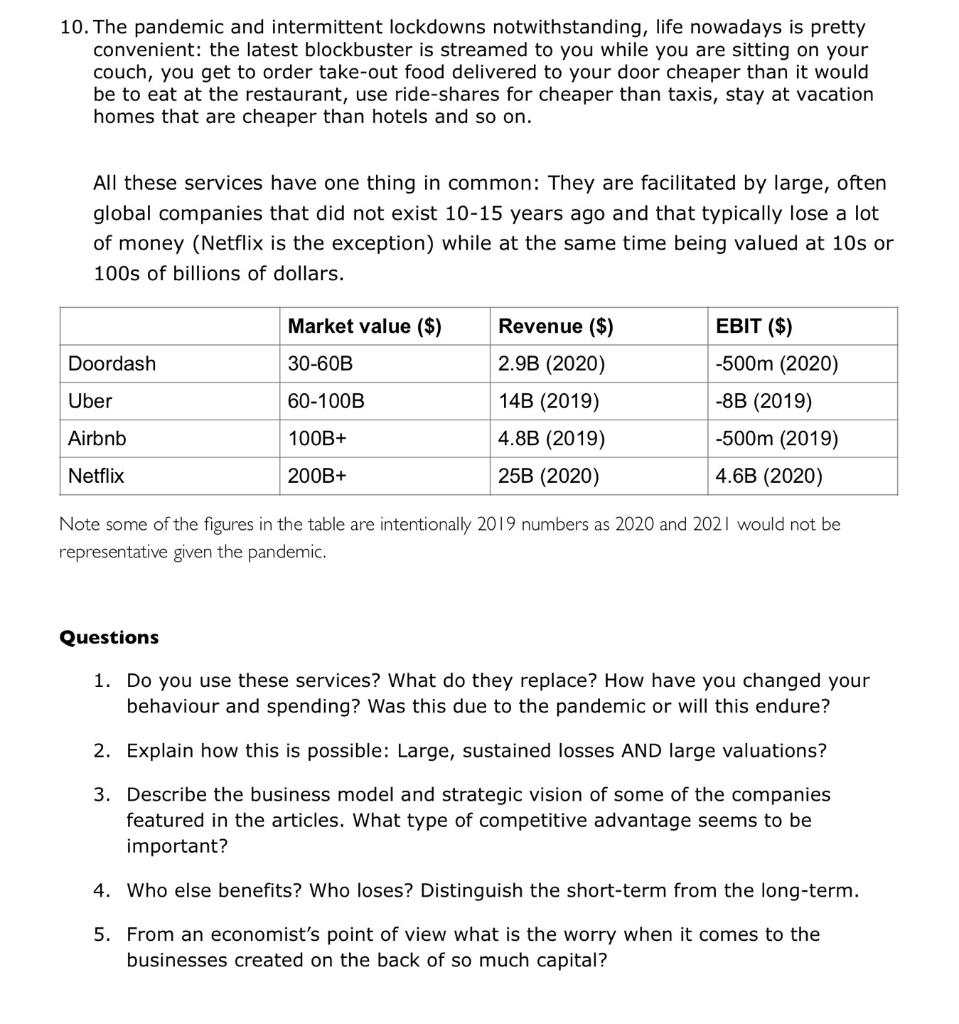

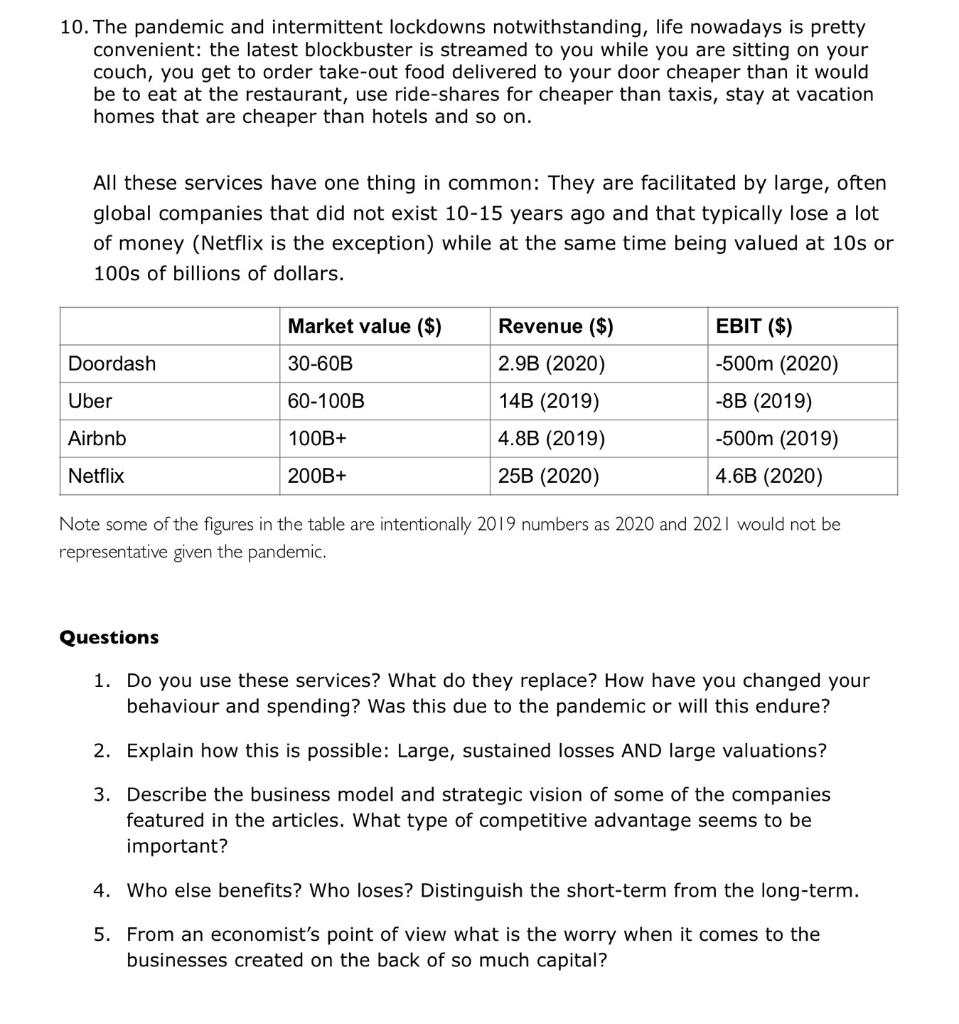

10. The pandemic and intermittent lockdowns notwithstanding, life nowadays is pretty convenient: the latest blockbuster is streamed to you while you are sitting on your couch, you get to order take-out food delivered to your door cheaper than it would be to eat at the restaurant, use ride-shares for cheaper than taxis, stay at vacation homes that are cheaper than hotels and so on. All these services have one thing in common: They are facilitated by large, often global companies that did not exist 10-15 years ago and that typically lose a lot of money (Netflix is the exception) while at the same time being valued at 10s or 100s of billions of dollars. Market value ($) Doordash 30-60B Uber 60-100B Revenue ($) 2.9B (2020) 14B (2019) 4.8B (2014) 25B (2020) EBIT ($) -500m (2020) -8B (2019) -500m (2019) 4.6B (2020) Airbnb 100B+ Netflix 200B+ Note some of the figures in the table are intentionally 2019 numbers as 2020 and 2021 would not be representative given the pandemic. Questions 1. Do you use these services? What do they replace? How have you changed your behaviour and spending? Was this due to the pandemic or will this endure? 2. Explain how this is possible: Large, sustained losses AND large valuations? 3. Describe the business model and strategic vision of some of the companies featured in the articles. What type of competitive advantage seems to be important? 4. Who else benefits? Who loses? Distinguish the short-term from the long-term. 5. From an economist's point of view what is the worry when it comes to the businesses created on the back of so much capital? 