Answered step by step

Verified Expert Solution

Question

1 Approved Answer

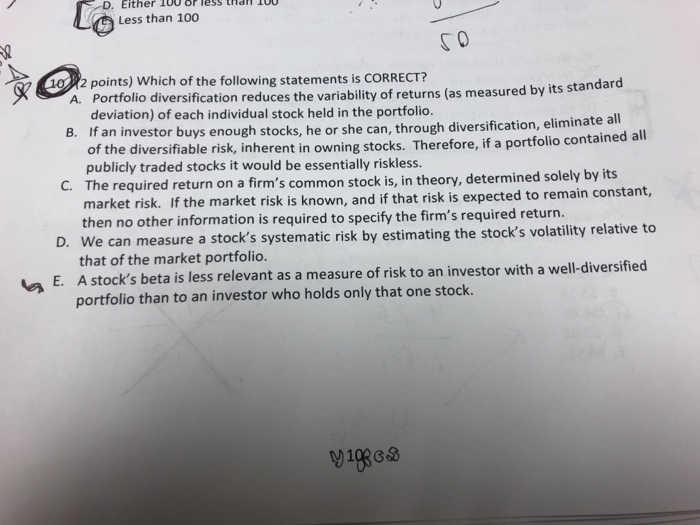

10 NEED HELP ASAP Le Less than 100 102 points) Which of the following statements is CORRECT? A. Portfolio diversification reduces the variability of returns

10

Le Less than 100 102 points) Which of the following statements is CORRECT? A. Portfolio diversification reduces the variability of returns (as measured by its standard deviation) of each individual stock held in the portfolio. B. If an investor buys enough stocks, he or she can, through diversification, eliminate an of the diversifiable risk, inherent in owning stocks. Therefore, if a portfolio contained an publicly traded stocks it would be essentially riskless. C. The required return on a firm's common stock is, in theory, determined solely by its market risk. If the market risk is known, and if that risk is expected to remain constant, then no other information is required to specify the firm's required return. D. We can measure a stock's systematic risk by estimating the stock's volatility relative to that of the market portfolio. E. A stock's beta is less relevant as a measure of risk to an investor with a well-diversified portfolio than to an investor who holds only that one stock. y 1986$ NEED HELP ASAP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started