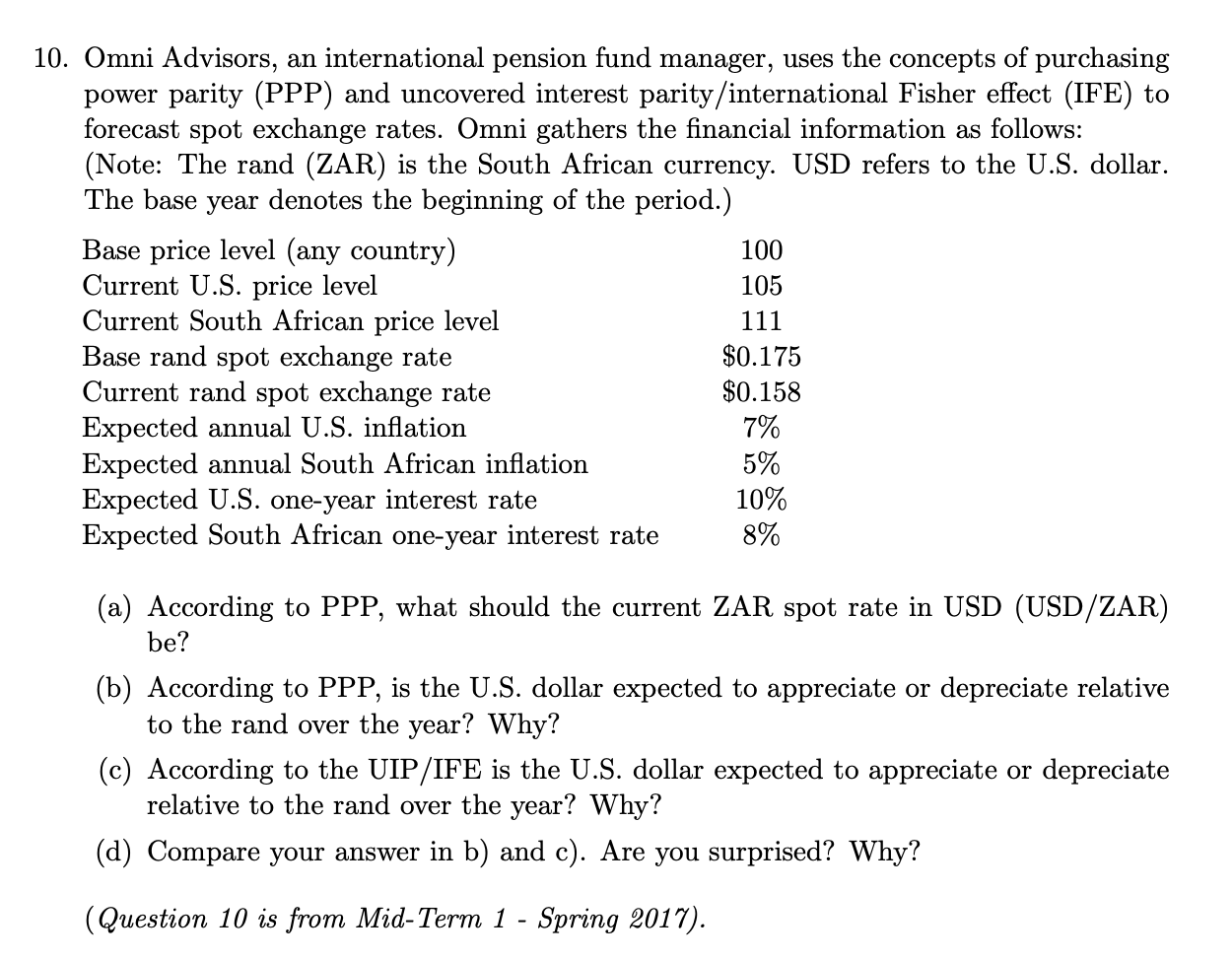

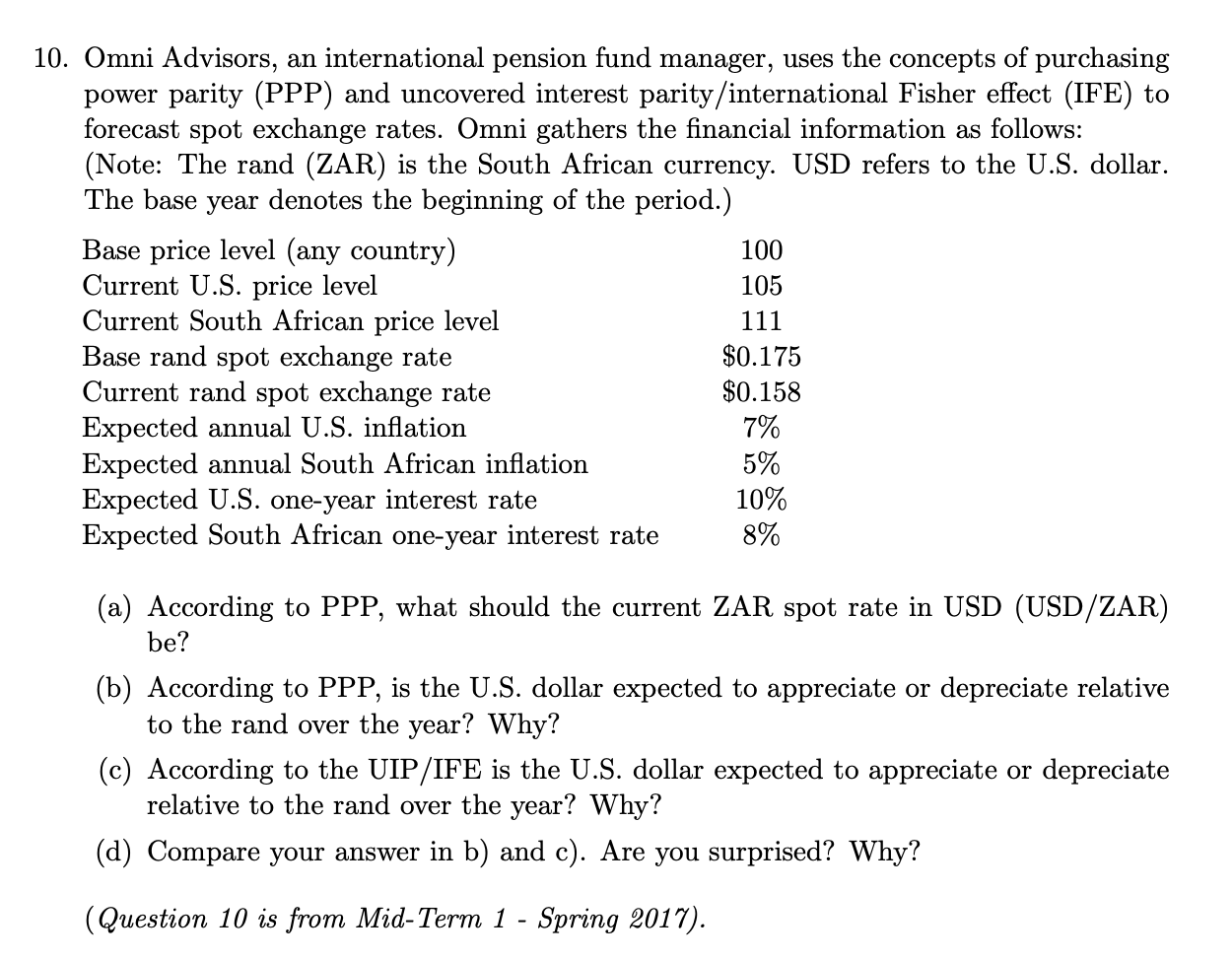

10. Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and uncovered interest parity/international Fisher effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: (Note: The rand (ZAR) is the South African currency. USD refers to the U.S. dollar. The base year denotes the beginning of the period.) Base price level (any country) 100 Current U.S. price level 105 Current South African price level 111 Base rand spot exchange rate $0.175 Current rand spot exchange rate $0.158 Expected annual U.S. inflation 7% Expected annual South African inflation 5% Expected U.S. one-year interest rate 10% Expected South African one-year interest rate 8% (a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR) be? (b) According to PPP, is the U.S. dollar expected to appreciate or depreciate relative to the rand over the year? Why? (c) According to the UIP/IFE is the U.S. dollar expected to appreciate or depreciate relative to the rand over the year? Why? (d) Compare your answer in b) and c). Are you surprised? Why? (Question 10 is from Mid-Term 1 - Spring 2017). 10. Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and uncovered interest parity/international Fisher effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows: (Note: The rand (ZAR) is the South African currency. USD refers to the U.S. dollar. The base year denotes the beginning of the period.) Base price level (any country) 100 Current U.S. price level 105 Current South African price level 111 Base rand spot exchange rate $0.175 Current rand spot exchange rate $0.158 Expected annual U.S. inflation 7% Expected annual South African inflation 5% Expected U.S. one-year interest rate 10% Expected South African one-year interest rate 8% (a) According to PPP, what should the current ZAR spot rate in USD (USD/ZAR) be? (b) According to PPP, is the U.S. dollar expected to appreciate or depreciate relative to the rand over the year? Why? (c) According to the UIP/IFE is the U.S. dollar expected to appreciate or depreciate relative to the rand over the year? Why? (d) Compare your answer in b) and c). Are you surprised? Why? (Question 10 is from Mid-Term 1 - Spring 2017)