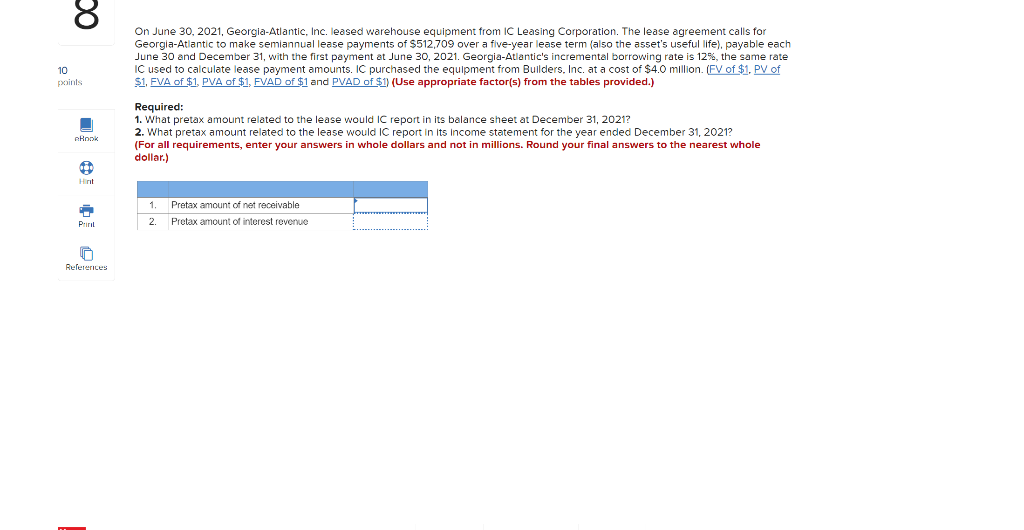

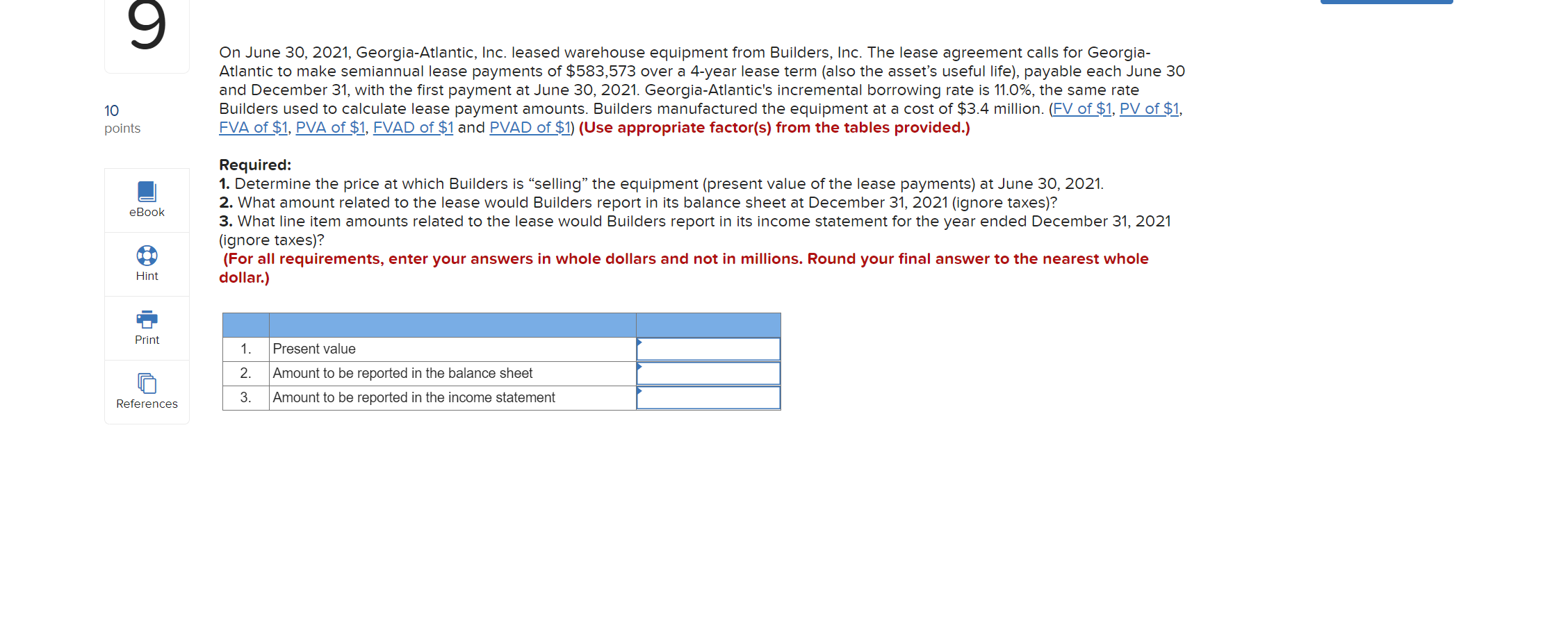

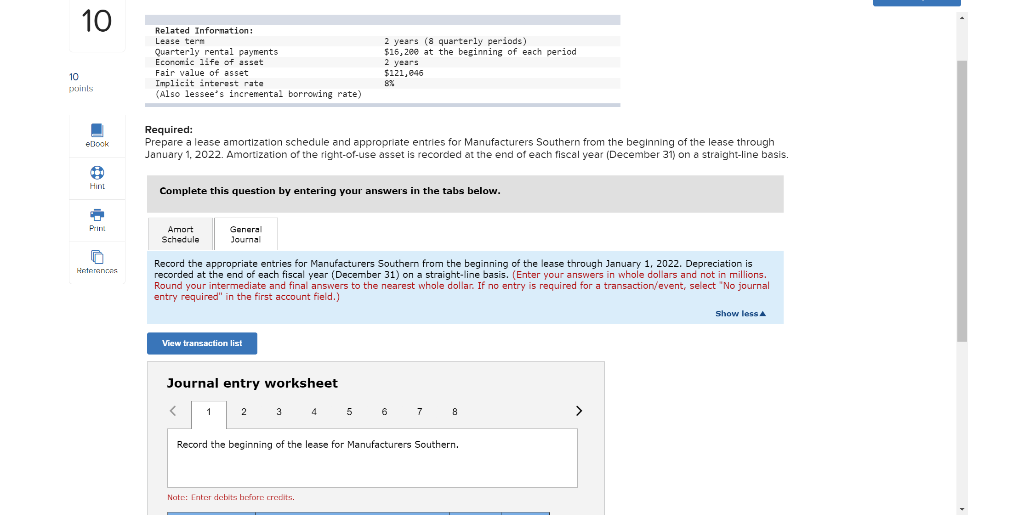

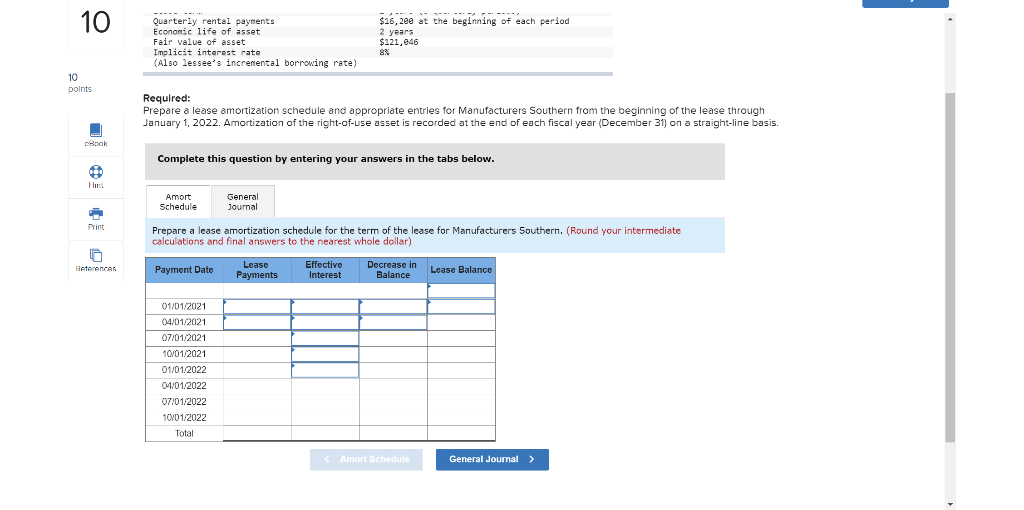

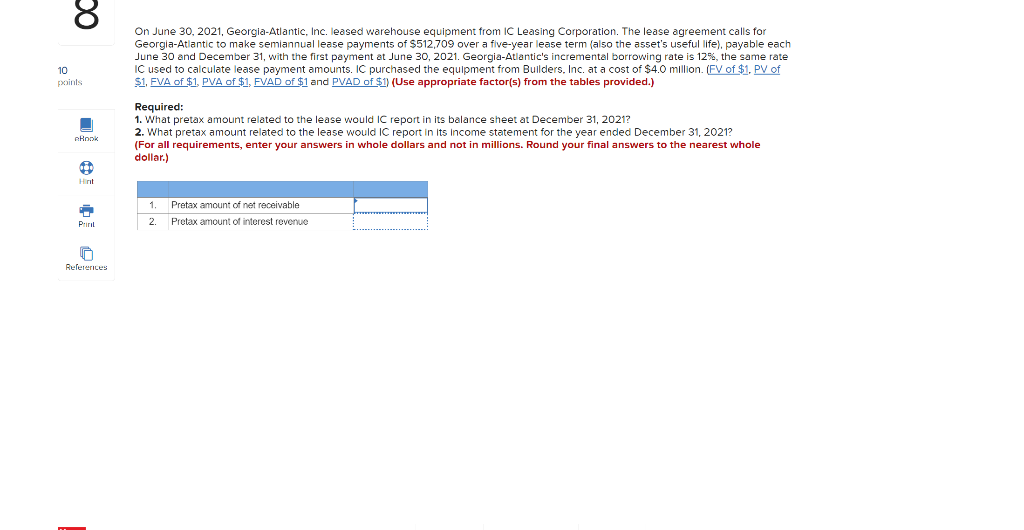

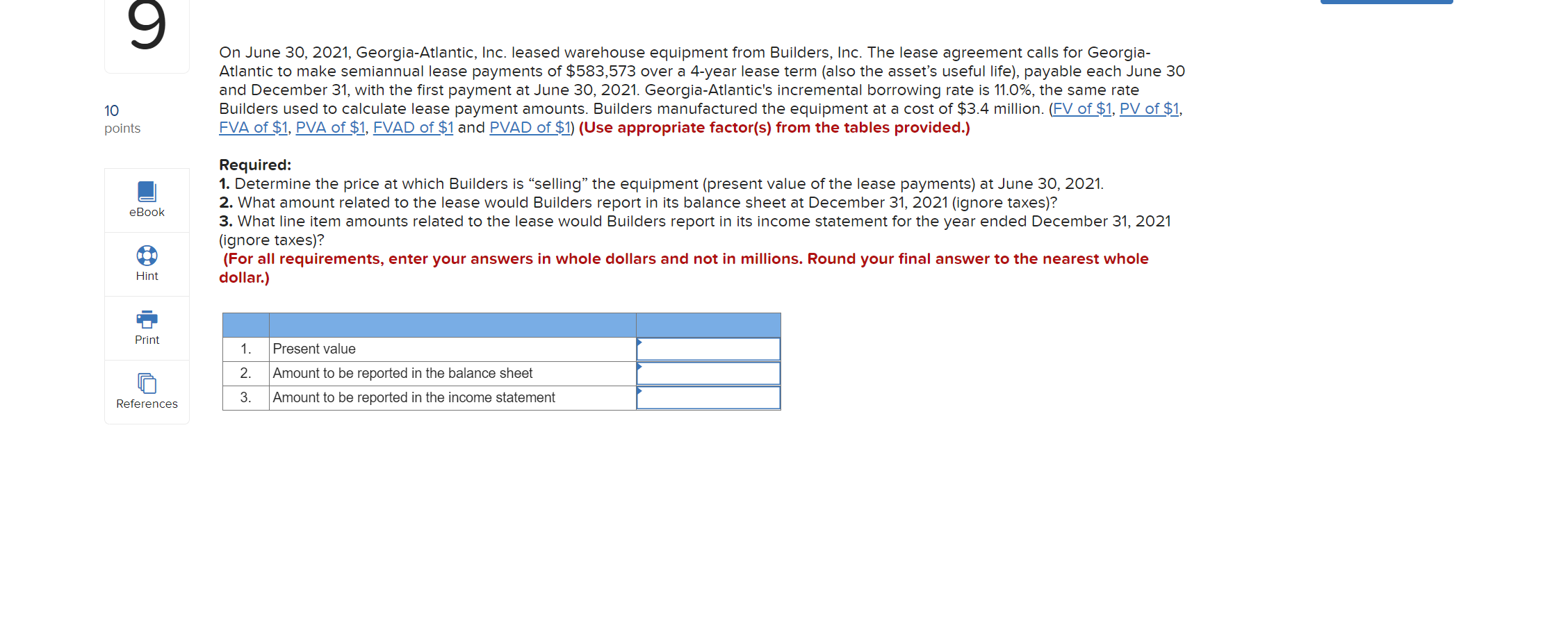

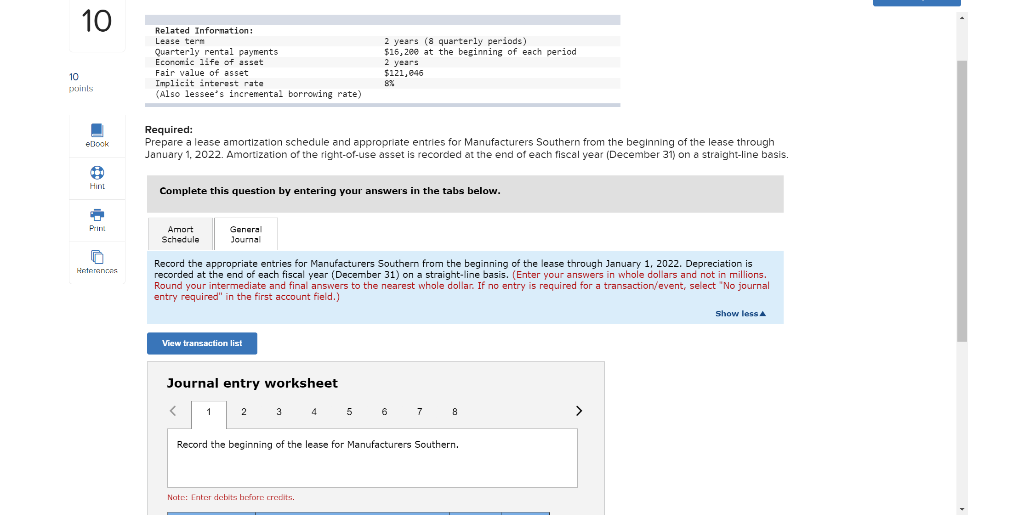

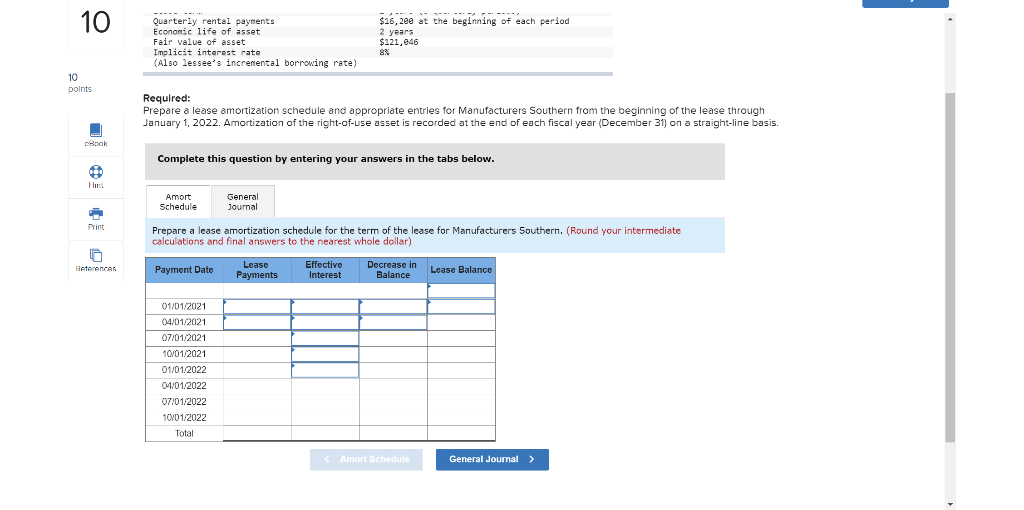

10 points On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from IC Leasing Corporation. The lease agreement calls for Georgia-Atlantic to make semiannual lease payments of $512,709 over a five-year lease term (also the asset's useful life) payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 12%, the same rate I used to calculate lease payment amounts. IC purchased the equipment from Builders, Inc. at a cost of $4.0 million. (FV of $1. PV of S1, FVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What pretax amount related to the lease would IC report in its balance sheet at December 31, 2021? 