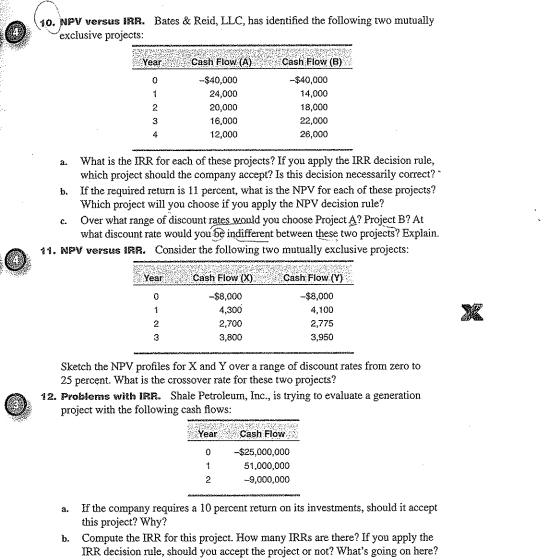

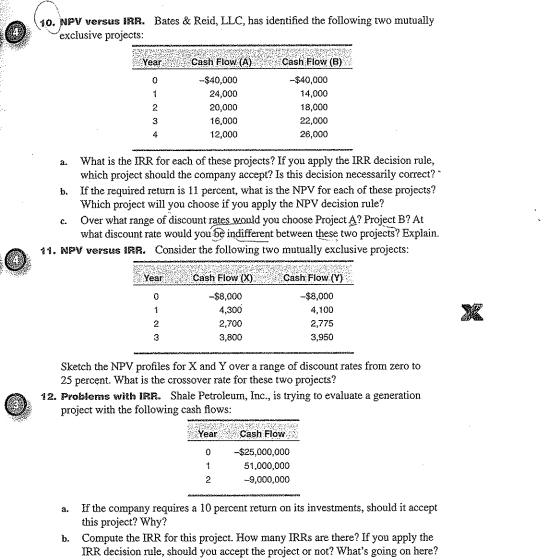

10. NPV versus IRR. Bates & Reid, LLC, has identified the following two mutually exclusive projects: Year 1 2 3 Cash Flow (A) -$40,000 24,000 20,000 16,000 12,000 Cash Flow (B) -$40,000 14,000 18,000 22,000 26,000 What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule? c. Over what range of discount rates would you choose Project A? Project B? At what discount rate would you be indifferent between these two projects? Explain. 11. NPV versus IRR. Consider the following two mutually exclusive projects: Year 0 1 2 Cash Flow (X) -$8,000 4,300 2,700 3,800 Cash Flow (V) $8,000 4,100 2,775 3,950 Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? 12. Problems with IRR. Shale Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Year 0 Cash Flow -$25,000,000 51,000,000 -9,000,000 1 2 8. If the company requires a 10 percent return on its investments, should it accept this project? Why? b. Compute the IRR for this project. How many IRRs are there? If you apply the IRR decision rule, should you accept the project or not? What's going on here? 10. NPV versus IRR. Bates & Reid, LLC, has identified the following two mutually exclusive projects: Year 1 2 3 Cash Flow (A) -$40,000 24,000 20,000 16,000 12,000 Cash Flow (B) -$40,000 14,000 18,000 22,000 26,000 What is the IRR for each of these projects? If you apply the IRR decision rule, which project should the company accept? Is this decision necessarily correct? b. If the required return is 11 percent, what is the NPV for each of these projects? Which project will you choose if you apply the NPV decision rule? c. Over what range of discount rates would you choose Project A? Project B? At what discount rate would you be indifferent between these two projects? Explain. 11. NPV versus IRR. Consider the following two mutually exclusive projects: Year 0 1 2 Cash Flow (X) -$8,000 4,300 2,700 3,800 Cash Flow (V) $8,000 4,100 2,775 3,950 Sketch the NPV profiles for X and Y over a range of discount rates from zero to 25 percent. What is the crossover rate for these two projects? 12. Problems with IRR. Shale Petroleum, Inc., is trying to evaluate a generation project with the following cash flows: Year 0 Cash Flow -$25,000,000 51,000,000 -9,000,000 1 2 8. If the company requires a 10 percent return on its investments, should it accept this project? Why? b. Compute the IRR for this project. How many IRRs are there? If you apply the IRR decision rule, should you accept the project or not? What's going on here