10).

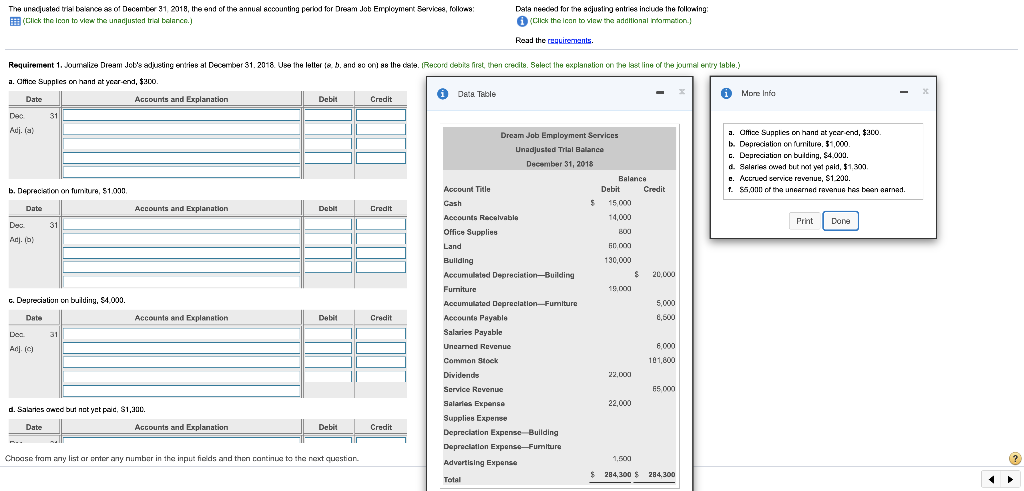

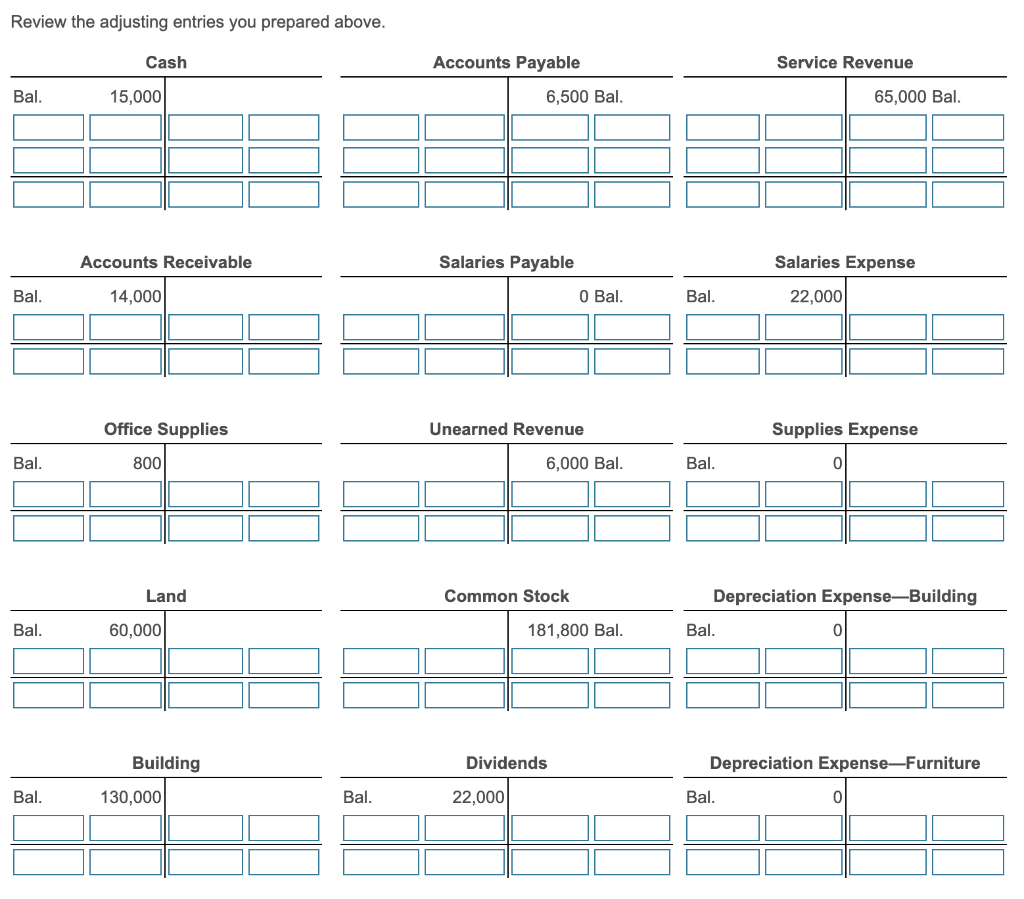

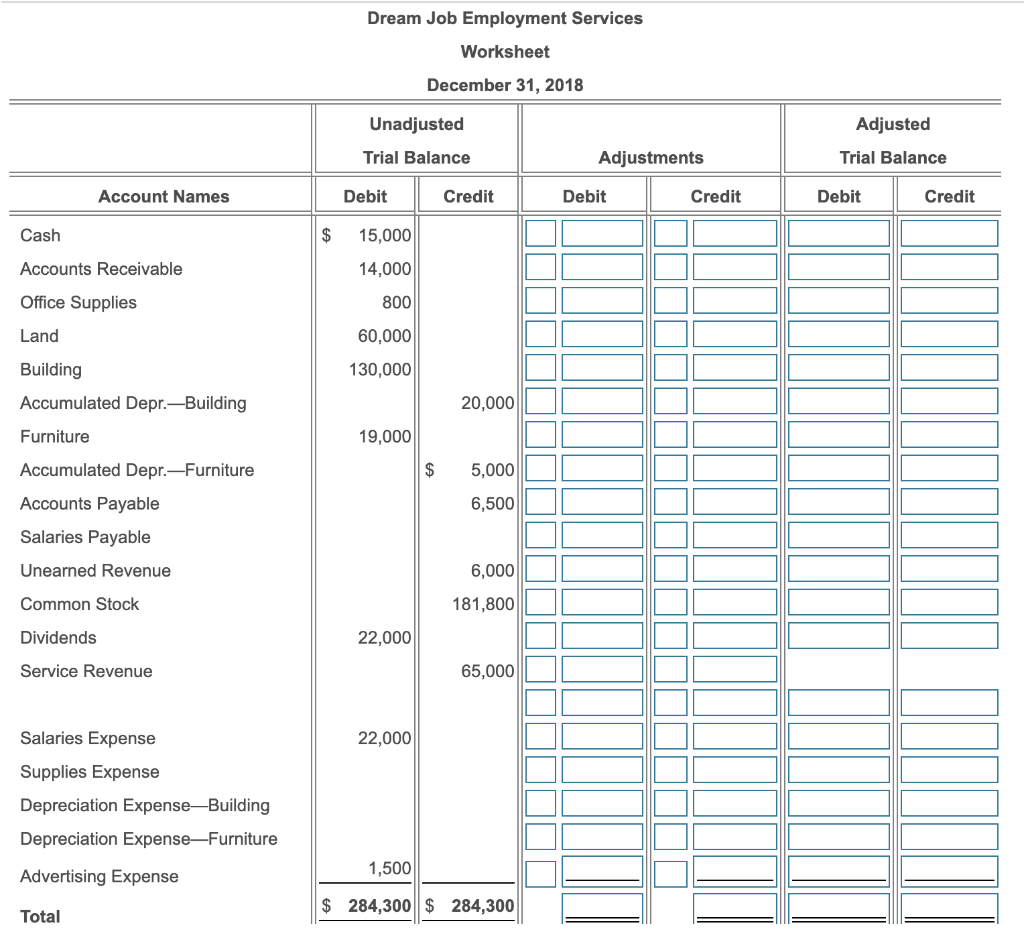

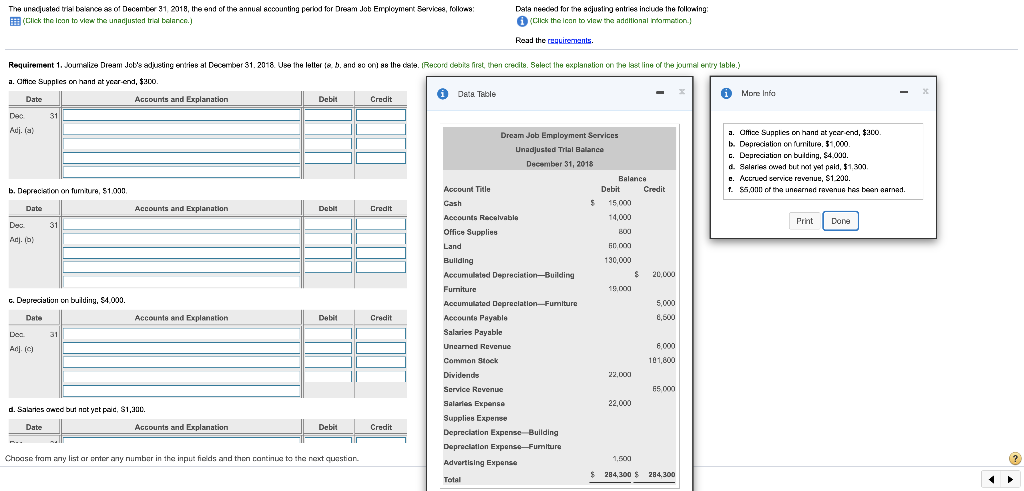

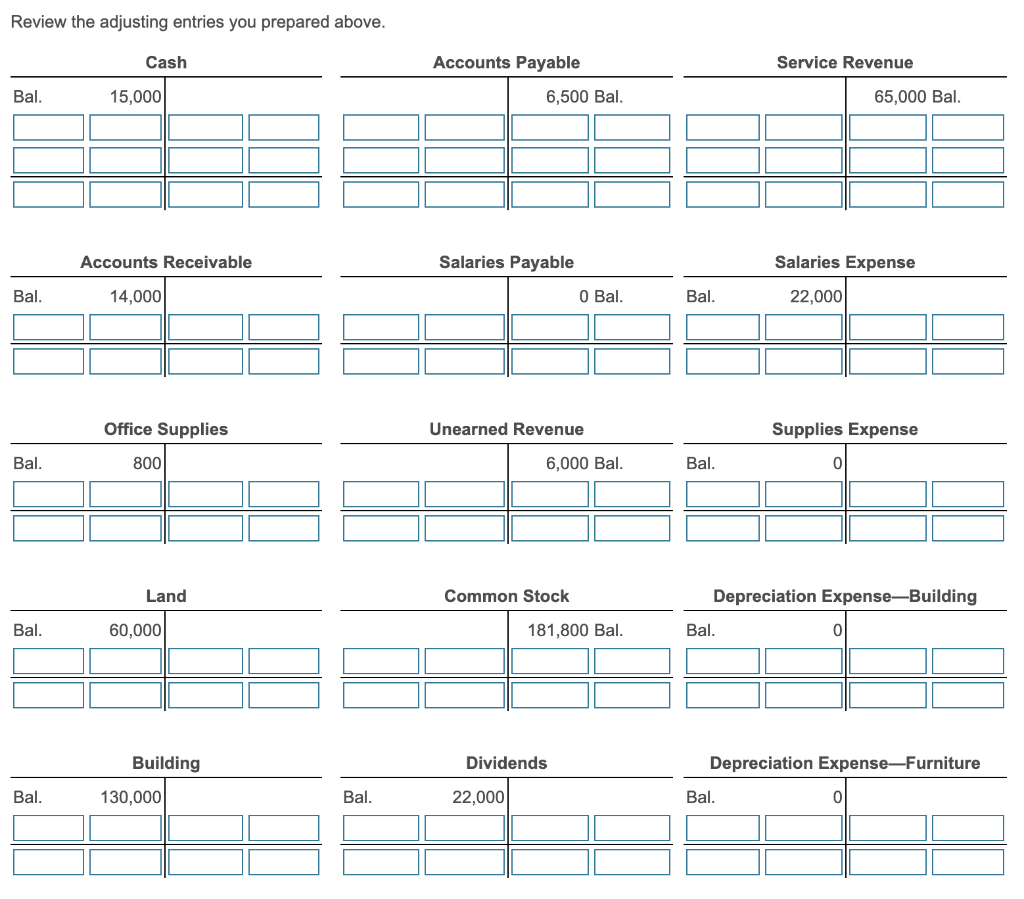

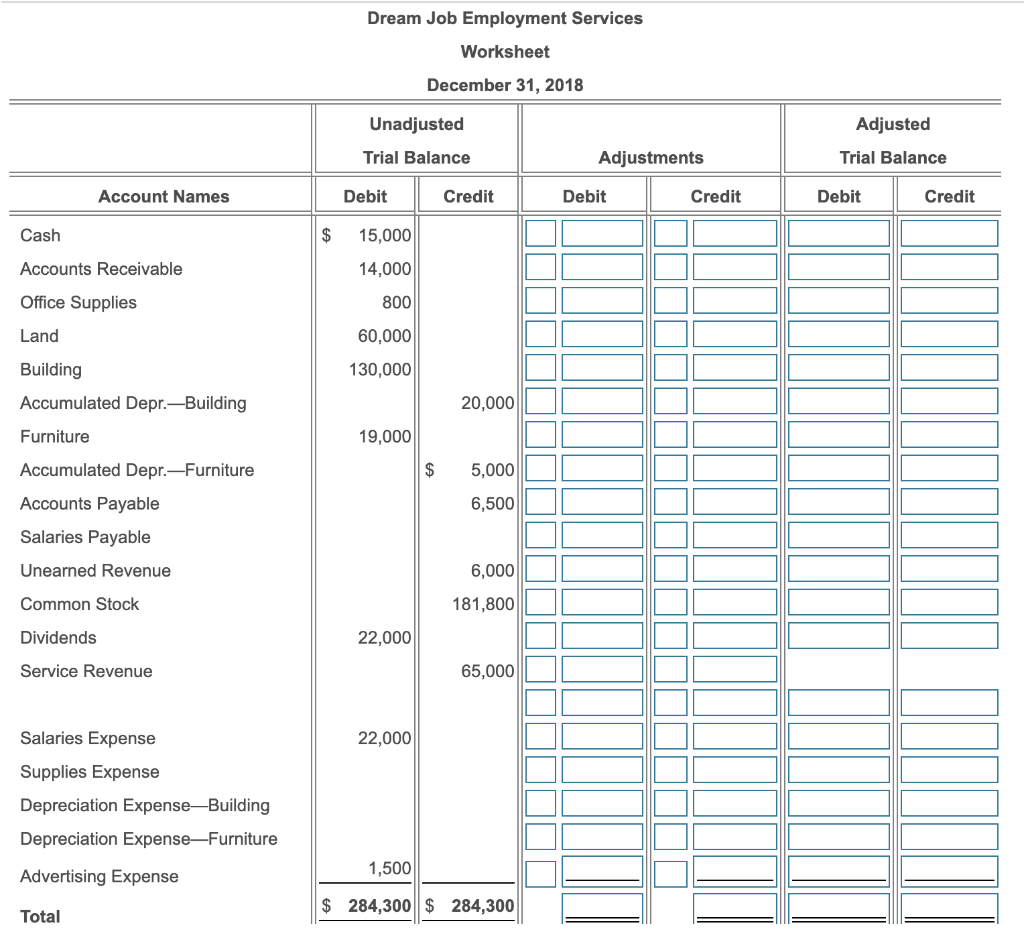

The unsdalec trial bases of December 31 2018, the end of the annual accounting period for Dream Job Employment Services, forms (Click the icon to view the unadjustat tral balance.) Dale needed for the adjusting entries include the following Click the icon to view the additional tomation Read the requiremnants. Requirement 1. Journelize Dream Job's adjusting entries al December 31, 20-8 Use the lettera 5.and so on as the carte. Record del Prat, then crecits. Select the explanation on the last line of the journal entry table. a. Office