10. The pandemic and intermittent lockdowns notwithstanding, life nowadays is pretty convenient: the latest blockbuster is streamed to you while you are sitting on your couch, you get to order take-out food delivered to your door cheaper than it would be to eat at the restaurant, use ride-shares for cheaper than taxis, stay at vacation homes that are cheaper than hotels and so on. All these services have one thing in common: They are facilitated by large, often global companies that did not exist 10-15 years ago and that typically lose a lot of money (Netflix is the exception) while at the same time being valued at 10s or 100s of billions of dollars. Market value ($) Doordash 30-60B Uber 60-100B Revenue ($) 2.9B (2020) 14B (2019) 4.8B (2014) 25B (2020) EBIT ($) -500m (2020) -8B (2019) -500m (2019) 4.6B (2020) Airbnb 100B+ Netflix 200B+ Note some of the figures in the table are intentionally 2019 numbers as 2020 and 2021 would not be representative given the pandemic. Questions 1. Do you use these services? What do they replace? How have you changed your behaviour and spending? Was this due to the pandemic or will this endure? 2. Explain how this is possible: Large, sustained losses AND large valuations? 3. Describe the business model and strategic vision of some of the companies featured in the articles. What type of competitive advantage seems to be important? 4. Who else benefits? Who loses? Distinguish the short-term from the long-term. 5. From an economist's point of view what is the worry when it comes to the businesses created on the back of so much capital