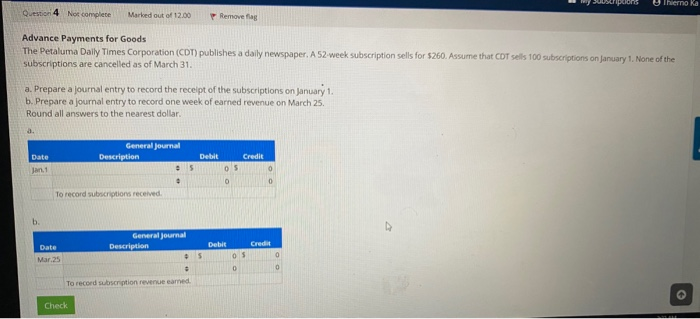

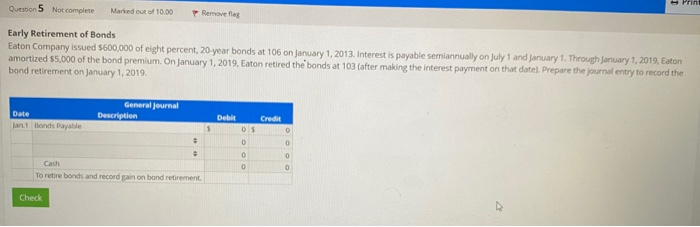

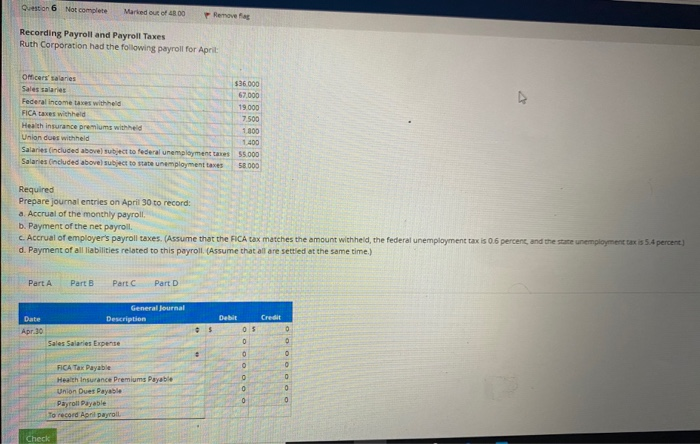

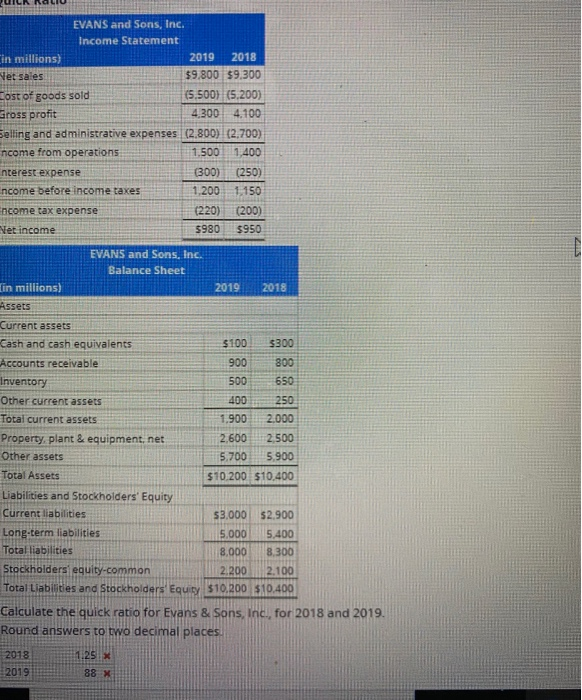

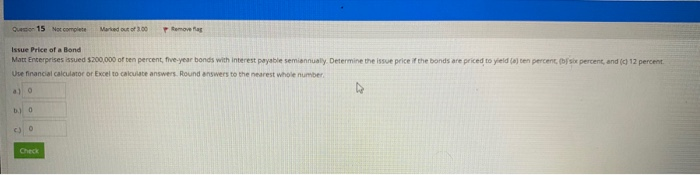

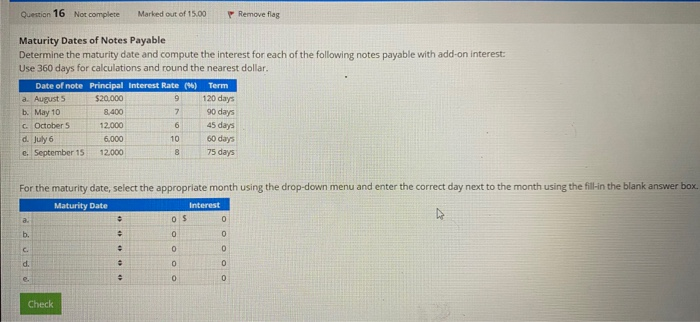

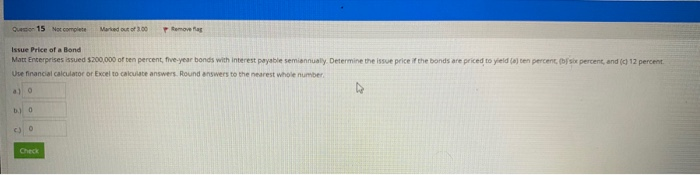

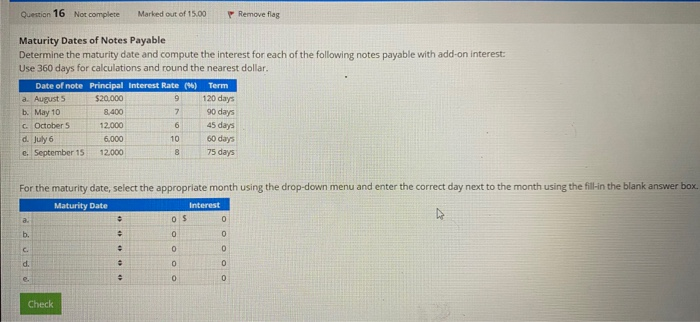

Susion Thermo ka Question 4 Not complete Marked out of 12.00 Remove flag Advance Payments for Goods The Petaluma Daily Times Corporation (CDT) publishes a daily newspaper. A 52-week subscription sells for $260. Assume that CT sells 100 subscriptions on January 1. None of the subscriptions are cancelled as of March 31. a. Prepare a journal entry to record the receipt of the subscriptions on January 1, b. Prepare a journal entry to record one week of earned revenue on March 25. Round all answers to the nearest dollar. General Journal Description Date Debit Credit To record subscriptions received General Journal Description Debit Date Credit To record subscription revenue eame Check Print Question 5 Not complete Marked out of 10.00 Remove flas Early Retirement of Bonds Eaton Company issued 5600,000 of eight percent, 20-year bonds at 106 on January 1, 2013. Interest is payable semiannually on July 1 and January 1. Through January 1, 2019. Eaton amortized $5,000 of the bond premium. On January 1, 2019. Eaton retired the bonds at 103 (after making the interest payment on that datel. Prepare the journal entry to record the bond retirement on January 1, 2019. Date un General Journal Description Credit nonds Pavable Cash To retire bonds and record in on bond retirement Check Question 6 Not complete Maried out of 48.00 Remove for Recording Payroll and Payroll Taxes Ruth Corporation had the following payroll for April Officers' salaries Sales salaries Federal income taxes withheld FICA taxes withheld Health Insurance premiums with Union does withheld Salaries (included above) subject to federal unem mentares 55.000 Salaries included above) subject to state unemployment taxes 50 000 Required Prepare journal entries on April 30 to record a Accrual of the monthly payroll b. Payment of the net payroll. C.Accrual of employer's payroll taxes. Assume that the FICA tax matches the amount withheld, the federal unemployment tax is 06 percent, and the state