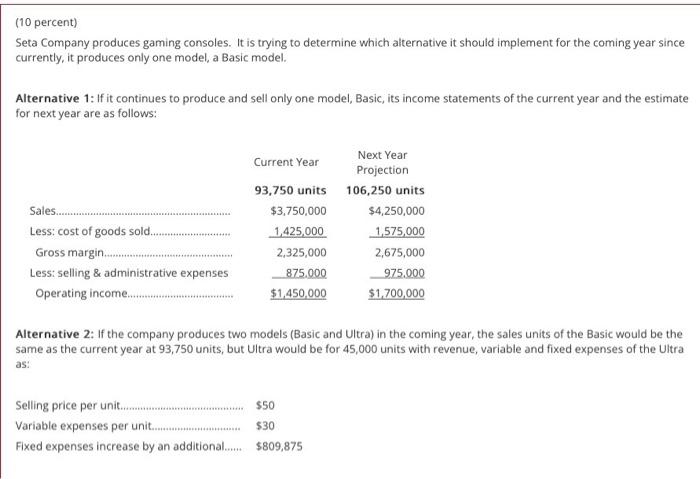

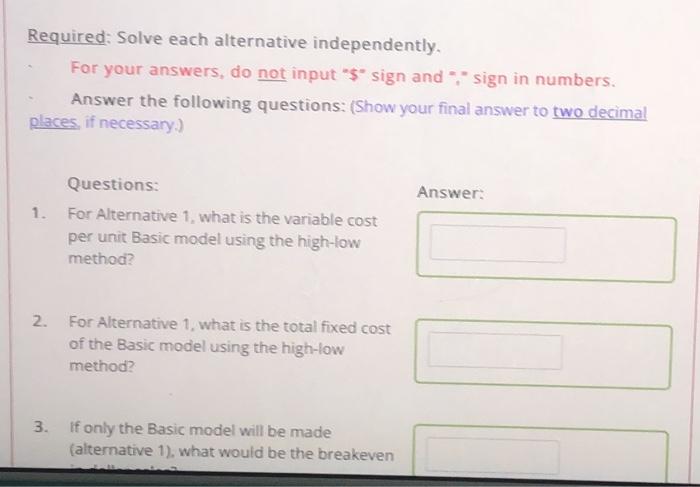

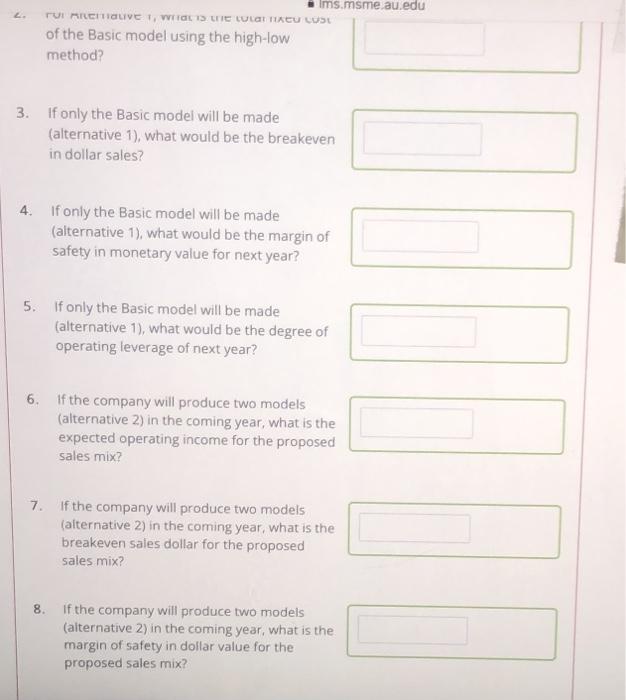

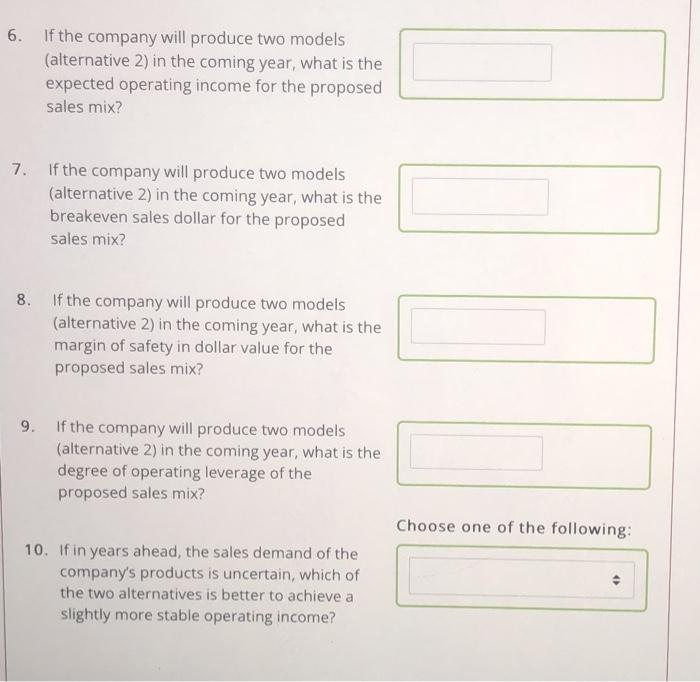

(10 percent) Seta Company produces gaming consoles. It is trying to determine which alternative it should implement for the coming year since currently, it produces only one model, a Basic model. Alternative 1: If it continues to produce and sell only one model, Basic, its income statements of the current year and the estimate for next year are as follows: Sales... Less: cost of goods sold.. Gross margin Less: selling & administrative expenses Operating income...... Current Year Next Year Projection 93,750 units 106,250 units $3,750,000 $4,250,000 1,425,000 1,575,000 2,325,000 2,675,000 875.000 975.000 $1,450,000 $1.700,000 Alternative 2: If the company produces two models (Basic and Ultra) in the coming year, the sales units of the Basic would be the same as the current year at 93,750 units, but Ultra would be for 45,000 units with revenue, variable and fixed expenses of the Ultra as: Selling price per unit..... $50 Variable expenses per unit... $30 Fixed expenses increase by an additional... $809,875 Required: Solve each alternative independently. For your answers, do not input '$* sign and sign in numbers. Answer the following questions: (Show your final answer to two decimal places, if necessary.) Answer: 1. Questions: For Alternative 1. what is the variable cost per unit Basic model using the high-low method? 2. For Alternative 1. what is the total fixed cost of the Basic model using the high-low method? 