRSP for the LLP and is required to repay $1,800 a year. In 2018, she paid only $1,000. Which of the following statements is true? a. Maggie can pay an extra $800 the next year but she has to pay interest of 1% for 12 months on the $800. b. The $800 is added to her outstanding balance and amortized over the remaining year but she has to pay interest throughout the remaining years. c. The $800 is considered taxable income and has to be repaid. d. The $800 is considered taxable income and does not have to be repaid. 11. Which of the following are true of the Home Buyers' Plan: i. Tax is not withheld from the amount. ii. A mobile home qualifies. iii. If you declare bankruptcy, you do not have to repay the withdrawal. iv. You are not a first-time home buyer if you have ever owned a home before. a. i and il only c. i, ii and iii only d. i, ii and iv only e. i and iv only 12. Maricar, a single mother, would like to maximize her CESG on her RESP deposit. She has never opened an RESP account and her daughter is now 3 years old. Once it is opened, how much should Maricar deposit to the RESP account in the first year in order to maximize her CESG? a. $2,500 b. $5,000 c. $7,500 d. $10,000 13. Anne and Pete divorced shortly after their son, Tim, was born. For the next several years, they contributed equally to an RESP for Tim and maximized the CESG. When Tim was 18, he declared that he was not going to go to university or college as he wanted to become a jazz musician and didn't need a degree for that. By the time they could withdraw the funds as accumulated income payments (when Tim turned 21), the CESG had a balance of $117,751 - $50,000 in contributions, $7,200 in CESG, $6,791 income from the CESG and $53,760 in income on the contributions. Anne has no RRSP contribution room while Pete, a starving artist, has $30,000 of unused RRSP contribution room. Which of the following is true? a. Tim can make a tax-free withdrawal of his parents after-tax contributions. b. Anne and Pete must return the CESG and the $6,791 income from the CESG to the government. C. Anne can withdraw her share of the $6,791 and $53,760 in interest payments and will pay tax at her marginal tax rate. d. Pete can transfer his share of the $6,791 and $53,760 in interest payments to his RRSP. 10. Maggie borrowed from her RRSP for the LLP and is required to repay $1,800 a year. In 2018, she paid only $1,000. Which of the following statements is true? a. Maggie can pay an extra $800 the next year but she has to pay interest of 1% for 12 months on the $800. b. The $800 is added to her outstanding balance and amortized over the remaining year but she has to pay interest throughout the remaining years. c. The $800 is considered taxable income and has to be repaid. d. The $800 is considered taxable income and does not have to be repaid. 11. Which of the following are true of the Home Buyers' Plan: i. Tax is not withheld from the amount. ii. A mobile home qualifies. iii. If you declare bankruptcy, you do not have to repay the withdrawal. iv. You are not a first-time home buyer if you have ever owned a home before. a. i and il only c. i, ii and iii only d. i, ii and iv only e. i and iv only 12. Maricar, a single mother, would like to maximize her CESG on her RESP deposit. She has never opened an RESP account and her daughter is now 3 years old. Once it is opened, how much should Maricar deposit to the RESP account in the first year in order to maximize her CESG? a. $2,500 b. $5,000 c. $7,500 d. $10,000 13. Anne and Pete divorced shortly after their son, Tim, was born. For the next several years, they contributed equally to an RESP for Tim and maximized the CESG. When Tim was 18, he declared that he was not going to go to university or college as he wanted to become a jazz musician and didn't need a degree for that. By the time they could withdraw the funds as accumulated income payments (when Tim turned 21), the CESG had a balance of $117,751 - $50,000 in contributions, $7,200 in CESG, $6,791 income from the CESG and $53,760 in income on the contributions. Anne has no RRSP contribution room while Pete, a starving artist, has $30,000 of unused RRSP contribution room. Which of the following is true? a. Tim can make a tax-free withdrawal of his parents after-tax contributions. b. Anne and Pete must return the CESG and the $6,791 income from the CESG to the government. C. Anne can withdraw her share of the $6,791 and $53,760 in interest payments and will pay tax at her marginal tax rate. d. Pete can transfer his share of the $6,791 and $53,760 in interest payments to his RRSP