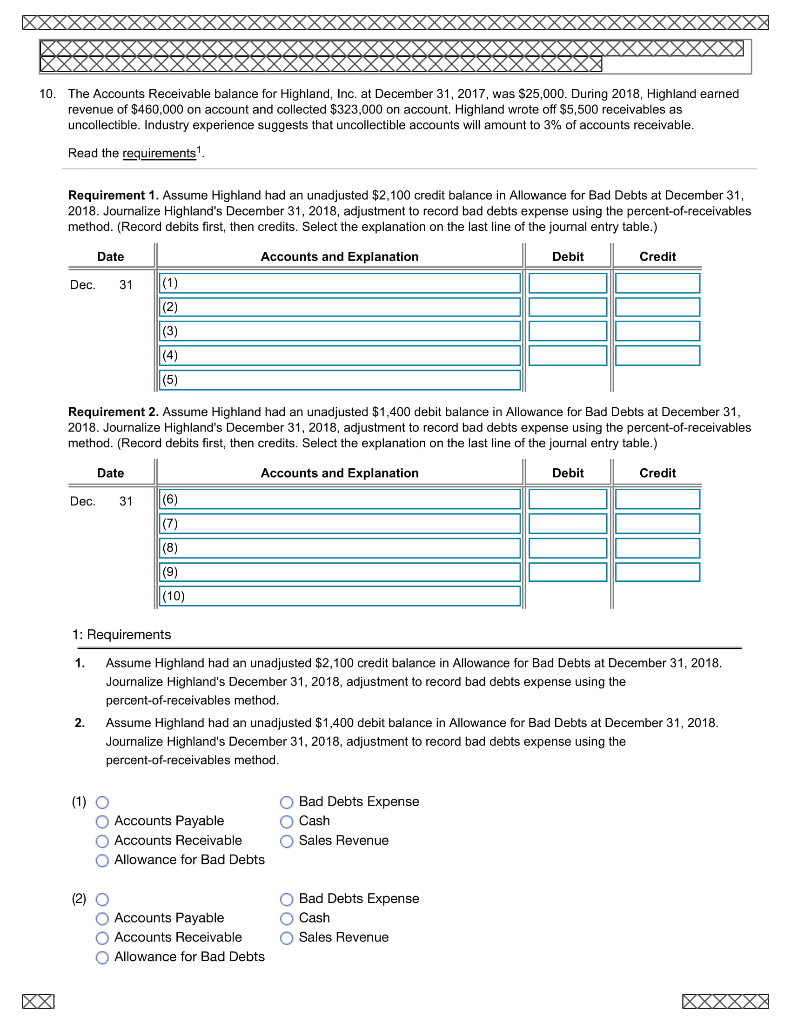

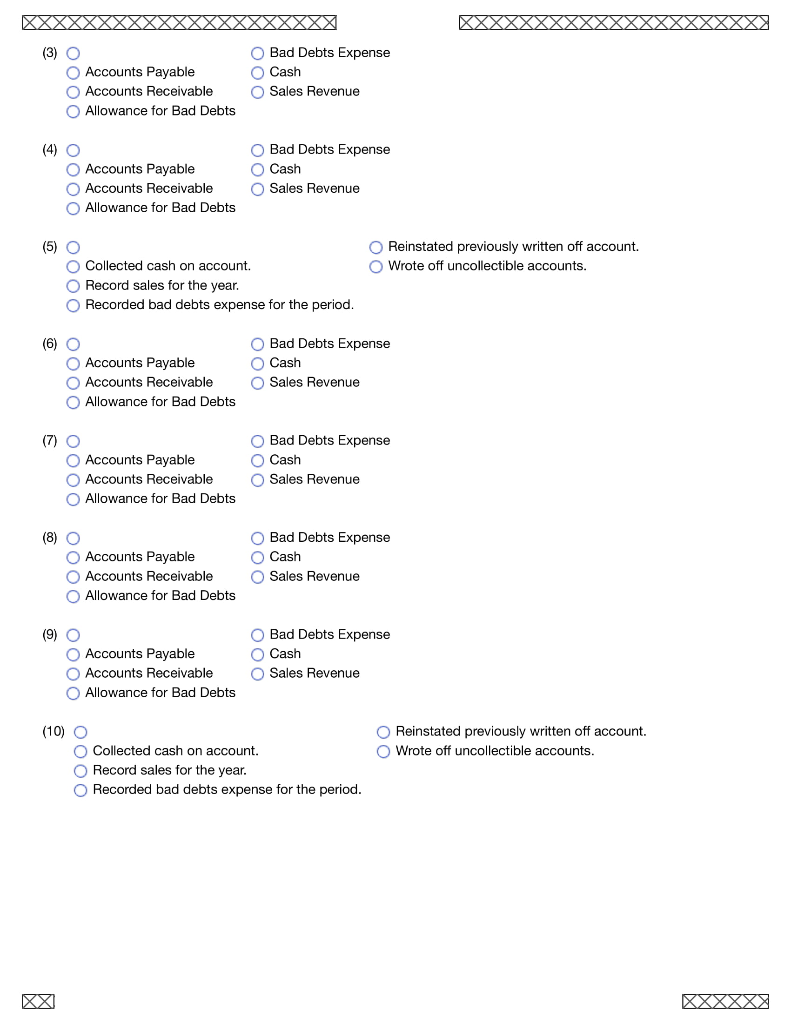

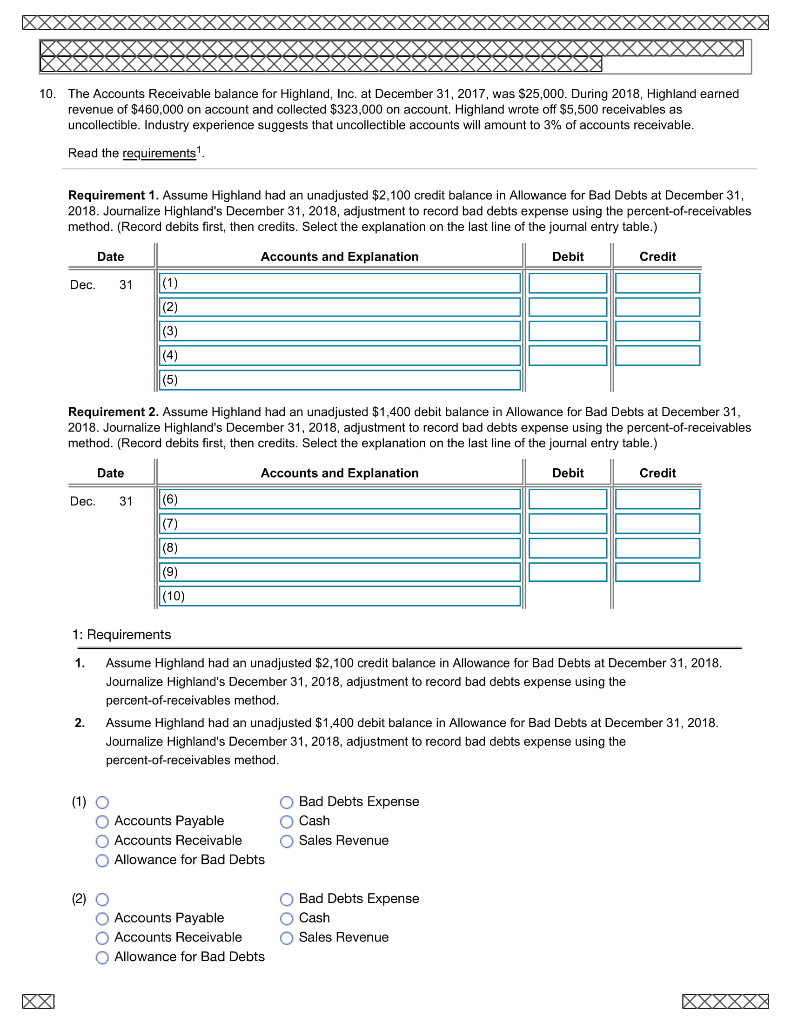

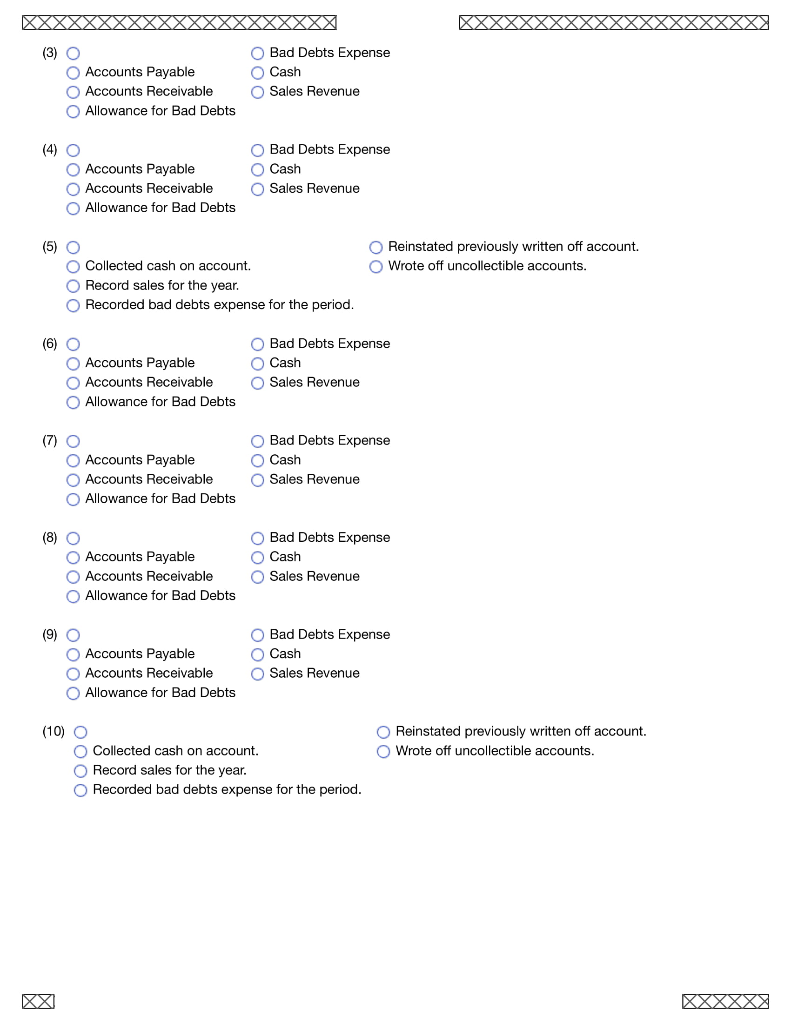

10 The Accounts Receivable balance for Highland, Inc. at December 31, 2017, was $25,000. During 2018, Highland earned revenue of $460,000 on account and collected $323,000 on account. Highland wrote off $5,500 receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 3% of accounts receivable. Read the requirements Requirement 1. Assume Highland had an unadjusted $2,100 credit balance in Allowance for Bad Debts at December 31, 2018. Journalize Highland's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 (2) (3) (4) (5) Requirement 2. Assume Highland had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2018. Journalize Highland's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit