Answered step by step

Verified Expert Solution

Question

1 Approved Answer

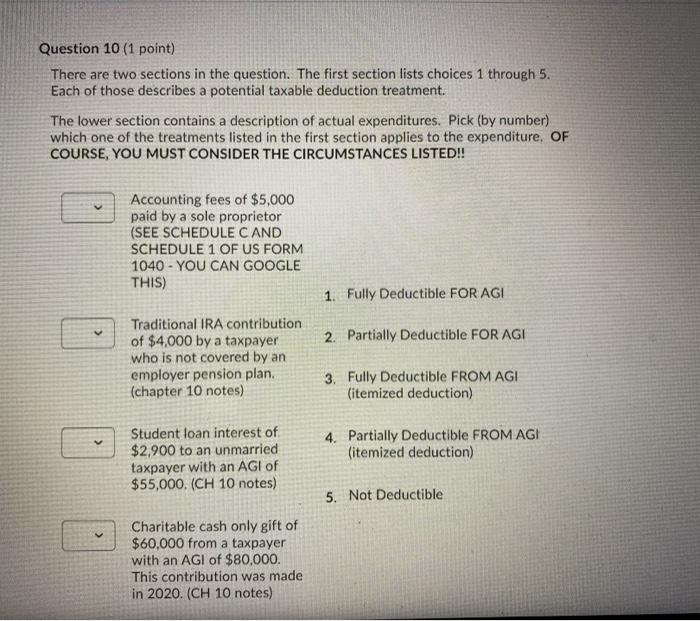

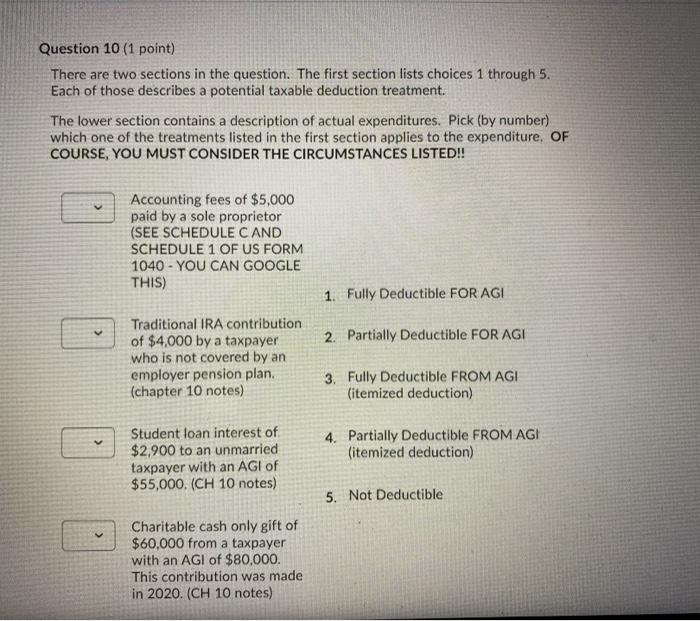

10 Question 10 (1 point) There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a

10

Question 10 (1 point) There are two sections in the question. The first section lists choices 1 through 5. Each of those describes a potential taxable deduction treatment. The lower section contains a description of actual expenditures. Pick (by number) which one of the treatments listed in the first section applies to the expenditure. OF COURSE, YOU MUST CONSIDER THE CIRCUMSTANCES LISTED!! v Accounting fees of $5,000 paid by a sole proprietor (SEE SCHEDULE C AND SCHEDULE 1 OF US FORM 1040 - YOU CAN GOOGLE THIS) 1. Fully Deductible FOR AGI 2. Partially Deductible FOR AGE Traditional IRA contribution of $4,000 by a taxpayer who is not covered by an employer pension plan. (chapter 10 notes) 3. Fully Deductible FROM AGI (itemized deduction) Student loan interest of $2,900 to an unmarried taxpayer with an AGI of $55,000. (CH 10 notes) 4. Partially Deductible FROM AGI (itemized deduction) 5. Not Deductible Charitable cash only gift of $60,000 from a taxpayer with an AGI of $80,000. This contribution was made in 2020. (CH 10 notes)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started