Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Mr. Peter is planning to purchase a shop that costs SA. He plans to put B % down in cash and borrow the

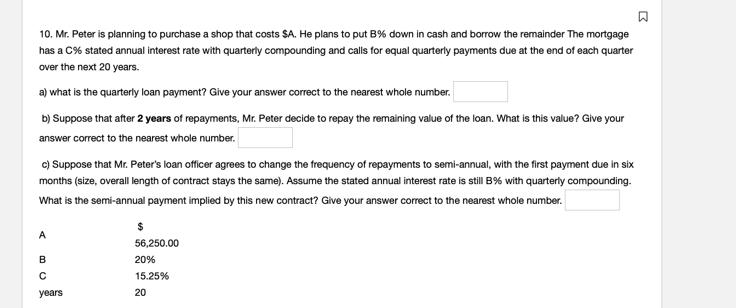

10. Mr. Peter is planning to purchase a shop that costs SA. He plans to put B % down in cash and borrow the remainder The mortgage has a C % stated annual interest rate with quarterly compounding and calls for equal quarterly payments due at the end of each quarter over the next 20 years. a) what is the quarterly loan payment? Give your answer correct to the nearest whole number. b) Suppose that after 2 years of repayments, Mr. Peter decide to repay the remaining value of the loan. What is this value? Give your answer correct to the nearest whole number. c) Suppose that Mr. Peter's loan officer agrees to change the frequency of repayments to semi-annual, with the first payment due in six months (size, overall length of contract stays the same). Assume the stated annual interest rate is still B % with quarterly compounding. What is the semi-annual payment implied by this new contract? Give your answer correct to the nearest whole number. A B years $ 56,250.00 20% 15.25% 20

Step by Step Solution

★★★★★

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Here are the calculations for the given questions but please remember that these are just examples a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started