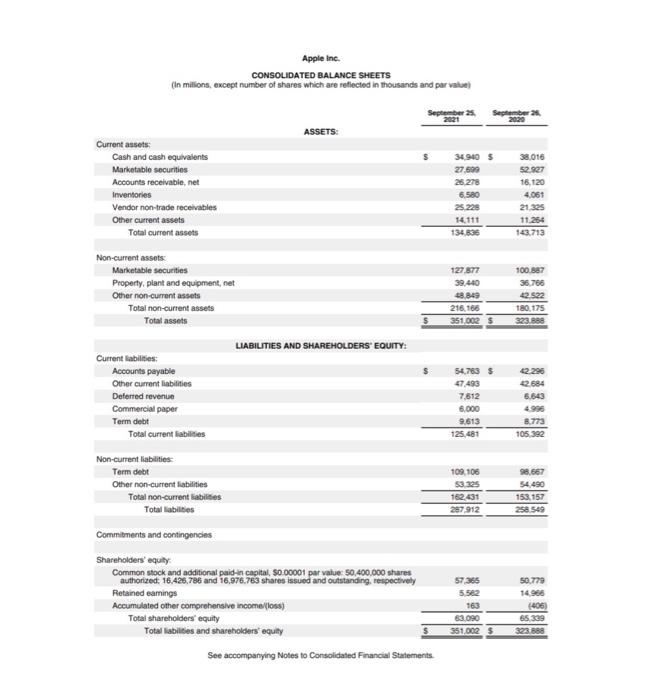

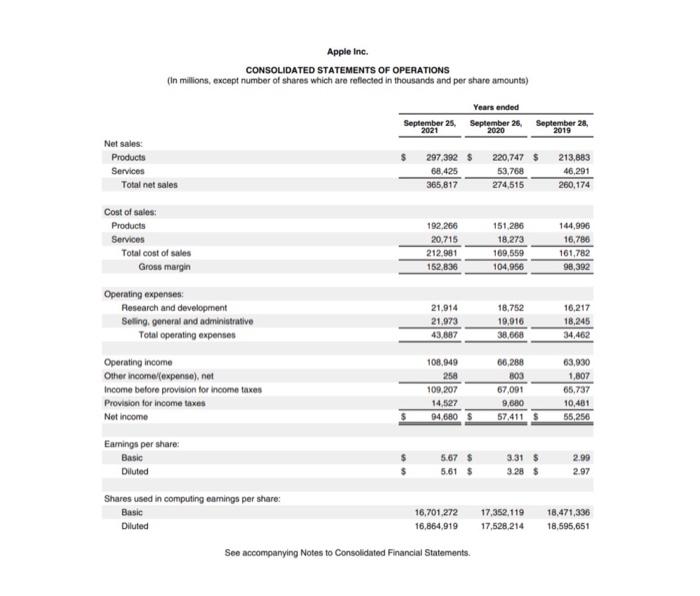

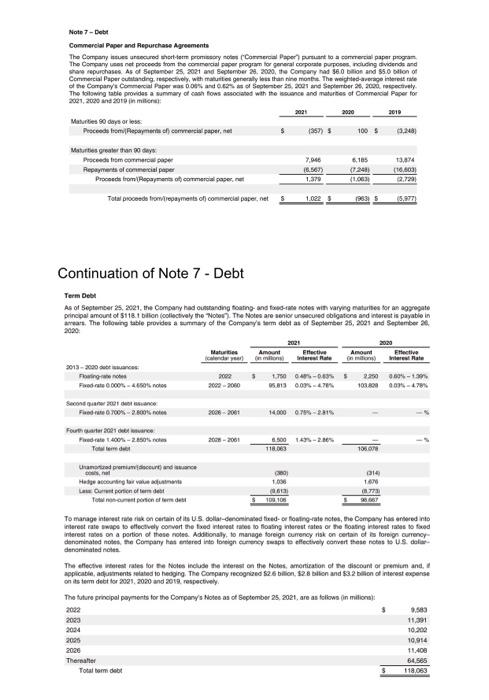

10. The September 25, 2021 market share price of Apple Inc. was approximately $146 per share. Use this market share price to determine the market capitalization of Apple at September 25, 2021, using 16,426,786,000 as the number of shares outstanding. [Note: the number of shares is included in the balance sheet description of 'Common stock' at the 2021 fiscal year-end.] i) Compare the market capitalization at September 25, 2021 to the value of shareholders' equity on the consolidated balance sheet at the same date. Which is larger? By how much? ii) The company's share price at the end of fiscal 2020 was approximately $112 per share. What was the increase in the company's share price in fiscal 2021? How does this compare to the earnings per share in fiscal 2021? Which is larger? By how much? Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 25, September 26 ASSETS: Current assets Cash and cash equivalents Marketable securities Accounts receivable.net Inventories Vendor non-trade receivables Other current assets Total current assets 34.9405 27.500 26 278 6.580 38.016 52.927 16.120 4.064 21 325 11.254 143.713 14.111 134.836 Non-current assets Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 127.877 39.440 18.849 216.166 351.0025 100.887 36.788 42.522 180.175 323.888 LIABILITIES AND SHAREHOLDERS' EQUITY: Current abilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities 12.684 6.643 54.783 $ 47.493 7.612 6.000 9,613 125,481 8.773 105,392 Non-current liabilities Term debt Other non-current liabilities Total non-current abilities Total abilities 109 108 53325 162.431 287912 98.667 54.490 153.157 258 549 Commitments and contingencies Shareholders' equity Common stock and additional paid in capital, 50.00001 par value 50,400.000 shares authorized: 16 425,786 and 16,976.763 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive incomes) Total shareholders' equity Total abilities and shareholders equity See accompanying Notes to Consolidated Financial Statements 57,365 5.562 163 50.779 14 966 (406) 65 339 323 888 63.000 3510025 Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are reflected in thousands and per share amounts) Years ended September 25, September 26, September 26, 2021 2020 2019 Net sales: Products 297,392 $ 220,747 $ 213,883 Services 68.425 53,768 46,291 Total net sales 365,817 274,515 260.174 Cost of sales: Products Services Total cost of sales Gross margin 192.266 20,715 212.981 152.836 151.286 18,273 169,559 104,956 144,996 16,786 161,782 98,392 21.914 21,973 43.887 18,752 19,916 38,668 16,217 18,245 34.462 Operating expenses Research and development Selling general and administrative Total operating expenses Operating income Other Income/expense), net Income before provision for income taxes Provision for income taxes Net income 108.949 258 109.207 14.527 94.680$ 66,288 803 67,091 9,680 57,411 S 63,930 1,807 65.737 10,481 55,256 Earnings per share: Basic Diluted 5.67$ 5.61 $ 3.31 $ 3.28 $ 2.99 2.97 Shares used in computing earnings per share: Basic Diluted 16,701,272 16,864,919 17,352,119 17,528 214 18,471,336 18,595,651 See accompanying Notes to Consolidated Financial Statements. Note 7 - Debt Commercial Paper and Repurchase Agreements The Company is secured short-term pembory notes (Commercial Paper put to a comercial paper program The Company uses et proceeds from the commercial paper program for general corporate purpos, cluding dividends and she repurchase. As of September 25 2021 and September 28, 2020, the Company had 580 billion and $5 billion of Commercial Paper cutstanding, respectively, with mature generally less than nine monte The weighted average interest rate of the Company Commercial Paper was 0.00 and of September 2009 and September 26, 2000. recruty The filowing table provides a summary of cash flows associated wth the sunce and matures of Commercial Paper for 221,2000 and 2010 in miliona 2021 2020 2010 Maulties days or less Proceede trompa comercial paper (357) 100S Maturtles greater than any Proceed to commer Repayments of commercial paper Proceeds from Repayments of commercial paper, Total proceeds from repayments of commercial paper.net 7,046 18.567) 1,370 6105 (7241 (1.06 13.894 16.000 2.720 1.0223 196315 15.971 Continuation of Note 7 - Debt Term Debt As of September 25, 2021, the Company has standing foating and come notes with varying mature for an aggregate principal amount of $118.1 billion collectively the The Notes are senior cured obligations and interest is payable in wears. The following table provides a summary of the Company's serm debt as of September 25, 2001 and September 2000 Matures Amount Erective Amour Erective called your home where are coming ware Mate 2002 1.750 04-05 2200 2004-13 2009-2010 5.813 0.09.47% 103.300 - 478 2013-20 Foring Foto 0000.0 Second 2001 F 700% -2,600 Pour de 400-250 Tere! 2000-2001 14.000 0.70-2.315 2000-2001 -20% 3.500 118.063 100 Urande 014 Hege accounting torvet 1.09 1.6 Liportion of om det i77 To portion for To manage interest rate rok on certain of its US dollar-denominated feed-or floating rate noto, the Company has entered into interest rate wape to effectively convert the food interest rates to floating norest rates or the boating interest rates to fred interest rates on a portion of those note. Additional to manage foreign currency risk on certain of storio currency denominated to the Company has entered in foreign currency to effectively convert these not to US doo denominados The effective worest rates for the Nole incluse the interest on the Notes anonication of the discount or premium and applicatie, adjustments related to heagire. The Company recognized $2.6 billion, 528 billion and $3.2 billion of interest expense on is term det for 2021 2020 and 2019. respectively The future principal payments for the Company's Note as of September 25, 2021, are as follows (in milioni 2022 0.583 11,391 2014 10.200 2025 10,914 2020 11.400 Therler Total met 118.063 2023 54585