Answered step by step

Verified Expert Solution

Question

1 Approved Answer

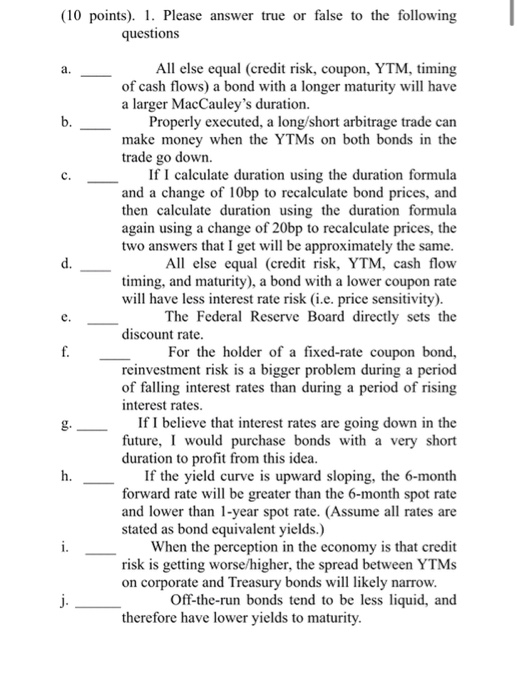

(10 points). 1. Please answer true or false to the following questions a. b. d. e. . f. All else equal (credit risk, coupon, YTM,

(10 points). 1. Please answer true or false to the following questions a. b. d. e. . f. All else equal (credit risk, coupon, YTM, timing of cash flows) a bond with a longer maturity will have a larger MacCauley's duration. Properly executed, a long/short arbitrage trade can make money when the YTMs on both bonds in the trade go down If I calculate duration using the duration formula and a change of 10bp to recalculate bond prices, and then calculate duration using the duration formula again using a change of 20bp to recalculate prices, the two answers that I get will be approximately the same. All else equal (credit risk, YTM, cash flow timing, and maturity), a bond with a lower coupon rate will have less interest rate risk (i.e. price sensitivity). The Federal Reserve Board directly sets the discount rate. For the holder of a fixed-rate coupon bond, reinvestment risk is a bigger problem during a period of falling interest rates than during a period of rising interest rates. If I believe that interest rates are going down in the future, I would purchase bonds with a very short duration to profit from this idea. If the yield curve is upward sloping, the 6-month forward rate will be greater than the 6-month spot rate and lower than 1-year spot rate. (Assume all rates are stated as bond equivalent yields.) When the perception in the economy is that credit risk is getting worse/higher, the spread between YTMs on corporate and Treasury bonds will likely narrow. Off-the-run bonds tend to be less liquid, and therefore have lower yields to maturity. g. h

(10 points). 1. Please answer true or false to the following questions a. b. d. e. . f. All else equal (credit risk, coupon, YTM, timing of cash flows) a bond with a longer maturity will have a larger MacCauley's duration. Properly executed, a long/short arbitrage trade can make money when the YTMs on both bonds in the trade go down If I calculate duration using the duration formula and a change of 10bp to recalculate bond prices, and then calculate duration using the duration formula again using a change of 20bp to recalculate prices, the two answers that I get will be approximately the same. All else equal (credit risk, YTM, cash flow timing, and maturity), a bond with a lower coupon rate will have less interest rate risk (i.e. price sensitivity). The Federal Reserve Board directly sets the discount rate. For the holder of a fixed-rate coupon bond, reinvestment risk is a bigger problem during a period of falling interest rates than during a period of rising interest rates. If I believe that interest rates are going down in the future, I would purchase bonds with a very short duration to profit from this idea. If the yield curve is upward sloping, the 6-month forward rate will be greater than the 6-month spot rate and lower than 1-year spot rate. (Assume all rates are stated as bond equivalent yields.) When the perception in the economy is that credit risk is getting worse/higher, the spread between YTMs on corporate and Treasury bonds will likely narrow. Off-the-run bonds tend to be less liquid, and therefore have lower yields to maturity. g. h

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started