Answered step by step

Verified Expert Solution

Question

1 Approved Answer

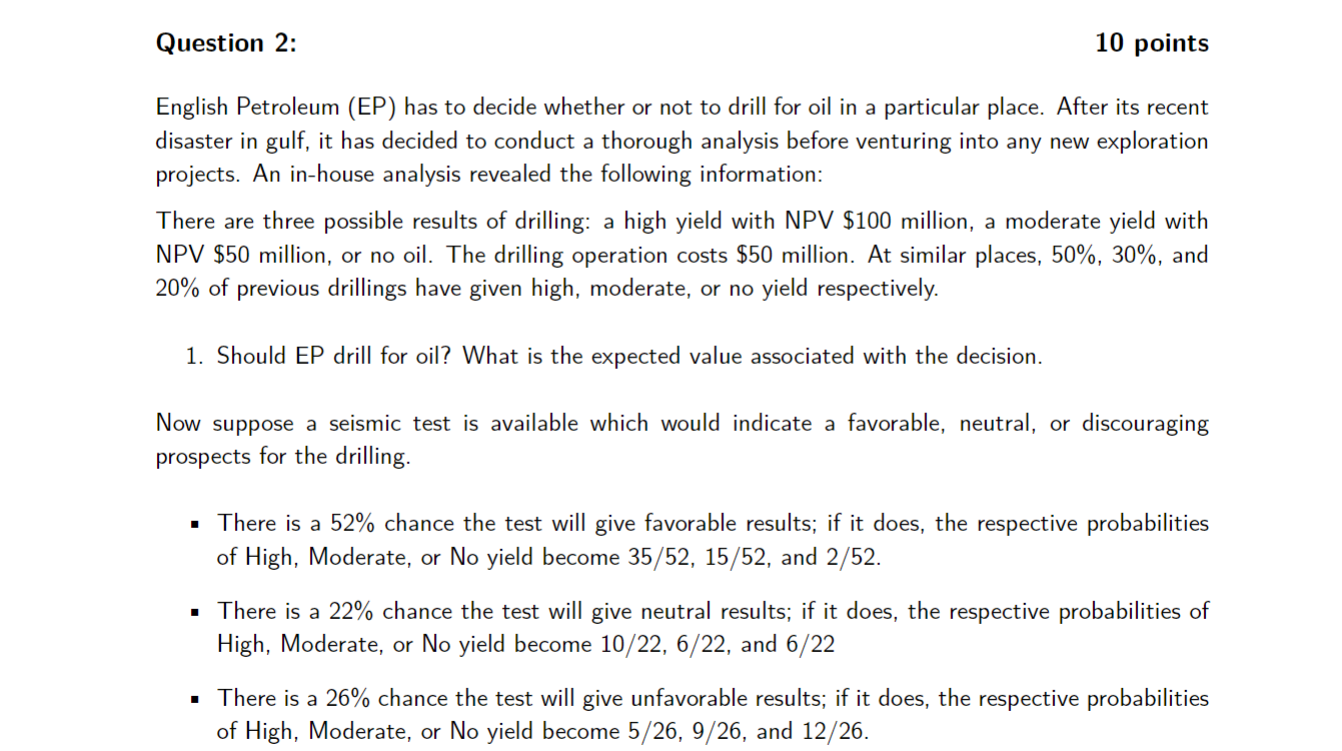

10 points English Petroleum (EP) has to decide whether or not to drill for oil in a particular place. After its recent disaster in

10 points English Petroleum (EP) has to decide whether or not to drill for oil in a particular place. After its recent disaster in gulf, it has decided to conduct a thorough analysis before venturing into any new exploration projects. An in-house analysis revealed the following information: Question 2: There are three possible results of drilling: a high yield with NPV $100 million, a moderate yield with NPV $50 million, or no oil. The drilling operation costs $50 million. At similar places, 50%, 30%, and 20% of previous drillings have given high, moderate, or no yield respectively. 1. Should EP drill for oil? What is the expected value associated with the decision. Now suppose a seismic test is available which would indicate a favorable, neutral, or discouraging prospects for the drilling. There is a 52% chance the test will give favorable results; if it does, the respective probabilities of High, Moderate, or No yield become 35/52, 15/52, and 2/52. There is a 22% chance the test will give neutral results; if it does, the respective probabilities of High, Moderate, or No yield become 10/22, 6/22, and 6/22 There is a 26% chance the test will give unfavorable results; if it does, the respective probabilities of High, Moderate, or No yield become 5/26, 9/26, and 12/26. Answer the following questions based on the information above. 2. Find the optimal decision on the assumption that a test is made. 3. What is the maximum amount that would be worth paying for such a test?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Should EP drill for oil What is the expected value associated with the decision Without the seismi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started