Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Pat and Dale have been common-law partners for over 10 years. They live in a house in Calgary which they own jointly. They also

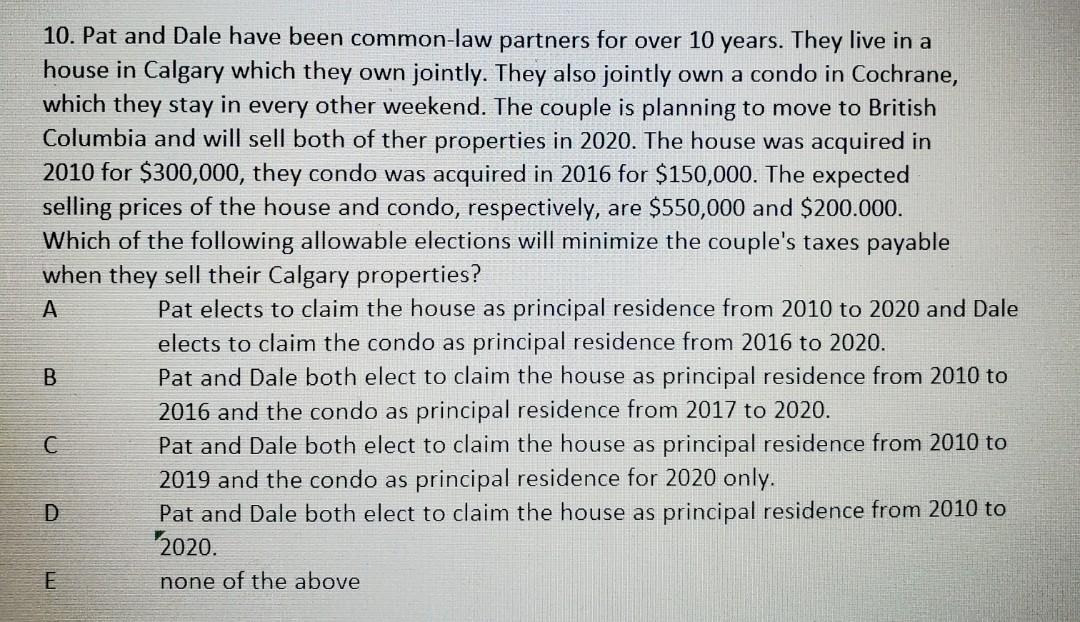

10. Pat and Dale have been common-law partners for over 10 years. They live in a house in Calgary which they own jointly. They also jointly own a condo in Cochrane, which they stay in every other weekend. The couple is planning to move to British Columbia and will sell both of ther properties in 2020. The house was acquired in 2010 for $300,000, they condo was acquired in 2016 for $150,000. The expected selling prices of the house and condo, respectively, are $550,000 and $200.000. Which of the following allowable elections will minimize the couple's taxes payable when they sell their Calgary properties? A Pat elects to claim the house as principal residence from 2010 to 2020 and Dale elects to claim the condo as principal residence from 2016 to 2020. B Pat and Dale both elect to claim the house as principal residence from 2010 to 2016 and the condo as principal residence from 2017 to 2020. Pat and Dale both elect to claim the house as principal residence from 2010 to 2019 and the condo as principal residence for 2020 only. Pat and Dale both elect to claim the house as principal residence from 2010 to 2020. none of the above E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started