Supplies on hand ot year-end, $200. Date Accounts and Explanation Debit 1 Date Table Credit i More Infa 31 Auj. la TI Dream Job Employment Services a. Office Supplies on hand at ycer-end, $200 1. Depreciation on furiture. 35.000 Unadjusted Trial Balance c. Depreciation on bulding, $4.000. December 31, 2018 d. SalAree owad but not yet paid $1.300 BALANCA c. Acurved service revenue, S1.200. b. Depreciation on fumtur, $1.000 Account Title Debit Credit f. $6,000 of the unAnAdrevenue has been sarna. Cash $ Date Accounts and Explanation 15.000 Debit Credit Accounts Recavabla Dec 31 14,000 Print Done Office Supplies B00 Adj.) Land 0 000 II Bullding 130,000 Accumulated Depreciation Building $ 20,000 Furniture 19.000 c. Depreciation on bulding, S4,000. Accumulated Depreciation-Fumiture 5,000 Date Account and Explanation DA Credit Accounts Payable 6,500 Dea 31 Salaries Payable Ad (0) Uneamed Revenue 6.000 Common Stock 101,800 TO Dividends 22.000 Service Revenue 65 000 Salaries Expanse 22,000 d. Salsnes Acc but not yet paid, S1,200. Supplies Expense Date Accounts and Explanation Debit Credit Depreciation Expense Building Depreciation Expense-Fumitura Choose from any list aronter any number in the input fields and then continue to the rest question 1,500 Advertising Expense $ 284,300 $ 284,300 Total ? Review the adjusting entries you prepared above. Cash Accounts Payable Service Revenue Bal. 15,000 6,500 Bal. 65,000 Bal. Accounts Receivable Salaries Payable Salaries Expense 22,000 Bal. 14,000 O Bal. Bal. Office Supplies Unearned Revenue Supplies Expense Bal. 800 6,000 Bal. Bal. 0 Land Common Stock Depreciation Expense-Building Bal. 60,000 181,800 Bal. Bal. Building Dividends Depreciation Expense-Furniture Bal. Bal. 130,000 Bal. 22,000 Dream Job Employment Services Worksheet December 31, 2018 Unadjusted Adjusted Trial Balance Adjustments Trial Balance Account Names Debit Credit Debit Credit Debit Credit Cash $ 15,000 Accounts Receivable 14,000 Office Supplies 800 Land 60,000 130,000 Building Accumulated Depr.-Building 20,000 Furniture 19,000 Accumulated Depr.Furniture $ 5,000 6,500 Accounts Payable Salaries Payable Unearned Revenue 6,000 Common Stock 181,800 Dividends 22,000 Service Revenue 65,000 22,000 Salaries Expense Supplies Expense Depreciation ExpenseBuilding Depreciation Expense-Furniture Advertising Expense 1,500 $ 284,300 $ 284,300 Total