Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[10] Mutual funds are classified as load or no- load funds. Load funds require an investor to pay an initial fee based on a percentage

-

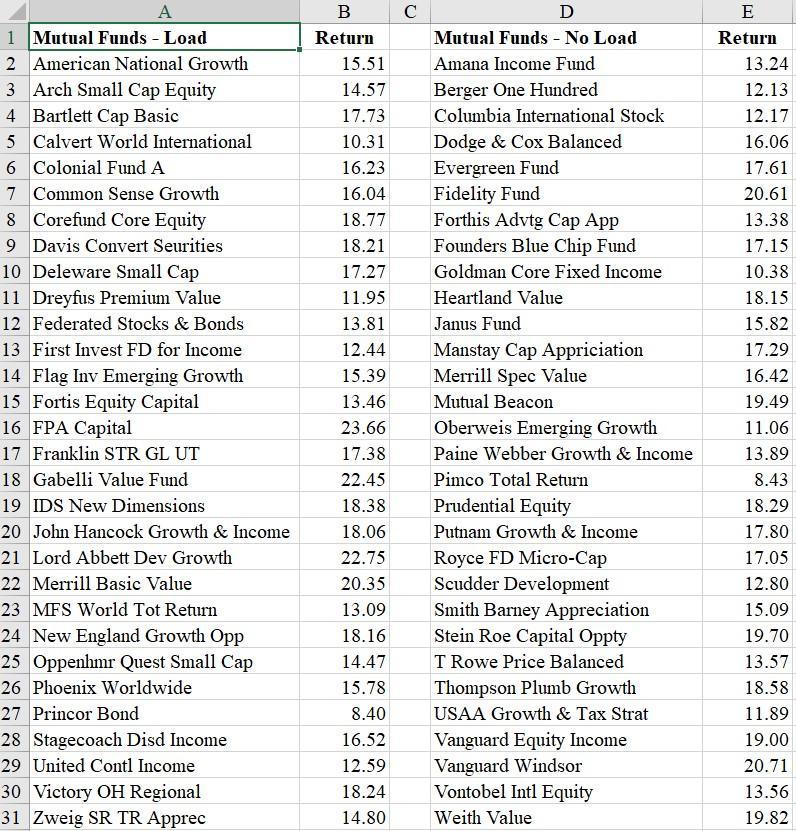

[10] Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee becaise these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load and 30 no-load funds were selected. Data were collected on the annual return for the funds over a five-year period. The data are contained in the data set Mutual. Conduct an appropriate hypothesis test to determinewhether the load funds have a higher mean annual return over the five-year period. Include the error you might be committing.

[10] Mutual funds are classified as load or no-load funds. Load funds require an investor to pay an initial fee based on a percentage of the amount invested in the fund. The no load funds do not require this initial fee. Some financial advisors argue that the load mutual funds may be worth the extra fee becaise these funds provide a higher mean rate of return than the no-load mutual funds. A sample of 30 load and 30 no-load funds were selected. Data were collected on the annual return for the funds over a five-year period. The data are contained in the data set Mutual. Conduct an appropriate hypothesis test to determinewhether the load funds have a higher mean annual return over the five-year period. Include the error you might be committing.

- [2 marks]

- [6 marks for calculations]

- [3] Suppose that it is generally accepted that the variance in returns for the Mutual question is considered equal for no-load and load funds. Redo your calculations as necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started