Answered step by step

Verified Expert Solution

Question

1 Approved Answer

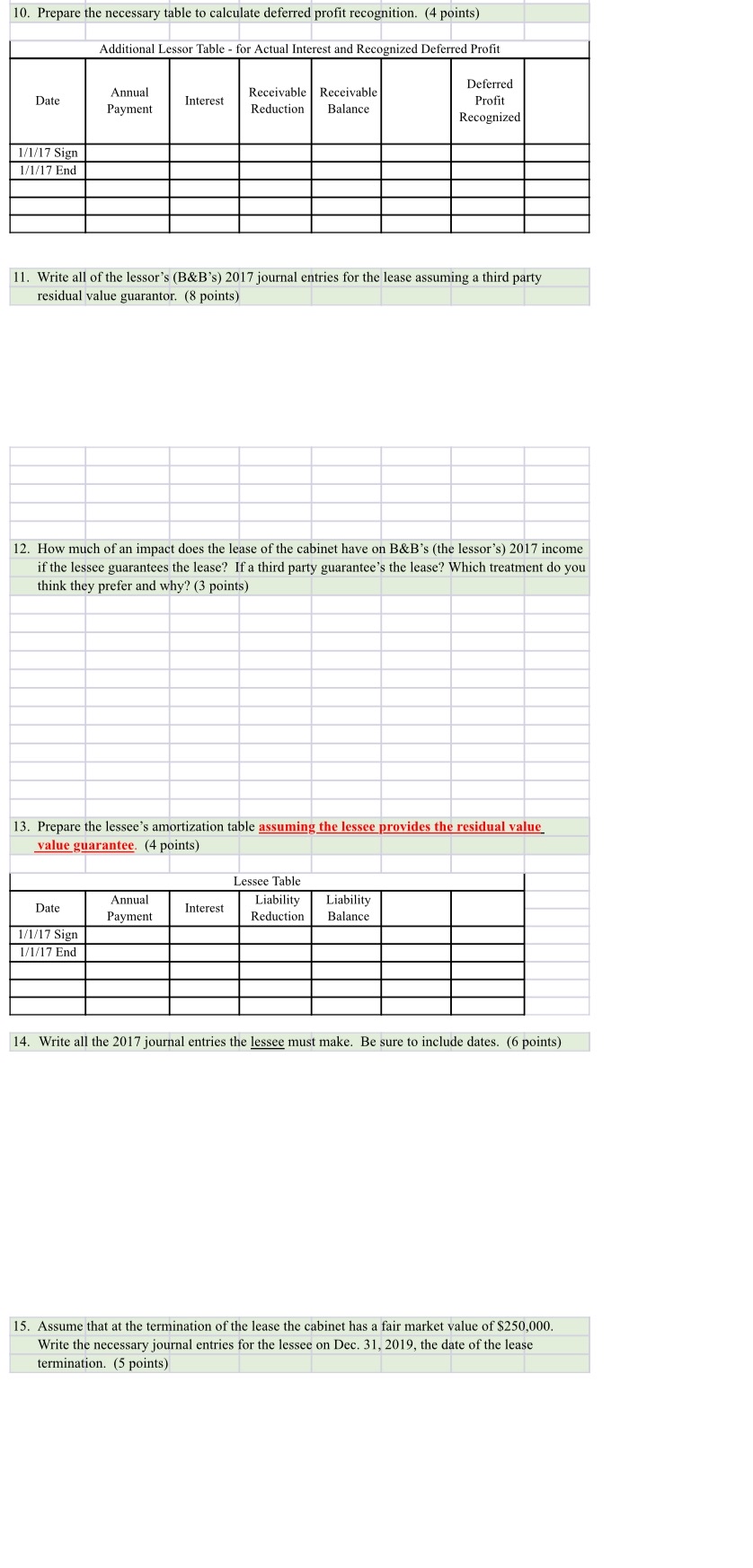

10. Prepare the necessary table to calculate deferred profit recognition. (4 points) Additional Lessor Table for Actual Interest and Recognized Deferred Profit Date Annual

10. Prepare the necessary table to calculate deferred profit recognition. (4 points) Additional Lessor Table for Actual Interest and Recognized Deferred Profit Date Annual Payment Interest Receivable Receivable Reduction Balance 1/1/17 Sign 1/1/17 End Deferred Profit Recognized 11. Write all of the lessor's (B&B's) 2017 journal entries for the lease assuming a third party residual value guarantor. (8 points) 12. How much of an impact does the lease of the cabinet have on B&B's (the lessor's) 2017 income if the lessee guarantees the lease? If a third party guarantee's the lease? Which treatment do you think they prefer and why? (3 points) 13. Prepare the lessee's amortization table assuming the lessee provides the residual value value guarantee. (4 points) Date Annual Payment Interest Lessee Table Liability Reduction Liability Balance 1/1/17 Sign 1/1/17 End 14. Write all the 2017 journal entries the lessee must make. Be sure to include dates. (6 points) 15. Assume that at the termination of the lease the cabinet has a fair market value of $250,000. Write the necessary journal entries for the lessee on Dec. 31, 2019, the date of the lease termination. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started