2. What pretax amount related to the lease would IC report in its income statement for the year ended December 31, 2021? (For all requirements, enter your answers in whole dollars and not in millions. Round your final answers to the nearest whole dollar.) Rook Hml Pretax amount of not receivable Pretax amount of interest revenue Pent 2 References 9 On June 30, 2021, Georgia-Atlantic, Inc. leased warehouse equipment from Builders, Inc. The lease agreement calls for Georgia- Atlantic to make semiannual lease payments of $583,573 over a 4-year lease term (also the asset's useful life), payable each June 30 and December 31, with the first payment at June 30, 2021. Georgia-Atlantic's incremental borrowing rate is 11.0%, the same rate Builders used to calculate lease payment amounts. Builders manufactured the equipment at a cost of $3.4 million. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) 10 points eBook Required: 1. Determine the price at which Builders is "selling the equipment (present value of the lease payments) at June 30, 2021. 2. What amount related to the lease would Builders report in its balance sheet at December 31, 2021 (ignore taxes)? 3. What line item amounts related to the lease would Builders report in its income statement for the year ended December 31, 2021 (ignore taxes)? (For all requirements, enter your answers in whole dollars and not in millions. Round your final answer to the nearest whole dollar.) Hint Print 1. Present value 2. Amount to be reported in the balance sheet Amount to be reported in the income statement 3. References 10 Related Information: Lease term Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) 2 years (& quarterly periods) $15,zee at the beginning of each