Dec. 31 (6) (7) (8) (9) (10) 1: Requirements 1. Assume Highland had an unadjusted $2,100 credit balance in Allowance for Bad Debts at December 31, 2018. Journalize Highland's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. Assume Highland had an unadjusted $1,400 debit balance in Allowance for Bad Debts at December 31, 2018. Journalize Highland's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. 2. (1) O Accounts Payable Accounts Receivable Allowance for Bad Debts Bad Debts Expense O Cash Sales Revenue (2) Accounts Payable O Accounts Receivable O Allowance for Bad Debts Bad Debts Expense O Cash Sales Revenue XX XXXXX XX (3) O Bad Debts Expense O Cash Accounts Payable Accounts Receivable Allowance for Bad Debts O Sales Revenue (4) O Accounts Payable Accounts Receivable Allowance for Bad Debts Bad Debts Expense O Cash O Sales Revenue (5) O OO Reinstated previously written off account. Wrote off uncollectible accounts. Collected cash on account. Record sales for the year. Recorded bad debts expense for the period. (6) O Accounts Payable Accounts Receivable Allowance for Bad Debts Bad Debts Expense O Cash O Sales Revenue O Accounts Payable Accounts Receivable Allowance for Bad Debts Bad Debts Expense O Cash O Sales Revenue (8) Accounts Payable Accounts Receivable Allowance for Bad Debts Bad Debts Expense O Cash O Sales Revenue (9) Bad Debts Expense O Cash Accounts Payable Accounts Receivable Allowance for Bad Debts Sales Revenue (10) Reinstated previously written off account. Wrote off uncollectible accounts. Collected cash on account. Record sales for the year. Recorded bad debts expense for the period. XXXXX