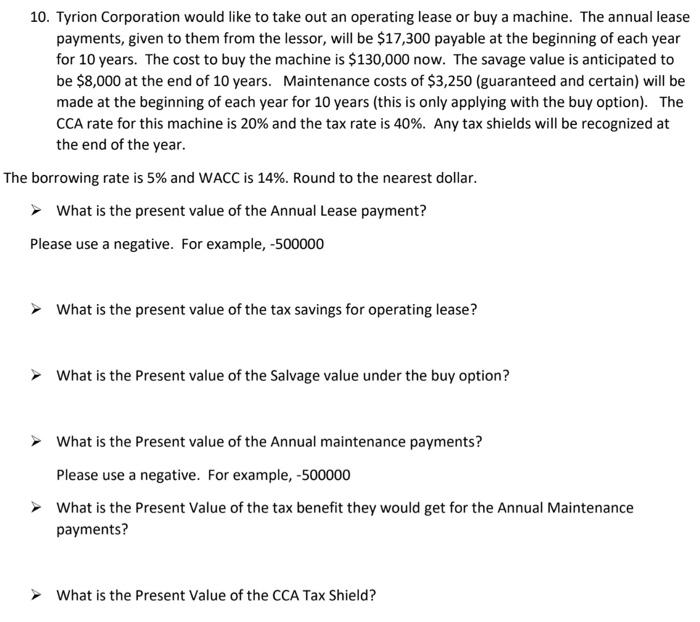

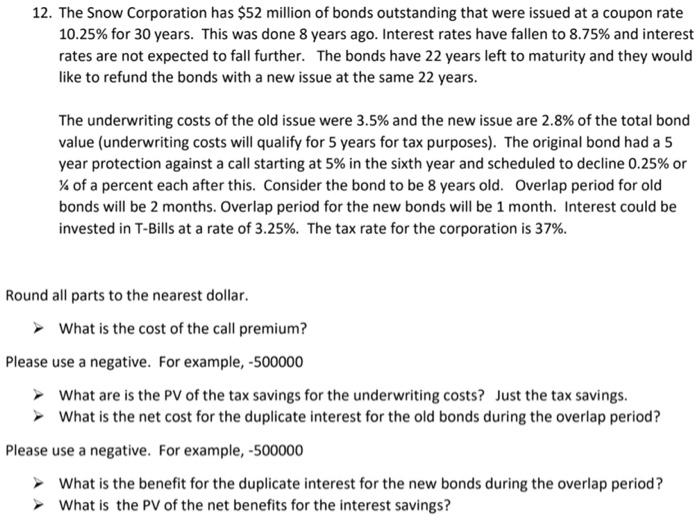

10. Tyrion Corporation would like to take out an operating lease or buy a machine. The annual lease payments, given to them from the lessor, will be $17,300 payable at the beginning of each year for 10 years. The cost to buy the machine is $130,000 now. The savage value is anticipated to be $8,000 at the end of 10 years. Maintenance costs of $3,250 (guaranteed and certain) will be made at the beginning of each year for 10 years (this is only applying with the buy option). The CCA rate for this machine is 20% and the tax rate is 40%. Any tax shields will be recognized at the end of the year. The borrowing rate is 5% and WACC is 14%. Round to the nearest dollar. What is the present value of the Annual Lease payment? Please use a negative. For example, -500000 What is the present value of the tax savings for operating lease? What is the Present value of the Salvage value under the buy option? What is the Present value of the Annual maintenance payments? Please use a negative. For example, -500000 What is the Present Value of the tax benefit they would get for the Annual Maintenance payments? What is the Present Value of the CCA Tax Shield? 12. The Snow Corporation has $52 million of bonds outstanding that were issued at a coupon rate 10.25% for 30 years. This was done 8 years ago. Interest rates have fallen to 8.75% and interest rates are not expected to fall further. The bonds have 22 years left to maturity and they would like to refund the bonds with a new issue at the same 22 years. The underwriting costs of the old issue were 3.5% and the new issue are 2.8% of the total bond value (underwriting costs will qualify for 5 years for tax purposes). The original bond had a 5 year protection against a call starting at 5% in the sixth year and scheduled to decline 0.25% or % of a percent each after this. Consider the bond to be 8 years old. Overlap period for old bonds will be 2 months. Overlap period for the new bonds will be 1 month. Interest could be invested in T-Bills at a rate of 3.25%. The tax rate for the corporation is 37%. Round all parts to the nearest dollar. What is the cost of the call premium? Please use a negative. For example, -500000 What are is the PV of the tax savings for the underwriting costs? Just the tax savings. What is the net cost for the duplicate interest for the old bonds during the overlap period? Please use a negative. For example, -500000 What is the benefit for the duplicate interest for the new bonds during the overlap period? What is the PV of the net benefits for the interest savings