period 2 years $121.646 8% 10 points ebook Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2022. Amortization of the right-of-use asset is recorded at the end of each fiscal year (December 31) on a straight-line basis. Hint Complete this question by entering your answers in the tabs below. Amort Schedule Genera Journal Heren Record the appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2022. Depreciation is recorded at the end of each fiscal year (December 31) on a straight-line basis. (Enter your answers in whole dollars and not in millions. Round your intermediate and final answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Show less View transaction list Journal entry worksheet Record the beginning of the lease for Manufacturers Southern. Note: Enter dcbits before credits. 10 Quarterly rental payments Economic life of asset Fair value of asset Implicit interest rate (Also lessee's incremental borrowing rate) $16, 2ee at the beginning of each period 2 years $121,846 8% 10 points Required: Prepare a lease amortization schedule and appropriate entries for Manufacturers Southern from the beginning of the lease through January 1, 2022. Amortization of the right-of-use asset is recorded at the end of each fiscal year (December 31) on a straight-line basis. Complete this question by entering your answers in the tabs below. Hot Amort Schedule General Journal . Prepare a lease amortization schedule for the term of the lease for Manufacturers Southern. (Round your intermediate calculations and final answers to the nearest whole dollar) o RetenACAS Payment Date Lease Payments Effective Interest Decrease in Balance Lease Balance 01/01/2021 04/01/2021 07/01/2021 10/01/2021 01/01/2022 04/01/2022 07/01/2022 10101/2022 Total (Amort Schedule General Journal >