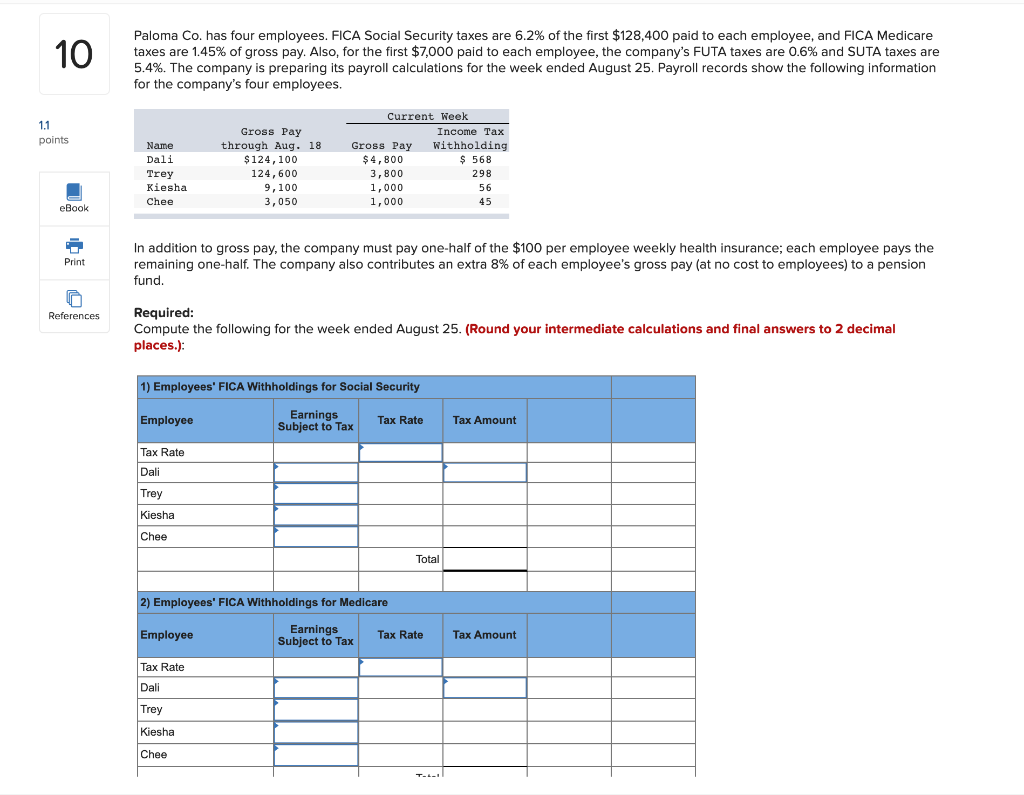

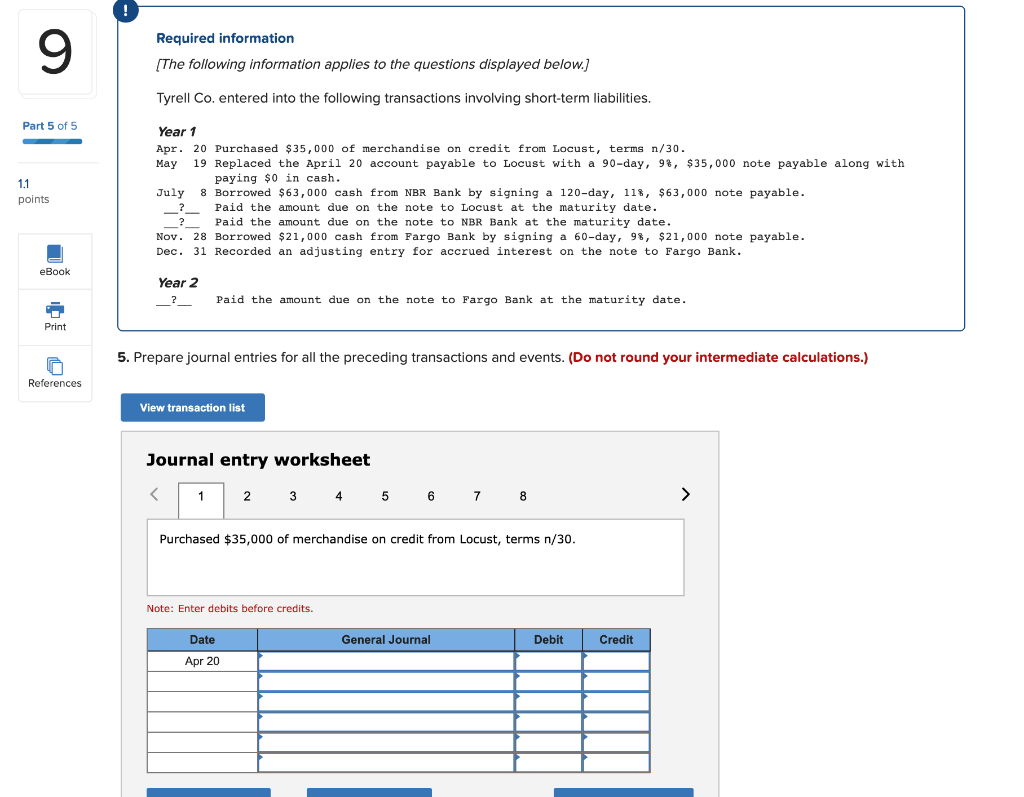

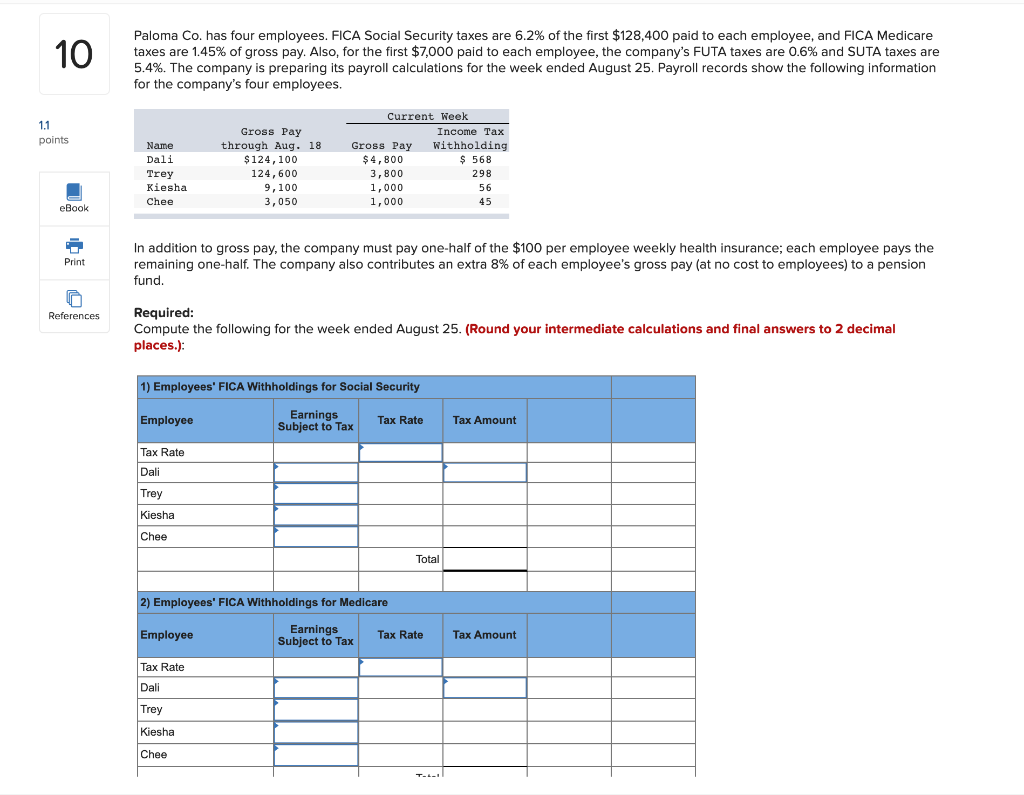

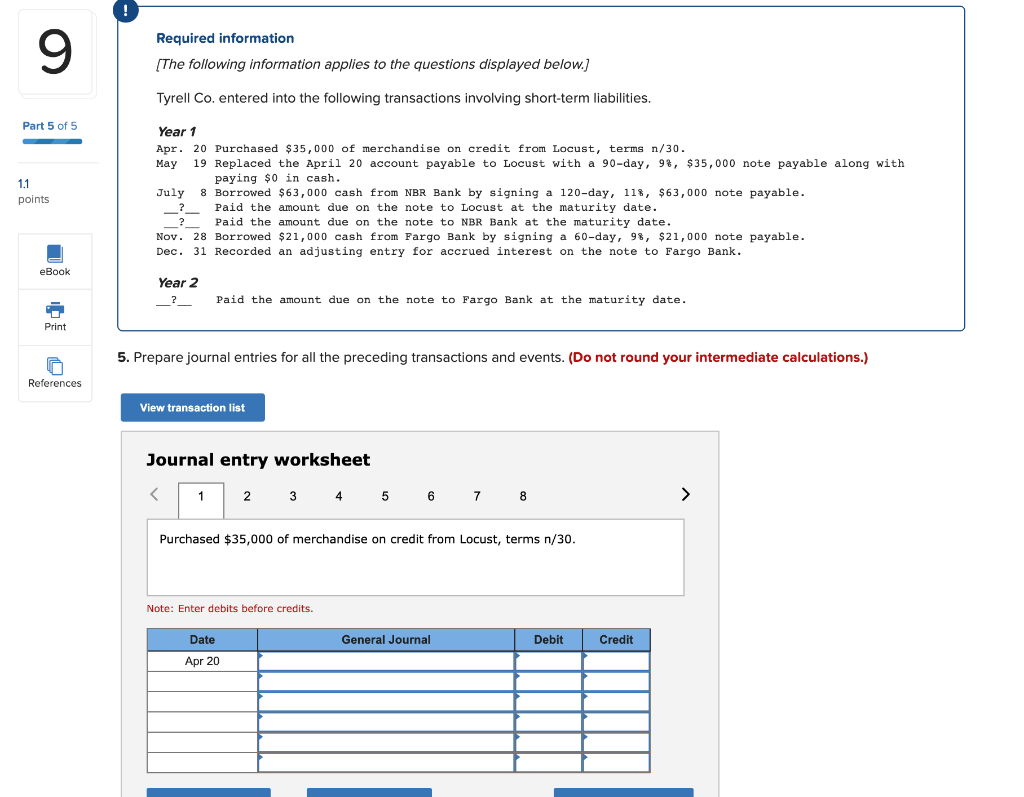

10 Paloma Co. has four employees. FICA Social Security taxes are 6.2% of the first $128,400 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25. Payroll records show the following information for the company's four employees. 1.1 points Name Dali Trey Kiesha Chee Gross Pay through Aug. 18 $124,100 124,600 9,100 3,050 Current Week Income Tax Gross Pay Withholding $4,800 $ 568 3,800 298 1,000 56 1,000 45 eBook Print In addition to gross pay, the company must pay one-half of the $100 per employee weekly health insurance; each employee pays the remaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. References Required: Compute the following for the week ended August 25. (Round your intermediate calculations and final answers to 2 decimal places.): 1) Employees' FICA Withholdings for Social Security Earnings Employee Tax Rate Subject to Tax Tax Amount Tax Rate Dali Trey Kiesha Chee Total 2) Employees' FICA Withholdings for Medicare Employee Earnings Subject to Tax Tax Rate Tax Amount Tax Rate Dali Trey Kiesha Chee T. 9 Required information [The following information applies to the questions displayed below.) Tyrell Co. entered into the following transactions involving short-term liabilities. Part 5 of 5 1.1 Year 1 Apr. 20 Purchased $35,000 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 9%, $35,000 note payable along with paying $0 in cash. July 8 Borrowed $63,000 cash from NBR Bank by signing a 120-day, 11%, $63,000 note payable. Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. Nov. 28 Borrowed $21,000 cash from Fargo Bank by signing a 60-day, 98, $21,000 note payable. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. points eBook Year 2 Paid the amount due on the note to Fargo Bank at the maturity date. Print 5. Prepare journal entries for all the preceding transactions and events. (Do not round your intermediate calculations.) References View transaction list Journal entry worksheet Purchased $35,000 of merchandise on credit from Locust, terms n/30. Note: Enter debits before credits. Date General Journal Debit Credit Apr 20