3. If only the Basic model will be made (alternative 1), what would be the breakeven Ims.msme au.edu , of the Basic model using the high-low method? 3. If only the Basic model will be made (alternative 1), what would be the breakeven in dollar sales? 4 If only the Basic model will be made (alternative 1), what would be the margin of safety in monetary value for next year? 5. If only the Basic model will be made (alternative 1), what would be the degree of operating leverage of next year? 6. If the company will produce two models (alternative 2) in the coming year, what is the expected operating income for the proposed sales mix? 7. If the company will produce two models (alternative 2) in the coming year, what is the breakeven sales dollar for the proposed sales mix? 8. If the company will produce two models (alternative 2) in the coming year, what is the margin of safety in dollar value for the proposed sales mix? 6. If the company will produce two models (alternative 2) in the coming year, what is the expected operating income for the proposed sales mix? 7. If the company will produce two models (alternative 2) in the coming year, what is the breakeven sales dollar for the proposed sales mix? 8. If the company will produce two models (alternative 2) in the coming year, what is the margin of safety in dollar value for the proposed sales mix? 9. If the company will produce two models (alternative 2) in the coming year, what is the degree of operating leverage of the proposed sales mix? Choose one of the following: 10. If in years ahead, the sales demand of the company's products is uncertain, which of the two alternatives is better to achieve a slightly more stable operating income