Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. The entry to record the purchase of direct materials on account would include a: A) debit to the Raw Materials Inventory account. B)

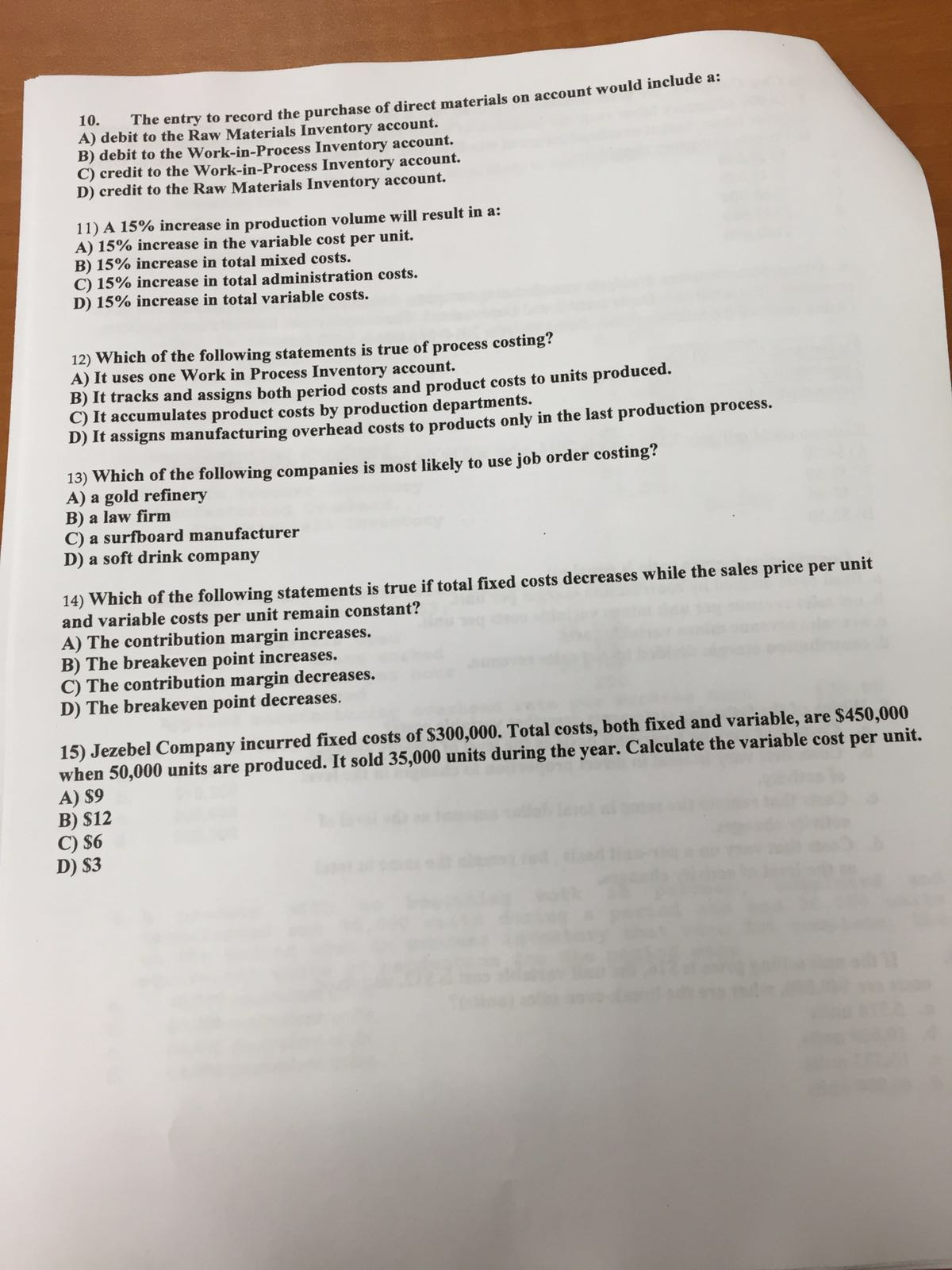

10. The entry to record the purchase of direct materials on account would include a: A) debit to the Raw Materials Inventory account. B) debit to the Work-in-Process Inventory account. C) credit to the Work-in-Process Inventory account. D) credit to the Raw Materials Inventory account. 11) A 15% increase in production volume will result in a: A) 15% increase in the variable cost per unit. B) 15% increase in total mixed costs. C) 15% increase in total administration costs. D) 15% increase in total variable costs. 12) Which of the following statements A) It uses one Work in Process Inventory account. B) It tracks and assigns both period costs and product costs to units produced. C) It accumulates product costs by production departments. D) It assigns manufacturing overhead costs to products only in the last production process. true of process costing? 13) Which of the following companies is most likely to use job order costing? A) a gold refinery B) a law firm C) a surfboard manufacturer D) a soft drink company 14) Which of the following statements is true if total fixed costs decreases while the sales price per unit and variable costs per unit remain constant? A) The contribution margin increases. B) The breakeven point increases. C) The contribution margin decreases. D) The breakeven point decreases. 15) Jezebel Company incurred fixed costs of $300,000. Total costs, both fixed and variable, are $450,000 when 50,000 units are produced. It sold 35,000 units during the year. Calculate the variable cost per unit. A) $9 B) $12 C) $6 D) $3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 10D credit to the Raw Materials Invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started