unemployment taxis 5.4 percent d. Payment of all liabilities related to this payroll. (Assume that all are settled at the same time.) Part A Part B Part C Part D General Journal Description Sales Sales Expense FICA Tax Payable Health Insurance Premiums P Union Duet Payable Payroll Payable To record April payroll Check JUILA NALIU EVANS and Sons, Inc. Income Statement Cin millions) 2019 2018 Vet sales $9.800 $9.300 Cost of goods sold (5.500) (5.2001 Gross profit 4.300 4.100 Selling and administrative expenses (2.800) (2.700) ncome from operations 1.500 1,400 nterest expense (300) (250) ncome before income taxes 1,200 1,150 ncome tax expense (220) (200) Net income 5980 $950 300 EVANS and Sons, Inc. Balance Sheet in millions) 2019 2018 Assets Current assets Cash and cash equivalents $100 Accounts receivable Inventory 500 Other current assets 250 Total current assets 1.900 2.000 Property, plant & equipment, net 2.600 2.500 Other assets 5.700 5.900 Total Assets $10.200 $10,400 Liabilities and Stockholders' Equity Current liabilities 53.000 $2.900 Long-term liabilities 5.000 5.400 Total liabilities 8,000 8,300 Stockholdersi equity-common 2.200 2.100 Total Liabilities and Stockholders Equity $10,200 $10.400 Calculate the quick ratio for Evans & Sons, Inc., for 2018 and 2019. Round answers to two decimal places. 2019 On 15 Natcome met Issue Price of a Bond Matt Enterprises issued $200,000 often percent, five-year bonds with interest payable semiannually. Determine the issue price if the bonds are priced to yeld a ten percent, (se percent, and ( 12 percent. Use financial calculator or Excel to calculate answers. Round answers to the nearest whole number a) o c) 0 Check Question 16 Not complete Marked out of 15.00 Remove flag Maturity Dates of Notes Payable Determine the maturity date and compute the interest for each of the following notes payable with add-on interest Use 360 days for calculations and round the nearest dollar. Date of note Principal Interest Rate (1) Term a. Augusts $20.000 120 days b. May 10 8.400 90 days c. October 12.000 45 days d. July 6 6,000 60 days e. September 15 12.000 75 days For the maturity date, select the appropriate month using the drop-down menu and enter the correct day next to the month using the fill-in the blank answer box Maturity Date Check