Answered step by step

Verified Expert Solution

Question

1 Approved Answer

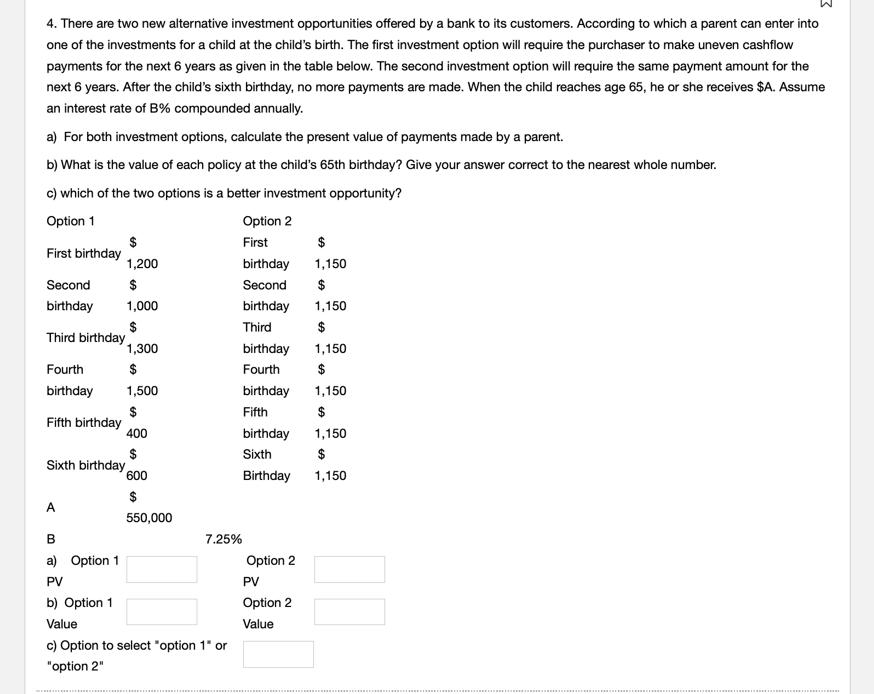

4. There are two new alternative investment opportunities offered by a bank to its customers. According to which a parent can enter into one

4. There are two new alternative investment opportunities offered by a bank to its customers. According to which a parent can enter into one of the investments for a child at the child's birth. The first investment option will require the purchaser to make uneven cashflow payments for the next 6 years as given in the table below. The second investment option will require the same payment amount for the next 6 years. After the child's sixth birthday, no more payments are made. When the child reaches age 65, he or she receives $A. Assume an interest rate of B% compounded annually. a) For both investment options, calculate the present value of payments made by a parent. b) What is the value of each policy at the child's 65th birthday? Give your answer correct to the nearest whole number. c) which of the two options is a better investment opportunity? Option 1 Option 2 First First birthday $ 1,200 Second $ birthday 1,000 $ Third birthday 1,300 Fourth $ birthday 1,500 Fifth birthday $ 400 $ 600 $ 550,000 Sixth birthday A B a) Option 1 PV b) Option 1 Value 7.25% c) Option to select "option 1" or "option2" birthday Second birthday Third birthday Fourth birthday Fifth birthday Sixth Birthday Option 2 PV Option 2 Value $ 1,150 $ 1,150 $ 1,150 $ 1,150 $ 69 1,150 $ 1,150

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Present Value PV of Payments for Both Options Option 1 Year 1 1200 1 007251 114425 Year 2 1150 1 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started