Answered step by step

Verified Expert Solution

Question

1 Approved Answer

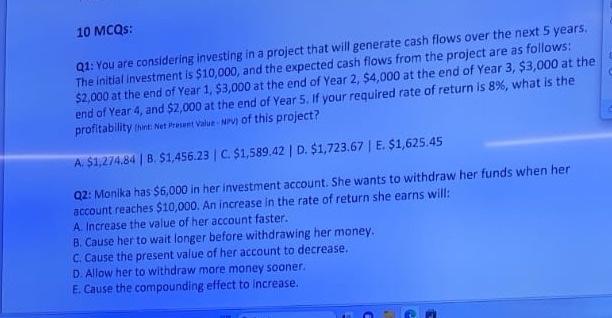

10 MCQs: Q1: You are considering investing in a project that will generate cash flows over the next 5 years. The initial investment is $10,000,

10 MCQs: Q1: You are considering investing in a project that will generate cash flows over the next 5 years. The initial investment is $10,000, and the expected cash flows from the project are as follows: $2,000 at the end of Year 1, $3,000 at the end of Year 2, $4,000 at the end of Year 3, $3,000 at the end of Year 4, and $2,000 at the end of Year 5. If your required rate of return is 8%, what is the profitability (Nrt Net Present Value NPV) of this project? A. $1,274.84 | B. $1,456.23 | C. $1,589.42 | D. $1,723.67 | E. $1,625.45 Q2: Monika has $6,000 in her investment account. She wants to withdraw her funds when her account reaches $10,000. An increase in the rate of return she earns will: A. Increase the value of her account faster. 8. Cause her to wait longer before withdrawing her money. C. Cause the present value of her account to decrease. D. Allow her to withdraw more money sooner. E. Cause the compounding effect to increase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started